Global Payments + Worldpay is 1+1=2

The deal adds breadth without addressing product or distribution gaps

Key insights in this post

Global Payments/WorldPay & FIS/TSYS add bulk and focus to each entity

FIS enhances its bank focus with a market-leading issuer-processor platform

Global Payments becomes a bigger, pure-play merchant acquirer

However, neither side of the deal provides much revenue synergy

FIS/TSYS

FIS matches up better against arch-rival Fiserv who owns the other big issuer-processor (Optis)

Issuer processing is saturated with few portfolios converting except via client-side M&A, e.g., Capital One/Discover

TSYS has a sustainable lead over Optis in commercial cards, but its issuer clients face competition that could erode TSYS growth

Amex at the high end is the market leader and processes in-house

The “Expense Management” Fintechs are booming at the lower end and moving up market; all are in-house

The only apparent revenue synergy is to build an Agent business, similar to US Bank’s Elan; but that requires a bank partner to host the lending

GPN/WorldPay

Combined-GPN matches up better against Fiserv and JPMorgan across most acquiring segments

Lacks a competitive ISV solution to compete with Fiserv’s Clover or independents like Square and Toast

Does nothing to close the eCommerce gap with Adyen, Stripe & Braintree

The main apparant revenue synergy is adding more ISV prospects to the Payrix business (PayFac-as-a-Service)

Cost synergies are available

Data center and network consolidation

Functional overhead consolidation, e.g., Finance, HR, etc.

Potential development synergies if they can convert clients to a common acquiring system, but this takes a long time

The new combinations are “complementary” in the sense that they flesh out the portfolios of both entities, but without making either of them more competitive

Introduction

For anyone who hasn’t been paying attention, Global Payments (GPN) is buying Worldpay while selling TSYS. FIS is selling its residual stake in Worldpay to buy TSYS. That gives FIS an apples-to-apples portfolio to compete again Fiserv in its banking business and it bulks up GPN to compete in merchant acquiring. The markets have been happy with FIS and unhappy with GPN.

I am not a finance guy so I can’t opine on the GPN stock sell-off, but I do have perspective on the strategic combinations of FIS+TSYS in bank processing and GPN+WorldPay in merchant acquiring. They are pretty much the same story:

FIS adds a new product to push through its bank distribution channels, but the likely lift is modest and there are sectoral headwinds

GPN broadens its offerings, but gains limited revenue synergies. The value is primarily in cost synergies. The combined entity has the same product gaps as its predecessors

The remainder of this post will examine each side of the deal.

FIS + TSYS

As we saw in last week's post, the credit card business is concentrated. The top 5 issuers have ~75% of spend volume, assuming Capital One closes its acquisition of Discover. If anything, the industry is becoming more concentrated each year.

But the “Issuer processing” segment of the credit card value chain is even more concentrated. Between Fiserv’s Optis business and TSYS, virtually every major issuer is already served. Few portfolios change hands and there is virtually no white space. Growth needs to come from client volume growth.

Here is a view of the top issuers and their processing arrangements:

JPM & Amex are in-house and not going anywhere

Citi outsources its Retail Cards to Fiserv, but the Citi-brands (including AA & Costco) are on an in-house system that could be outsourced, likely to Fiserv

Capital One & Bank of America are already on custom TSYS instances at low price per account

Discover is in-house but will likely convert to the Capital One platform post-acquisition — a TSYS win

Only US Bank is white space. They are the lowest scale issuer to be running an in-house system. One attraction is that USB have a large “agent bank” issuing business, called Elan, which issues cards for small banks – the small bank is basically a cobrand partner. That could make USB particularly appealing to either FIS or Fiserv each of whom already provide core processing services to thousands of small banks. FIS/TSYS & Fiserv/Optis would bid aggressively for such an opportunity.

One wild card here is the Apple portfolio, which Goldman runs in-house. The contenders to take over for Goldman seem to be JPM, Amex & Synchrony. If JPM or Amex win, the portfolio escapes both TSYS and Optis. If Synchrony wins, Apple Card moves to Optis. TSYS has no champion in this competition.

Issuer processors benefit from their clients’ growth: either organic growth or the occasional M&A transaction, such as PNC/BBVA or Capital One/Discover. Issuers rarely switch processors. The one-time conversion cost is hard to recover from the marginal reductions in operating costs. Further, most regional bank portfolios are growing slower than the mega-issuers, so organic growth trails market growth.

