Introduction

This post updates prior posts based on new developments:

The CFPB has changed leadership, which will impact several recent initiatives

PayPal published 2024 earnings which shows no real change in engagement

Varo Bank published its Q4 2024 call report which shows the Neobank model is still not working

I will not write a summary as each of these sections are fairly short

CFPB leadership change

To absolutely no one’s surprise, the CFPB changed leadership – although it took two weeks longer than expected. I have written about government initiatives several times, but not all of them were CFPB topics. So I wanted to do a quick inventory to see which are still active and which will likely change:

Rule 1033 likely to be dropped

I covered this topic in my post: CFPB's 1033 rule won't change much. My point was that the market had already provided Open Banking services via contracts between banks and data aggregators. The CFPB rule largely added an onerous layer of paperwork.

The 1033 rule was already challenged in court, but now that challenge will be moot. My take was that the rule added a massive compliance burden without actually helping most consumers. The loss of Rule 1033 should create some winners and losers:

Winners

Consumers. Surprise! The rule exempted smaller banks serving as much as 30% of consumers. Now those smaller banks are likely to demand Open Banking services from their processors, just to stay competitive. Consumers at bigger banks already had Open Banking access

Fiserv & FIS. They get to sell open banking services to their core processing banks who would have been exempt. New payments methods like Zelle, RTP & Fednow have accounted for material revenue growth at these processors and Open Banking will add yet another growth engine

Larger banks. The regulations required unlimited access to bank servers without the ability to manage demand or charge for it. To the best of my knowledge, no bank charges for access, but they do manage access to protect service levels at sensitive times — now they can keep doing so. These banks also avoid the compliance paperwork that rule 1033 would have imposed

Leading data aggregators. The rule would have commoditized some of what aggregators do. Without the rule, the market leaders can retain their lead for a while longer

Losers

Smaller banks. They have always been screen-scraped and will continue to be. But market pressures may force them to adopt an API solution from their core processor. This will add to their costs without generating any revenue — but it will keep them competitive

Fintechs. If you believe 1033 would have commoditized Open Banking, the Fintechs would have benefited from lower aggregation vendor costs. Without 1033, competition and scale will still push those costs down, but it will take longer

To be determined

Who bears liability? Rule 1033 avoided the question of liability in Open Banking. In other words, if data extracted by an aggregator led to fraud, who was responsible for the losses? Today, that issue is negotiated between the banks who provide data and the aggregators who distribute it. Under 1033 the ecosystem would decide how liability is split through consensus. The current situation favors the big banks, the 1033 approach likely favored the aggregators and Fintechs. But it is largely an unresolved issue for smaller and mid-sized banks. Perhaps the processors can negotiate limits on behalf of the smaller banks.

Akoya. Akoya was positioned to capture a lot more banks given the compliance burden of 1033. I think the Akoya proposition is still compelling, but without the rule deadline and compliance burden, bank urgency to integrate may diminish

The Zelle suit

I covered this topic in my post: Year-end grab bag.

The CFPB sued Zelle and its three largest members over the level of fraud and scams on the network. They did this under their Reg E authority. It was always a long shot and is now likely to be wrapped up.

My post pointed out that Zelle has lower fraud than all other payment methods, but it had a scams problem that was proving harder to resolve. Even counting scams, consumer losses overall were modest relative to other payment methods. Scams are the harder problem because the real customer did authorize the transaction. Under Reg E banks were already liable for unauthorized transactions, but prior CFPB leadership wanted banks to reimburse customers for these authorized transactions as well.

This suit will likely go away. The banks were already addressing both fraud and scams through a variety of rule changes, experience changes, and improved technology. Loss rates were coming down and will continue to do so – because it is in the members own interest to have a safe & secure network. The suit may have increased the urgency for change but not its direction.

Paradoxically, the three banks targeted in the lawsuit (JPM, BAC, & WFC) likely had the lowest loss rates and were doing the most to harden the system. They are the clear winners here as the litigation burden goes away.

Merchant Settlement and Visa Lawsuit

Neither of these are CFPB-initiated so they won’t be impacted directly.

The merchant settlement is still in negotiation with no announced deadline. The original complaint was filed over 10 years ago, so no one seems in a rush. It isn’t clear to me which side the new administration would come down on if it even cares.

