Key insights in this post

Fiserv, alone among its incumbent peers fielded a competitive ISV solution (Clover), with all the key components: payments + software + VAS

Clover is growing fast, and globalizing, but Fiserv’s overall position in the Small Business acquiring segment has plateaued

Fiserv recently started disclosing more data on its small business segment

Clover TPV growing by 14%

Clover revenue growing by 29%

Overall TPV growing by 4%

Overall revenue growing by 12%

If we back Clover data out of segment data, the legacy business has stagnated

Legacy TPV growth at -1%

Legacy Revenue growth at 2%

Inflation alone should deliver 3% growth

The reason for this is Fiserv’s indirect distribution model:

The Indirect network can only generate so many leads and that network is not growing much

Those leads are being disproportionately allocated to the Clover product at the expense of the legacy products

As result Clover shows high growth but legacy declines

Most of this is due to natural churn as small businesses fail and new startups form. I see no evidence of forced conversions or wins/losses against the competition from public sources

The Clover solution is not that effective at anchoring clients

The most common hardware choices are not a material sunk cost to merchants

Most Clover merchants do not use much software beyond payment acceptance

Most VAS do not produce revenue and are also available from the competition

Revenue producing VAS are also available from competitors on similar terms

The Clover distribution model faces headwinds, particularly at the 3 biggest banks

Bank of America left Clover years ago, and the installed base is eroding

Wells will terminate its JV this year and may or may not continue with Clover

PNC renewed its JV this year, but it also promotes its own restaurant ISV called Linga that PNC acquired a few years ago

Overall, Clover performance can be explained by lead allocation and VAS

The semi-fixed prospect flow is being allocated to Clover without increasing overall opportunity, which grows Clover share but not Fiserv market share

Clover is successfully selling Clover Capital and other VAS to the installed base, which grows revenue but not Fiserv market share

Introduction

Last week I wrote Clover vs. Square vs. Toast which was partially based on recent disclosures from Fiserv. Those disclosures showed Clover growing TPV by 14%. Something bothered me about this, so I looked deeper, and my spidey-sense hadn’t failed me, it just kicked in too late. This week’s post will be a deeper dive into Clover that will put that growth in perspective.

I admire Fiserv. Alone among the scale incumbents they created an ISV to keep pace with the insurgents – and, Clover has been a clear success in that mission. Clover executes the full ISV playbook including omnichannel, going global, and value-added services (VAS). Their incumbent peers waited too long and don’t execute the full playbook. So, Fiserv is better positioned in Small Business than any of its peers.

I have wanted to write a post on Clover for a while. Those new disclosures revealed new angles on Clover while still missing some key metrics. Despite the missing pieces, they made me see something I had previously missed.

In magic, misdirection is where “the performer draws audience attention to one thing to distract it from another.” Fiserv keeps pointing us to Clover as a growth engine, but isn’t revealing enough data for us to truly evaluate progress. They point to very impressive Clover growth rates, but are silent on where that growth is coming from.

My analysis concludes that Clover’s TPV growth is largely at the expense of Fiserv’s legacy business, not from share gains against the competition. Revenue is outgrowing TPV because Fiserv is successfully cross-selling VAS into its base, in particular Clover Capital.

Why is Clover so important to Fiserv?

Recall from last week’s post that Clover is distributed primarily via indirect channels – bank branches and ISOs/VARs. Arming those channels with competitive products on the ISV model (Software + Payments + VAS) was key to keeping those channels productive.

Clover also anchors the merchant to Fiserv acquiring services – where most of the profit is. Unlike a conventional POS terminal, which is acquirer-agnostic, Clover hardware only works with Fiserv Acquiring. A Clover merchant can’t switch acquirers without buying a new terminal. If the merchant also uses Clover software, their business processes are wrapped around the platform, making it even harder to defect.

So, Clover reduces churn -- one of the biggest problems in small business acquiring. Churn comes in two forms, clients failing and clients defecting.

Failure churn. According to the U.S. Bureau of Labor Statistics: “20.4% of businesses fail in their first year after opening, 49.4% fail in their first 5 years”. So client failures account for 15%-20% churn per year. Obviously, Clover does nothing to address failure churn — nor does any ISV solution

Defection churn. This churn is caused client defection to other providers. Clover can help limit this, both by raising barriers to exit and by providing good enough services to keep clients loyal

The question then becomes: Does Clover have fewer defections than other ISVs? I know of no reliable data source on this. It is the kind of disclosure that would be useful, such as wins and losses for established merchants (as opposed to startups).

