Key insights in this post

Clover, Square, & Toast are the US market leaders in serving single-location restaurants and small chains; they all operate the ISV model (software + payments)

They have similar restaurant strategies, but Toast is new to some aspects of this

Serve the breadth of non-chain, restaurant formats, although Toast seems to have more tailored solutions for less common formats

Offer omnichannel support for services like online ordering

Offer financial services like lending, payroll, payouts and Accounts Payable

Aim to move up-market to serve larger chains

Serve other verticals, although Toast is new to this

Serve other countries, although Toast has the most limited footprint

Use M&A to add back-end functionality, but not new verticals

Toast seems to have more proprietary solutions and somewhat more functional depth

They differ primarily in their distribution models and target starting point

Toast started with larger, single-location, table-service restaurants using a direct sales model. Direct sales aims to get critical mass in a metro area, triggering a “flywheel” that in turn generates inbound sales

Clover started with smaller, single-location, counter-service restaurants using an indirect sales model — via bank branches and ISOs/VARs. They leverage their parent, Fiserv, for entry into larger chains

Square started with smaller, single-location, counter service restaurants using a direct marketing model to drive inbound sales. They are adding direct and indirect channels to move upmarket

The open question is whether Toast has a big enough lead to sustain its market position as Clover & Square catch up on functionality and diversify distribution channels

Introduction

Any discussion of US ISVs usually starts with Square, Clover & Toast. Square invented the model, Clover is the biggest, & Toast is the leader within the key restaurant vertical. They all compete in Restaurants and they all have the same growth strategies: more verticals, more value added services, more countries, more omnichannel, more chains.

They differentiate on other dimensions, particularly distribution. Understanding these differences sheds light on their prospects going forward. It is helpful that all three are public companies that make transparent disclosures about their business. Fiserv in particular recently disclosed new Clover metrics where in the past they were a bit opaque. That openness allows us to compare the three leaders.

This post will first position these three in the broader acquiring space and then distinguish their differences in the key restaurant vertical.

The battlefield

This post is a deeper dive into one quadrant of the framework I introduced in Incumbent Acquirers face 3 disruptions:

All three focus on the lower left quadrant: small business, in-person. That quadrant has unique characteristics that sets the competitive stage:

Slow segment growth. The reason these three have high grow rates is that small merchants are transitioning from basic POS terminals towards tablet-based solutions with embedded, vertical SaaS software. Our three leaders specialize in the tablet/software proposition although Fiserv still offers the POS terminal model as well. The share of small merchants to convert is shrinking and will not support historical growth rates forever

High transaction margins, but also the highest distribution costs and churn. Small businesses fail more often than bigger ones, so distribution is a bit of a treadmill, with new sales needed to replace failed customers and to create net growth. Our three targets have different strategies to address this

Growing omnichannel needs. In retail, most small retailers have their own web site, often on Shopify, but also sell on marketplaces like Amazon, eBay & Etsy. While they need eCommerce support, not all their eCommerce volume goes to the core provider. Restaurants need online ordering but may also accept orders from the delivery companies and reservation specialists. This fragmentation is hard to service, and not all volume goes to the main ISV

Value-added services. Larger merchants often bid out each service independently and integrate them internally. Smaller merchants prefer to bundle with their core provider; that delivers higher ARPU per SMB client in addition to the higher acquiring margins

Fragmentation into sub-verticals with dedicated providers. This makes it hard to serve the quadrant with horizontal solutions. Our three leaders can’t serve every sub-vertical and typically focus their efforts on the biggest ones – restaurants in particular, but also Retail & Services. By focusing on the biggest verticals the leaders leave space for smaller ISVs to capture smaller verticals and sub-verticals with tailored solutions. Vertical diversification is expensive and difficult to pull off

By the numbers

The table below shows the state of play today among our three leaders:

Key 2024 metrics from 10Ks (except where noted)

Square has the highest margin, but the slowest growth. The high margin is likely because Square’s clients are smaller on average. In acquiring, the smaller the client the higher the margin, but also the higher the distribution costs and churn.

Square generates almost 60% of their TPV from clients with <$500k in annual TPV. Those smaller clients pay higher MDRs, but also have high churn

Toast averages ~$1.2M TPV per location, so their margin is lower, but their churn is also likely lower

Clover is the trickiest case.

Location size: Clover don’t disclose location count, but I found a quote that Clover serves 700K small businesses. At that level, average TPV per location is similar to Square at $443K

Margin: Margin is likely compressed because of revenue sharing with distribution partners. Their two biggest partners are Wells Fargo and PNC – both of whom own 60% of their respective JVs – leaving 40% for Fiserv

Accounting: While Clover’s margin may look like Toast’s, I suspect it is more like Square’s, but with revenue sharing treated as a contra-revenue. I could be wrong.