In general, there isn’t much functionality difference between the two platforms, but TSYS & Optis each have spikes that constrain switching:

Fiserv Optis dominates Private Label cards (PLCC). Optis processes for Synchrony, Citi’s Retail Cards, Bread, Wells Fargo, & TD. Those issuers account for 90%+ of the PLCC market. Generally, the cobrand cards associated with those PLCC merchants are bundled into the contracts. TSYS is unlikely to capture any of those issuers

TSYS dominates Commercial Cards. Every large commercial bank I am aware of processes their commercial cards on TSYS. Of course, American Express is the market share leader in T&E cards and has material share in purchasing cards (P-cards). Almost everyone else is on TSYS. The growth product is Virtual Cards for accounts payable, but these programs are concentrated in the biggest Treasury Services banks where TSYS margins are lower. Many regional bank issuers want one provider and will bundle consumer & commercial in a common contract. Score one for TSYS!

Another commercial card trend is the emergence of Fintech offerings from Brex, Ramp, Divvy/BILL and others. These operate under the umbrella term “expense management”. Today, they largely serve start-ups and lower middle market, but are moving relentlessly up-market. If they take share from the incumbents, TSYS is collateral damage. Amex recently bought their own expense management solution, so may also claw back market share. Other commercial card issuers are late to the trend. The laggards will likely be the smaller issuers where TSYS has the highest margins.

It is unlikely that TSYS’s relationships can be used to sell other FIS products, such as the NYCE network or core processing. FIS has independent relationships with most large banks on the deposits side and the tech side. Adding Card relationships doesn’t change the fundamental dynamics — the bigger the bank, the less they appreciate bundling without steep economic concessions.

Conclusion on FIS/TSYS

FIS is buying a stable business without step-change growth opportunities. The market is saturated and high-margin regionals are growing slower than the giants. TSYS grew accounts by 10% in 2024, but transactions on those accounts grew only 5% and revenue grew 3.5% -- so many of the new cards were either not primary or happened at low-priced Capital One.

That is what regionals I speak with say about their portfolios – it is not hard to get a relationship customer to take a card, but very hard to get them to use it. This segment generates most of TSYS profits but is growing slower than market.

It will be hard to energize growth:

FIS can create a USB Elan-style agent business for its small core processing banks, but they don’t bring much volume and FIS would need a balance sheet partner to fund the outstanding

FIS can win if a TSYS bank acquires another bank

TSYS grows if the acquired portfolio is white space, like Capital One/Discover

TSYS grows if the acquired portfolio is on Optis

TSYS loses revenue if a TSYS bank buys another TSYS bank. In this case, the acquired cards are added to the buyer’s contract at an incremental tier with a lower unit price — TSYS keeps all the volume but loses some of the revenue

TSYS loses if an Optis bank buys a TSYS bank

Otherwise, revenue growth requires more value-added services to increase ARPU. TSYS describes three kinds of VAS: Risk & Fraud, Data & Analytics, and Customer Experience. Both TSYS and Optis have tried to promote these kinds of services for years, but it has not moved the needle.

Global Payments + Worldpay

In JPMorgan’s announcement of the deal, they used the word “complementary” to characterize the fit between these two acquirers. I think that is the perfect one-word description. Both sides are global, but service different market segments that do not really benefit from the contributions of the other party. Where they overlap, they are in disadvantaged positions. There may be cost synergies, but it is hard to see where the revenue synergies are.