Another Clover advantage is the way VAS revenue is captured. When Clover is distributed through a partner, only the base services are subject to revenue sharing. In particular, any Clover Capital revenue goes 100% to Fiserv. As we discussed last week, the Clover distribution model incurs revenue sharing – so any revenue source not subject to revenue sharing is particularly valuable.

Therefore, moving merchants onto the Clover platform should improve long term economics, by reducing defection churn and increasing VAS revenue.

Clover TPV growth is not leading to share growth

Below is Fiserv’s disclosure on Clover performance from their Q4 earnings presentation. The Clover metrics are in the bottom right quadrant, highlighted in Fiserv Orange:

So what is the issue?

They are cannibalizing the legacy lead flow to build the Clover business, so not all Clover TPV growth is incremental

Not all Clover merchants are on the ISV model of Payments + Software + VAS, so defection risk is higher

Value-added Services are accelerating revenue growth, but not location count and therefore market share

Cannibalization

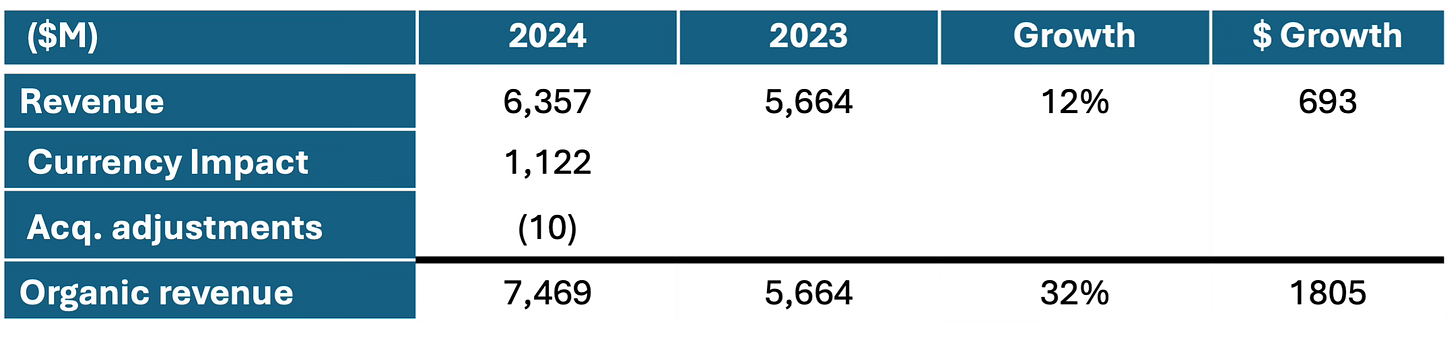

Here is how Fiserv discloses Small Business segment performance, of which Clover is one component:

Most of Clover is US at this point. Only about 15% of Fiserv’s total revenue is non-US and Clover is a relatively new global product. So I will stick with the Revenue line rather than the Organic Revenue line that reflects a currency adjustment.

The Clover disclosures from the prior page put this data in context:

“$2.7B of Clover revenue, 29% growth”

“$310B annualized Clover GPV”

“Clover annualized GPV up 14%”

“4% Small Business volume growth …”

[Note: Fiserv uses the term GPV while I prefer TPV. They are exact synonyms. Fiserv also uses the term “volume” in the last bullet, which is yet another synonym for TPV].

So, Clover revenue is outgrowing Clover TPV (29% vs. 14%), and Clover TPV is outgrowing segment TPV (14% vs. 4% with the 4% including Clover as well). What is likely happening is that Fiserv is routing all its prospects to Clover rather than legacy POS solutions and Fiserv is selling more VAS to Clover customers.

This is the right strategy – if they don’t cannibalize the legacy lead flow, other ISVs will. And VAS can be cross-sold via digital marketing and call centers rather than feet on the street – where Fiserv has limited capacity. And of course 100% of VAS accrues to Fiserv without a revenue sharing obligation.

But that means most Clover TPV growth is not incremental but, simply redirecting the indirect leads pipeline from the legacy model to the Clover model. I found evidence on merchant Reddit groups that this is indeed happening: The sales force push Clover over all other options. But the acquiring revenue from a Clover merchant is pretty much the same as the acquiring revenue from that same merchant on a legacy platform. So platform has no real impact on payments revenue or TPV.