While that revenue sharing depresses Clover nominal margins, this is not an apples-to-apples comparison. Both Toast and Square have their own distribution costs, but those costs are not treated as contra-revenue as I think Clover’s are:

Toast discloses Sales and Marketing cost which translates to ~30bps of TPV; this reduces margin to 58bps. Note that while Fiserv’s revenue sharing is ongoing, Toast Sales & Marketing is focused mostly on new business

Square does not split its ~$2B of Sales & Marketing costs between Cash App and Square – while the bulk is likely for Cash App, we just don’t know. Most of it would have to be on the Square side to push margins down to Clover levels. On the other hand, that may be why growth is slower

What this all tells us is that margin is not a reliable comparison point between the three entities because of different accounting treatments and distribution models.

Other differences in the business models include:

Clover & Square are already multi-vertical while Toast just recently launched in “Food-related Retail”. While almost all Toast revenue is in restaurants, Clover & Square split their TPV among a variety of verticals

Clover & Square are already multi-country while Toast just recently entered Canada, so almost all Toast TPV is US while the other two have material non-US TPV

Toast has the biggest US TPV in Restaurants. In fact, it is likely bigger than the other two combined since the other two have significant restaurant TPV outside the US

Market position in restaurants

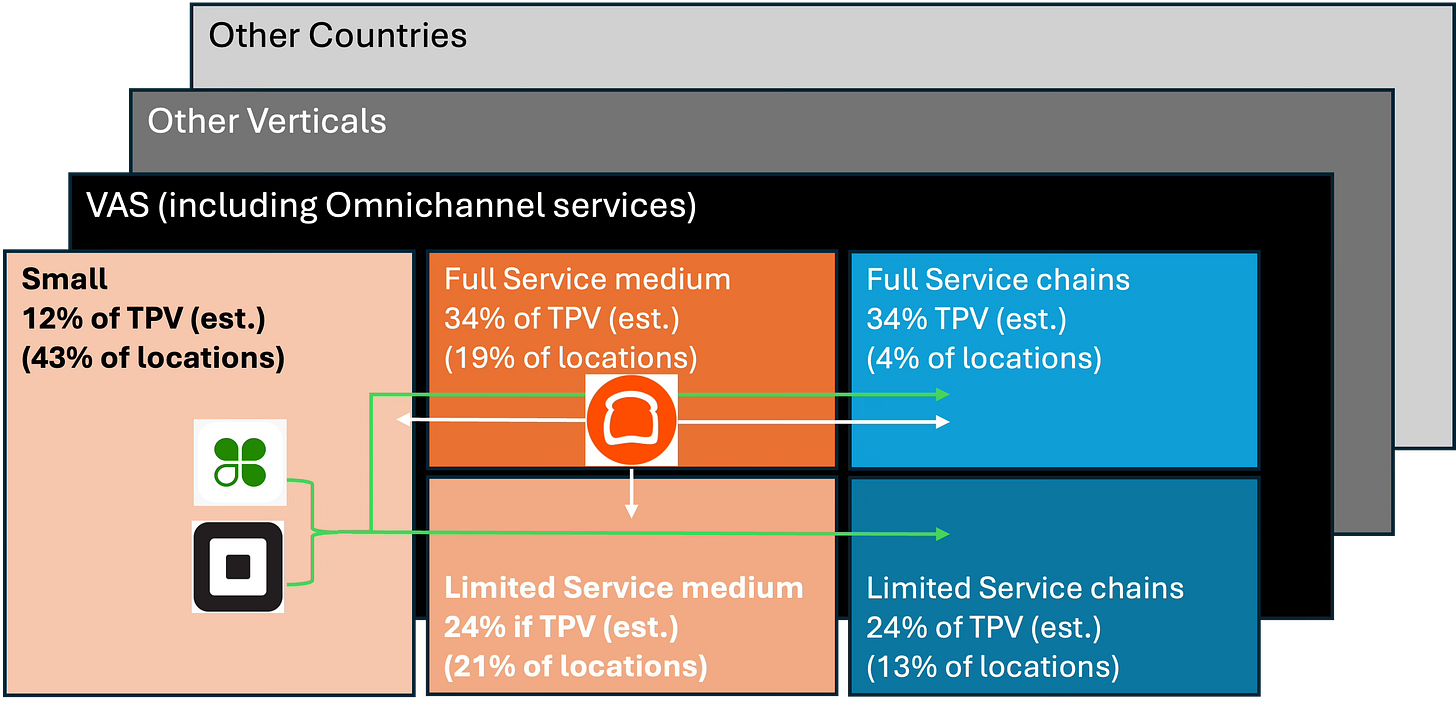

Think of the chart below as a breakout of the lower-left grid quadrant above, but only for restaurants. This table is built using the same data source I used for Are restaurant ISVs near Saturation?