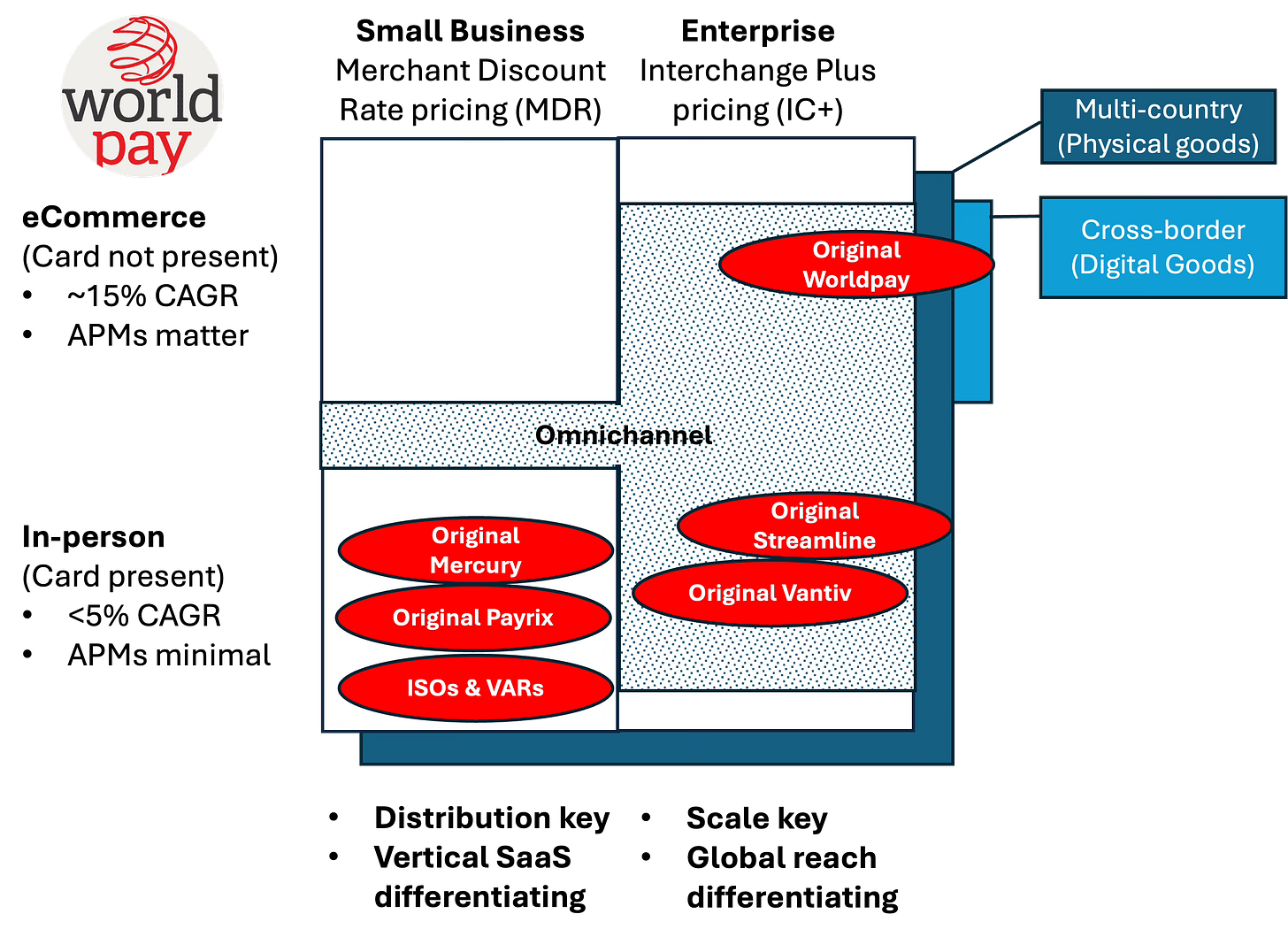

To demonstrate why this is true, I will return to my merchant acquiring framework.

Global Payments

Global Payments today competes largely in the lower left quadrant of the market (in person, SMB):

You can see that the “Global” part is a multi-country model where GPN partner with local banks to serve their domestic, small business and middle market customers. GPN’s EVO acquisition had the same global model. GPN has modest volume in Enterprise, but does have a few middle market specialty verticals.

In the high-margin small business segment, the original Heartland competes via a captive commissioned sales force, which is still productive; but, a core vertical is restaurants where Toast is lapping the field. The rest of GPN’s US small business portfolio is indirect and mostly undifferentiated. It has no specialized offering in the SB eCommerce space, but almost no one else does either – that is the domain of Stripe, Shopify, and PayPal.

Importantly, GPN also has no scale equivalent to Clover to capture the booming ISV market (Software + Payments + VAS). GPN did acquire a few vertically-focused ISVs but has not notably grown them or integrated them. As a result, it has been losing share in the high-margin small business market. Further, GPN have not jumped on the VAS bandwagon, as Clover has, and therefore can’t raise ARPU like its ISV-centric competitors.

Worldpay

Worldpay operates in a broader range of acquiring quadrants:

WorldPay in is one of the few acquirers that can service Enterprise. It has the biggest share of enterprise in the UK and is among the top three in the US. But Enterprise delivers low revenue per transaction – even if margins are attractive. Further, the in-person part of the market is not growing.

Worlday competes in the high-growth eCommerce Enterprise quadrant – including cross-border digital goods. The original Worldpay was in fact one of the eCommerce pioneers. Among other initiatives they bought a Fintech called Bibit that was an early innovator; of course, Bibit’s founders soon left and formed Adyen. While Worldpay is still competitive in this space, it is being outgrown by Adyen, Stripe, Braintree, Checkout, Nuvei and other modern acquirers.