Non-Clover TPV growth is not disclosed so we need to estimate it from data they do provide. Disclosed Small Business segment TPV growth (volume) is 4% while Clover TPV growth is disclosed at 14%. Small business revenue growth should roughly parallel TPV growth because merchants are charged an MDR on TPV rather than a flat fee per transaction. Clover accounted for 37% of SB revenue in 2023, so if we assume it was around one-third of TPV, then non-Clover TPV declined by 1% from 2023 to 2024.

The overall card spending market increased by around 8% YoY, so non-Clover growth trails market growth by 9% and Clover growth leads market growth by 5%. Note that TPV growth also reflects inflation, which was ~3% in 2024; so, these growth rates could all be reduced by 3% to capture real growth.

Failure Churn alone could lead to these outcomes. If 20% of non-Clover merchants disappear every year but are replaced by roughly the same number of new clients, overall TPV growth would be roughly flat, which is what it was last year after adjusting for inflation. But if half of new prospects are boarded as Clover merchants every year, you would expect Clover growth at around the levels they actually performed. That doesn’t require force converting the installed base, it simply routes half of incoming leads to Clover rather than legacy solutions. But that volume was coming to Fiserv one way or the other.

Conclusion

The Clover brand is indeed growing rapidly, but Fiserv’s small business segment is not. Fiserv seems to be allocating the inbound pipeline to Clover and away from non-Clover. The net result trails Small Business market growth, so Fiserv overall is losing share.

Are Clover merchants less like to defect?

Recall that Clover anchors the client to Fiserv in a few ways:

The hardware only works with Fiserv acquiring. To leave Fiserv, the merchant must buy new kit

The software anchors merchants to Clover because they build business processes around it

The software or VAS are sufficiently differentiated such that merchants prefer it to other ISV solutions

I am not sure any of these propositions holds for most Clover merchants.

Clover was a hardware company when Fiserv bought it and it shows: The terminals are sleek in my opinion. But, in my travels around town I notice most locations using a Clover Flex or Mini device only to capture card swipes/dips/taps. In other words, these merchants are not using much Clover software or VAS.

The Flex costs between $300-400, so it doesn’t present much of an economic barrier to exit. The Mini is about 50% more expensive, harder to abandon, but not that painful.

Fiserv Flex and Mini POS terminals

Below is a picture I took this weekend at a local Bagel store I frequent. You can see their black digital cash register in the background and a Clover Mini device in the center — behind a cash tip jar. Note that the placemat in the foreground is encouraging tap-to-pay, but the device is pointed towards the cashier, not the customer.

I often see the Flex or Mini integrated with a VAR solution like this – so the VAR provides the Software and the Flex/Mini is just an acceptance device with Fiserv as the transaction processor. It is worth noting that the coffee shop next door used to have a similar setup from the same VAR, but I was surprised to see they had converted to Toast in the recent past. Defection.

Software use is not apparent

The Mini has a big enough screen to run software that might anchor the client, but most Mini merchants I speak to use the Mini the same way they would a legacy terminal. The consumer-facing services they do use are tipping, surcharges & digital wallets – as I am sure you have noticed in your own travels. But, as best I can tell, Fiserv does not charge for these services.

Fiserv also has the Clover Station device with big, dual screens – one for the customer and one for the merchant. I usually see these at bigger, more sophisticated merchants – both restaurants and retailers. This is a better form factor for incremental software, but seems much rarer in the market.

Fiserv also lets merchant download third-party software for services like loyalty or marketing. Fiserv charges a fee for this, This could be another reason that revenue is outgrowing TPV. However, with a 22% VAS penetration rate, not many merchants take advantage of this option.

Value-added services

Fiserv lists their VAS offerings on their web site, some are for the Enterprise segment and some are only relevant to small merchants. Several can be used whether the merchant is on Clover or non-Clover hardware and do not incur incremental fees. These include Surcharging and Digital wallet integration.

Many Clover merchants can’t use some of the VAS because there is no merchant-facing screen. They can access those VAS through an online portal but most don’t seem to do so. Fiserv only claims 22% VAS penetration.

All the major ISVs have similar value-added services to Clover. Fiserv does not disclose the revenue associated with those VAS. Since Clover TPV is growing 14% while revenue is growing at 29%, there is either a lot of new VAS revenue or Clover has increased revenue in other ways:

Raising MDR, for which I find no evidence

Hardware sales could increase revenue without a TPV increase, but these are not disclosed. They would naturally rise with new clients, but it is a one-time event

Third-party software, for which I observe limited evidence in my travels

Direct sales without a revenue-sharing obligation would also drive up revenue — but it is unclear how often this happens. There is certainly some inbound traffic

I think the most likely source is rising VAS, particularly Clover Capital.