Restaurant competitive landscape for key ISVs

(Positioned by starting point, arrows show expansion ambitions), (TPV estimated)

All three have the same broad ambitions, but Toast had a different starting point.

Square & Clover started in a sector with the most locations but a relatively modest TPV per location (12% of TPV/ 43% of locations)

Toast started in the full-service, single location sector that has high TPV per location, but fewer locations (34% of TPV/ 19% of locations)

They are all diversifying but are at different stages of development:

They offer roughly equivalent Value-Added Services (VAS), although Toast may have a broader portfolio for restaurants

They are all moving up to chains, although that is where payments revenue per transaction are lowest and VAS opportunities are rare

They have all diversified into other verticals, but here Toast is the laggard with only one other vertical (Food-centric Retail), while Square & Clover serve many other verticals

They are all going multi-country, but Clover & Square are well ahead of Toast which thus far is only in Canada, with plans for the UK

One of my ex-Partners lives nearby and we have a running text chain identifying what local restaurants have adopted each ISV. Toast has at least two-thirds of the locations near us and gets most of the new ones. The bulk of what remains uses Clover or Square, although some smaller and older locations still just use a POS Terminal.

We occasionally see other providers, but they are notable for their rarity:

The one local LightSpeed location recently closed but a mini-chain of high-end restaurants in next-door Connecticut just started on LightSpeed

My colleague identified a chain bagel shop that uses Shift-4 and I found a food Kiosk in the local mall that uses Revel – also now Shift-4

I came across a Linga location a couple of towns over – it was a Turkish restaurant and Linga’s founders are Turkish

Broadly speaking, the leaders have similar strategies. If you review the acquiring map above, you see that in particular, distribution and vertical SaaS drive success in the in-person, small business quadrant. The three ISVs have similar SaaS/VAS but different distribution models

Software & Services for restaurants

Sales success in restaurants depends on Vertical SaaS functionality. Here we look at two dimensions:

How tailored is the solution for restaurant sub-verticals?

What is the breadth of services available?

1. Tailored solutions

Based purely on their web sites, all three providers serve most restaurant formats.

The big difference that jumps out is the granularity within formats. Clover & Square likely do all the same formats but don’t highlight the differences on their web sites. Toast focused entirely on restaurants until recently, and is more specific.

The only real gap is Hotel restaurants, which requires integration with the hotel’s hospitality gateway. Toast does this, Clover does it through Fiserv (its parent), and Square doesn’t mention it.

2. Services

These providers offer a breadth of functionality to restaurants; and all three offer roughly the same services menu.

So what is the real difference? This is more impressionistic than factual, but it was challenging to fill many of these cells for Clover & Square. I had to do Google searches rather than just finding it on the restaurant section of their web-sites. More concretely, more of Toast’s solution is proprietary rather than third-party integrations.

The sparseness of Clover & Square website details was surprising. Toast uses in-person sales, so it’s prospects rely less on the web site; Clover & Square rely more on inbound sales which would seem to call for very robust web sites so that clients can self-educate before calling in.

M&A strategy at all three seems focused on new services rather than new verticals or roll-ups. For example, Toast’s added their Supplier solution via acquisition of XtraCHEF. More recently they acquired Delphi Display Systems for drive-thru technology. Similarly, Clover acquired Bento Box. Square seems to be partnering rather than buying services outright, recent example include: Sysco, SevenRooms, & Restaurant 365.

One other observation is that some of the more “horizontal” services in this table, like loyalty or gift cards, were found in other parts of the Square & Clover websites. These services are vertical agnostic, so this organizational choice makes sense from an efficiency standpoint, but it made it harder to find specific capabilities if you only care about being a restaurant. I know it made it more challenging for me.

One caveat here is that the table simply indicates the presence of functionality, but not the depth of that functionality. I expect that in certain vertical-specific rows, the Toast solution may be more functional. By the same logic, Square & Clover may have the advantage in horizontal services like Loyalty and Inventory Management.