I covered this in my post: What happens if Honor All Cards goes away?. The judge in the case was pushing to change the “honor all cards” rule, and if that happens it would have significant impact on the ecosystem. Merchants could refuse certain card types or discriminate against certain issuers. My take was that many would start declining “virtual cards” which many Fintechs use to monetize. I still think that.The DOJ suit on Visa Debit Routing. I covered this in my post called: The DOJ Visa lawsuit won't change much. This is another case where it is hard to know what the new administration will do. The merchants want more levers to negotiate debit acceptance costs. Visa wants to maintain its leading position in Debit. A parallel action is taking place at the Fed to ensure that eCommerce merchants have debit routing rights.

My bet is both actions stay the course. The Fed action simply enforces old Durbin rights in eCommerce. The Visa lawsuit could be pursued in the name of reducing consumer costs, savings which might be positioned as offsetting inflation.

PayPal engagement

I promised an update to my post on PayPal engagement once they published Q4 results. That happened this week.

I need to own up to an error I made in that PayPal post. I assumed the “P2P ex Venmo” line item in their disclosures was a portion of the Branded Wallet line. Therefore, I subtracted it from the total before doing my calculations. It turns out that PayPal had already done that for me. Shame on me and kudos to them.

When I correct the error, PayPal wallet engagement is higher – 14.6 commerce transactions per year vs. 10.4. That raises monthly engagement to 1.2 where the prior calculation was 0.9. This does not change my conclusions, but I wanted to acknowledge the error.

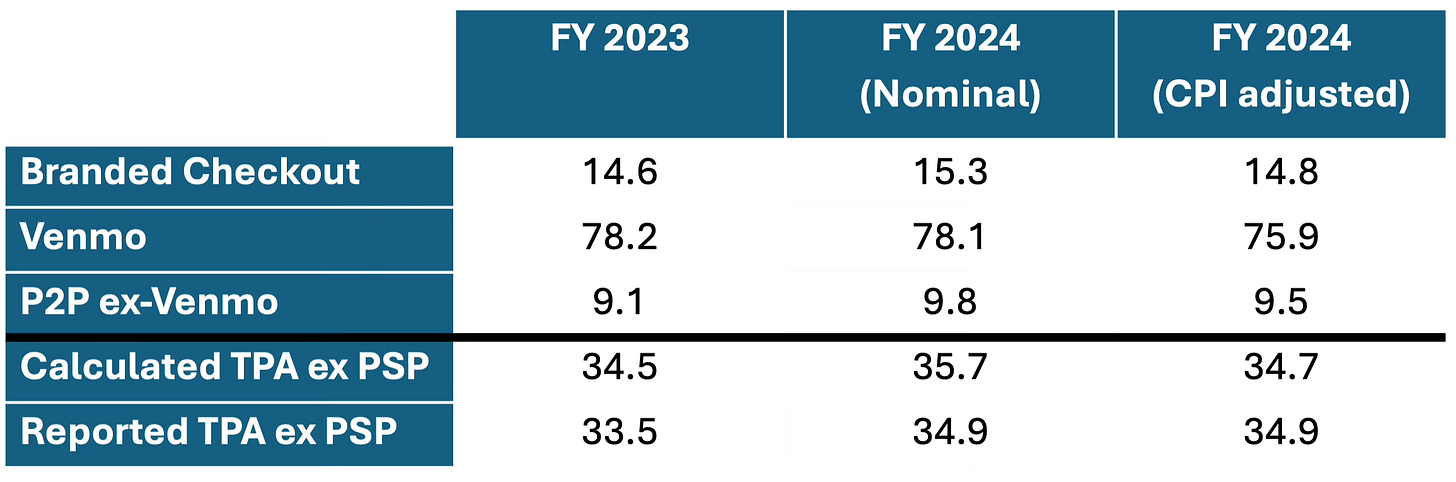

In this post I am (correctly!) comparing 2023 to 2024; to do so I felt the need to inflation-adjust the 2024 calculation. US inflation in 2024 was 2.9% so I raised the average tickets by that factor. My math foots very closely to PayPal’s disclosed “Transactions per account ex PSP”. All these figures are full year::

PayPal transactions per active account by product (revised)

To get to these results I assume Venmo has around 20% of actives. Recall that Venmo is a US-only product while the other two rows are global.

These results also accord with PayPal’s commentary. For example, they say that “P2P ex-Venmo TPV accelerated, benefiting from increased engagement among existing user base”. That is just what we see. They also disclose Branded Checkout was up 6%, but inflation adjusted, that number is really 3%. In fact, most of the growth seems to have been from a 2% increase in active accounts rather than an increase in usage from existing accounts. The math above shows inflation-adjusted engagement for Branded Wallet grew just 0.4%. The 2% increase in actives is good news, but engagement didn’t really change.