Like GPN, Worldpay lacks a Clover-equivalent. Early in the ISV phenomenon, Worldpay acquired Mercury to became a major “integrated payments” provider to ISVs. Essentially Worldpay provided the transaction processing while the ISV was a distribution channel – similar to the old ISO model. When most ISVs were small, this was very profitable – Worldpay got volume at good margins but didn’t need its own sales force. Investors cheered. Even if GPN got a Clover it lacks Fiserv’s distribution prowess via banks — that resides in FIS.

As ISVs got bigger, they wanted a bigger share of the payments pie and other acquirers competed away the margins. Today, a relatively modest ISV can get processing for a penny a transaction – while the volume sits in the lower left quadrant, “Integrated” revenue per transaction is more like enterprise. Investors are no longer cheering.

Similarly, Worldpay bought Payrix which helps ISVs become PayFacs, i.e., they can accept payments in their own names. Payrix is a VAS provider on top of pure processing. However, as ISVs get bigger, they often insource some of the functions that Payrix provides. Just like Integrated, the bigger the ISV, the lower the revenue per transaction. As the ISV space consolidates, this sector may consolidate as well.

So overall, Worldpay is not that competitive in the highest-margin segments but is very competitive in Enterprise where revenue per transaction is lowest. It has a position in cross-border digital goods, but is growth lags the market leaders.

The combination

If you layer the two companies on the framework, you see in that GPN doesn’t make legacy Worldpay more competitive and Worldpay doesn’t make legacy GPN more competitive:

Neither brings new products to the other’s distribution channels, with the exception of Payrix for GPN “integrated” clients

Neither has a Clover-equivalent solution to compete with Square, Toast, Clover, etc.

Legacy Worldpay does play in enterprise eCommerce but it lags Fintechs like Adyen & Stripe – and legacy GPN does nothing to help there

Neither has a meaningful small business eCommerce offering to compete with Stripe & PayPal – although no one else does either

From a revenue synergies perspective, the combined entity is the sum of the parts, but nothing more. 1+1=2, not 3.

That leaves cost synergies. These are difficult to capture in acquiring. In theory, the combined entity can reduce the number of acquiring platforms to conserve development expense. But that means converting clients from one system to another. Many clients won’t do that, or will use the opportunity to RFP their contract – risking attrition. Fiserv still runs several acquiring platforms decades after buying them.

The normal cost synergies should be available from combining overhead functions and from higher purchasing discounts. This may be particularly fruitful in smaller countries. Some savings should be available from infrastructure consolidation, e.g., data centers. Optimizing software spend would have delivered the most scale, but is hard to pull off.

Conclusions on GPN + WorldPay

As JPM said, these two entities are complementary. There isn’t much revenue synergy because they don’t have unique products to push through the other sides’ distribution channels. Cost savings are available, but the biggest pots are hard to monetize.

In short, the combination doesn’t improve the strategic situation of either party. Where they lagged they still lag, in the few places they led, they get no tailwind.

What could they do? No one wants to hear this, but more M&A might help. In particular, GPN could buy or partner with Lightspeed. Lightspeed would arm the combined GPN with a competitive ISV solution that can be pushed through all the legacy channels. Lightspeed has a great restaurant solution that is the market leader in Europe and they have a very competitive Retail platform in North America. They are already more global than their key competitors.

What Lightspeed lacks is payments penetration and distribution, areas where new GPN specializes. GPN would then stack up pretty well against Fiserv/Clover and independent ISVs. If acquisition is not in the cards, a partnership might accomplish the same goals without deploying as much capital.

Conclusions on the deal in total

On both sides of this deal, the asset movements don’t improve the competitive position of the new owner.

FIS won’t sell more legacy FIS products to TSYS customers or vice versa

GPN + WorldPay doesn’t make the combination any more competitive in acquiring; in particular the deal doesn’t get it an ISV or a better VAS proposition

Even on the cost side, there isn’t much low-hanging fruit. It will take work and time.

What this does provide is more focus to the successors. GPN becomes a pure-play acquirer, serving a broader set of segments. That focus should help it plug gaps in its product line-up. FIS becomes a bank-focused software and processing entity without the distraction of an acquiring arm serving merchants. In both cases, investment can be more focused and investors can compare results to the competition more easily.

That is something.