Distribution models

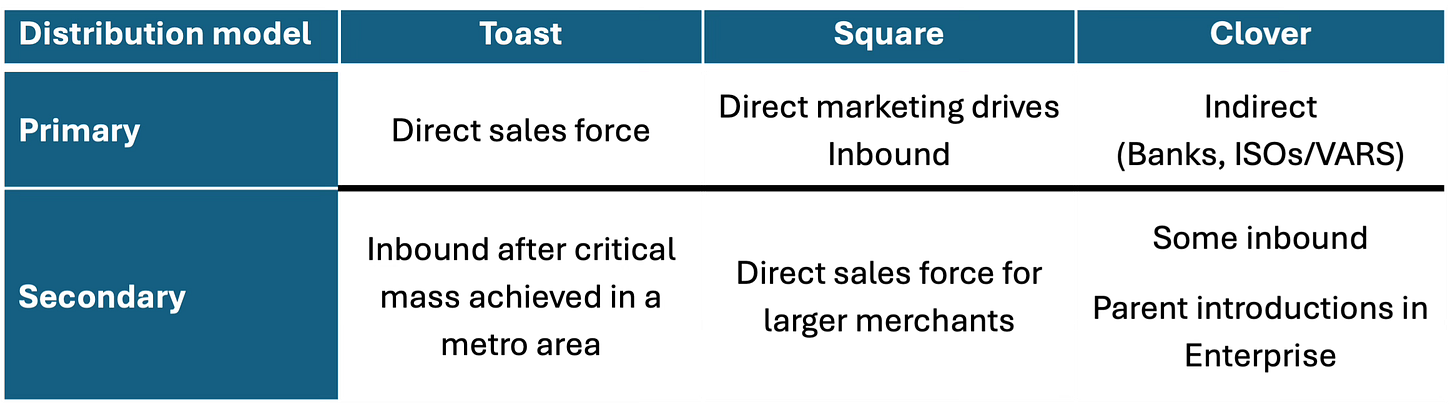

When I started researching this post, I knew that these three had different distribution strategies, but I hadn’t realized how distinct they were and how that drives outcomes:

Toast – Direct, local sales force, triggering inbound sales over time

The Toast Sales and Marketing strategy is outlined in their 10-K:

“We start with in-market sales teams that are deeply familiar with, and trusted by, the local community. This deep knowledge of the local food and beverage scene provides us with a competitive advantage. Our sales team consists of an acquisition team that is focused on new location growth and is organized by restaurant size (i.e., number of locations per customer), type, and geography. The acquisition team is complemented by a customer growth team that focuses on expansion into the install base “

This strategy leads to what they call the “Flywheel” in target metros. They have previously outlined that 75% of new locations come from inbound channels in these flywheel markets. This strategy is expensive at the outset but leads to high market share and lower costs in the out-years. In particular, they have no ongoing revenue sharing with distribution partners.

That “Customer Growth” team is cross-selling new services – growing ARPU, not locations.

As noted in my analysis of Toast market share, Toast has close to 50% share in their core single-location, table-service sector. Note however, that it serves several counter service formats like Cafes, Bakeries, and Pizzeria’s. It even reaches down to Food Trucks and up to Hotel restaurants. Just last week I bought lunch from two separate vendors in Grand Central Terminal’s food court and both were using Toast: A pizza place and an ice cream vendor. Those verticals were where I expected to see Square or Clover.

But Toast’s core is Fine Dining & Casual Dining (table service).

Clover – Indirect sales

Clover relies primarily on indirect distribution:

Banks – Clover partners with most major banks and many smaller ones to distribute via bank branches:

The two biggest partners operate in a JV structure where the bank owns 60%

Wells Fargo (~4,000 branches)

PNC (~2,200 branches)

Other banks partner in revenue sharing arrangements. Typically, the bigger the branch network, the higher the revenue share

ISOs & VARs – these are independent sellers of acquiring services with “feet on the street” in many communities. Small merchants often prefer using these intermediaries because they provide after sales installation & service

We have already seen the financial consequences of this strategy: Fiserv shares revenue with its distribution partners, but keeps its own sales and marketing costs lower. The nuance here is that Clover itself takes on the VAS upsell, particularly Clover Capital. This model uses digital marketing and call centers — similar to Toast’s “Customer Growth” teams.

Square – Direct marketing to generate inbound demand

According to its 10-K, 30% of Square’s TPV comes from the Food & Drink vertical. Across all verticals, 58% of volume is from sellers with <$500K in sales. That means well over two-thirds of locations are in this size range. But Square is steadily moving up-market as this metric was 84% in 2016.