Venmo engagement in my model declined on an inflation adjusted basis, which is surprising. PayPal says that “Venmo TPV accelerated with 4% growth in MAAs” where MAA is monthly active accounts. Venmo grew total TPV by ~9% which is ~6% adjusting for inflation, while the denominator for TPA grew by 4%. So that should have led to a 2% increase in engagement where I show a 3% decrease.

The good news on Venmo is that monetization is up. PayPal claims a 30% increase in Venmo-branded debit card MAA and a 20% increase in Pay-with-Venmo MAA. It does not disclose a base, so we don’t know how big these are in absolute terms, but it is a step in the right direction strategically.

Similarly, they claim 100% growth in the PayPal-branded debit card, but that has to be from a low base. It would be surprising if we didn’t see this growth given the high rate of advertising I see on TV and the generous rewards proposition. But again, we don’t know the absolutes.

Worth noting that the rewards proposition could be appealing to optimizers. I was at JPM when Pay-with-Venmo launched; we tracked it carefully in our customer data. We found that usage skyrocketed at merchants with generous promotions, but fell just as fast when the promotions were over. We saw a similar pattern on other wallet promotions.

PayPal is currently offering 5% cash back on one merchant category per month. Optimizers may use the card only at that category to maximize cash back. Cobrand credit cards often show a similar pattern. For example, cardholders use their Amazon card just at Amazon or their Target Card just at Target. PayPal is particularly vulnerable to this as every cardholder also has a bank-issued debit card and most PayPal accounts do not accrue a big balance (most consumers are spenders not merchants). So rapid growth in spend may not yield rapid growth in earnings.

Varo bank YE results

I covered this topic in my post: Neobanks are not the future.

Recall that Varo is the only Neobank that got a bank charter — the others all use a BIN-sponsor. Varo has to publish quarterly call reports, providing transparency into their performance.

Varo’s YE call report shows that while growth continues, losses are still high. They lost $65M in 2024; Capital declined from $107M to $60M even with a $6.5M capital infusion from their owners. Another year like this and they will be insolvent. Sometime sooner they will fall below regulatory minimums. They have cumulatively lost $744M over the life of the bank.

Some positive trends persist. Non-interest income was up 27% YoY, particularly “fees” (largely, income from ATM surcharges), but Interchange revenue also rose 12% YoY. Accounts grew 20% although balances grew only 6%, so average balance declined.

This was an improvement over 2023, but a good part of it was due to cost cutting and interest rates.

Expenses were down 7% or ~$16M — largely from lower headcount. Advertising spend was flat, which may explain the account growth

High interest rates gave them interest income from placing those deposits with other banks. But with the decline in interest rates, that revenue source is eroding

The Neobank model just isn’t working at Varo:

They have a modest lending portfolio and their provision is higher than their net interest income — although that might also reflect a 45% increase in loans. Total loans are just $72M versus $337M in deposits for a 21% loan to deposit ratio. The population they serve just isn’t credit-worthy enough to lend to, or they have better sources to borrow from, like BNPL

Deposits per account are just $65, down from 2023. If we back into debit-active accounts we get an estimated average balance of $390. That estimate suggests only 9% of accounts are debit-active – the rest are likely dormant or interest-bearing. They have plateaued on interest-bearing balances.

This is relevant data in anticipation of a Chime IPO. Chime has higher scale than Varo and their CEO recently claimed at least one profitable quarter. They don’t have a bank charter, so they may have a more variable cost structure. We will see the data when an S-1 is released.

But, based on Varo alone, Neobanks are still not the future.

Thank you for the comment. I don't get enough of these!

The reason I did this is because of the way PayPal reports at the product level. The only metric they provide on PayPal wallet is total GPV, which means I need to estimate transactions to calculate engagement. (Branded Wallet GPV/Est. Wallet Txs = TPA ex PSP)

I estimated $90 per transaction for the 2023 FY data based on other metrics in the public domain. So: 2023 GPV/$90 = Est. Transactions. But the 2024 GPV number represents nominal GPV growth not real GPV growth (i.e., it didn't adjust for inflation). The easiest way to make that adjustment was to apply 2.9% CPI to the average ticket.

If inflation is accurately measured by CPI then a nominal level of GPV overstate transactions unless we inflate the average ticket as well -- so in my methodology both numerator and denominator are inflation adjusted. Otherwise, numerator is inflated but denominator is not.

Andy, awesome analysis. I’m curious on the PayPal engagement if your TPA estimates also tie out with the number of transactions disclosed by the company adjusted to remove PSP? I estimate about 15.1 billion non-PSP transactions (26.3 bn x ratio of TPA ex PSP versus TPA.