The 10-K notes an emphasis on inbound sales with direct and indirect sales for larger locations or chains:

Inbound:

“Our products are designed to be self-serve and intuitive to make initial setup and new employee training fast and easy, although we also offer full-service setup and support.”

“Direct marketing, online and offline, has also been an effective customer acquisition channel. These tactics include online search engine optimization and marketing, online display advertising, direct mail campaigns, direct response television advertising, mobile advertising, and affiliate and seller referral programs.”

Direct: “Our direct sales and account management teams also contribute to the acquisition and support of larger sellers. … In the fourth quarter of 2024, we began hiring a field sales team to focus exclusively on in-person seller outreach to further increase acquisition of larger sellers.“

Indirect: “…we work with third-party developers and other partners who offer our solutions to their customers. Partners expand our addressable market to sellers with individualized or industry-specific needs.”

So Square has started emulating Toast (Direct) and Clover (Indirect), as bigger merchants need a more consultative sales process and smaller merchants often need hand-holding.

I usually see Square at smaller counter-service restaurants or small chains. For example, most of the food court restaurants at our local mall use Square. But just last week I frequented a high-end coffee place that is part of a small but fast-growing national chain. They serve food and provide table service, not just coffee-at-the-counter. They had just converted from a smaller ISV to Square and the wait staff was delighted – they all had mobile readers to take payments but were not using them yet to take orders. Square’s solution is clearly capable of serving table service locations and chains, and has been for a while; but, until recently, its distribution strategy did not support that segment well.

Conclusions

Despite a long tail of smaller and more specialized ISVs, these three dominate the market. Square & Clover across most verticals and Toast in the restaurant vertical. For restaurants, these three provide broadly equivalent services, although Toast’s are more tailored and integrated.

All three are now in all the domestic restaurant segments & formats, competing head-to-head. They are all expanding to new countries and new verticals. They are all adding new services, especially lending & omnichannel. They are all moving up-market to chains. The key difference among them is their distribution model and initial target segment:

Toast started by targeting larger, single-location, table-service restaurants using a direct sales model. Their specialization created a strong reputation – which in turn creates inbound demand in their target metros. We have heard waiters say they love Toast because they used it at prior jobs and didn’t have to retrain

Square started out targeting small, counter service restaurants with direct marketing driving inbound demand. They now deploy direct & indirect sales to reach larger restaurants

Clover started out targeting small, counter service restaurants with indirect distribution partners – Banks and ISOs/VARs. They rely on the Fiserv enterprise sales force to reach chains

I think Square and Clover started with the distribution model and took business where that resonated, i.e., smaller restaurants. I suspect Toast started with the target segment and tailored the distribution model to capture that segment.

Why is Toast growing faster? I suspect it is that their solution is still more functional and their distribution strategy uses a more consultative approach. Clover is face-to-face but with a less informed sales force while Square is still largely inbound. Both Clover & Square have experts available in call centers, but that may be too far back in the sales process. All three are converging on functionality and distribution approach.

The key open question is whether Toast’s lead position is sustainable. It has the inertial benefits of incumbency, and so far, it has a higher sustained growth rate. Most of its investments have been to increase ARPU, but it now requires investment for both vertical diversification and global expansion. Will those strategic initiatives distract it from its core or reinforce its leadership?

Thanks for the thoughtful comments! Here are some responses:

1. Shift4 is more chain oriented from what I can tell. That changed a bit when they bought Revel -- which is single-location focused -- but Revel is pretty small

2. Great point! Annoyed that I missed this myself

3. I am aware of the GPN efforts. They have a great sales force in the old Heartland franchise, but I think it is too little, too late to have much impact. Their Genius solution is untested in the market and likely lags Toast, Square & Clover on functionality given how new it is -- but I haven't done a feature-by-feature comparison so this is supposition

4. I agree. But churn comes from 2 sources: a restaurant switching providers and restaurants going out of business. Churn cause by customer failure is higher among small establishments, so Clover and Square suffer more based on who they target. The average Toast establishment has ~$1.5M in annual sales so it is not as vulnerable to failure

Great analysis. Few thoughts/questions:

1. Why is Shift4 not really in the analysis? Not a large enough player?

2. Toast and Shift4 both use HW as a marketing expense and give it away for free, whereas Clover and Square haven't historically. Jack Dorsey recently announced they're going to go full force into direct sales and give away HW for free to compete on restaurants.

3. GPN is trying to reenergize their many different brands under one - 'Genius'. We'll see how that turns out.

4. Toast has lower costs regarding churn because once they're established in a market they receive the predominant share of new openings, so churn reappears, but takes time.