The two VAS that seem Clover-specific and carry extra fees are Rapid Deposit and Clover Capital:

Rapid deposit allows a merchant to take their settlement intraday in return for a 1.75% fee. This is popular with small merchants who have tight cash flows. Other ISVs offer a similar service

Clover Capital is a discounted advance on future settlements. It is repaid as a percent of daily settlements. The advance might be used to fund inventory for a peak period or to make it through a slack period. Clover Capital advances seem to have totaled ~$800M in 2024. Most large ISVs offer a similar service, e.g.., Toast Capital, Square Loans

Fiserv makes no disclosures on how much it earns from these products. Clover Capital likely accounts for most of the gap between TPV growth (14%) and revenue growth (29%). By very rough math Square earns 50-60bp of TPV on its “Subscription & services-based revenue”. If Clover earns similar amounts on its VAS, then VAS could account for 60-75% of the gap between Revenue growth and TPV growth.

Conclusion

Clover installations don’t deliver the full anchoring effects of the ISV model. The terminals don’t cost that much, they don’t use much software, and they are unlikely platforms to monetize consumer-facing VAS. A small merchant won’t want to walk away these sunk costs, but they are not an insurmountable hurdle to defection — as the coffee shop shows.

VAS are a way to increase ARPU without selling new locations. Most major ISVs offer the same VAS, so it is not differentiating among them — it therefore has limited impact on share gain or loss. The impressive revenue growth is a share-of-wallet phenomenon — more revenue from the captive base — whereas TPV growth would mean market share capture.

The Small Business segment is growing TPV at only 4% (1% after inflation). This slags market growth and the TPV growth of larger ISVs; As a result, Fiserv is actually losing US small merchant share despite high Clover growth.

Other Open questions

I have two open questions on Clover that are not discussed in any commentary:

What will happen with its three biggest bank partners going forward?

Where do the revenues from its “integrated business” reside?

Channel challenges

Clover’s indirect distribution model is an asset relative to start-up ISVs; however, the channel is concentrated, with a few big banks that all represent headwinds to growth:

Bank of America dissolved a Fiserv JV years ago and stopped distributing Clover to new clients. The bank now distributes its own solution called Essentials. While it has not force-converted the installed Clover base, normal failure churn will diminish that base over time

Wells Fargo’s JV with Fiserv will expire in 2025. It is unclear whether WFC will continue to distribute Clover long term or follow the Bank of America path. Stay tuned

PNC renewed its JV with Fiserv, but the bank bought Linga, a restaurant-focused competitor, a few years ago. Restaurants are a key Clover vertical. It is unclear how PNC distributes restaurant leads between Clover & Linga

Fiserv already gets no new leads from BofA, and may face diminishing lead production from WFC & PNC. This is more of a slow drip than a gushing leak. But Fiserv has limited options to replace this lead flow. It claimed 100 new FIs as Clover distributors in 2024, but these must be small FIs without much opportunity. A rule of thumb is that a bank branch can generate 1 new merchant per month. So a 10-branch bank can generate 120 new merchants leads per year — less if the FI is a credit union. Wells and PNC combined have around 7k branches which would produce over 8000 leads annually on the same formula. There are no major unsigned small business focused banks to replace this production should it diminish.

The disclosures also don’t discuss how to make all the indirect channels more productive. Generally, bank branches are valuable lead sources because startup businesses come in to open bank accounts — which gives the bank an opportunity to sell Clover. If the network produces the same number of leads, and all those leads are eventually routed to Clover, Clover eventually runs out of runway. If Clover converts more leads than the legacy products would have, that would produce growth, but we have no evidence of that one way or the other. It would be useful to see some.

Integrated Payments

Fiserv has a business called Integrated Payments that used to be branded Clover Connect. It provides back-end processing for other ISVs. This is a wholesale processing business with low revenue per transaction and no direct relationship with the end merchant for VAS cross-sell. But it has an impact on TPV growth and location count. Here is how Fiserv’s web site describe the business:

“Integrated payments enable software providers and ISVs to seamlessly add secure payment features directly into their platforms”

“By offering a range of Clover payments hardware, from countertop terminals to portable and mobile devices, Fiserv provides flexibility that caters to the specific needs of each ISV's software and business needs, such as mobile payments, contactless options and streamlined checkout.”

Although it is wholesale processing, it uses Clover hardware; therefore, it is unclear to me where it metrics are reported:

If it is in Small Business segment and classified as Clover, then Clover TPV growth is overstated relative to the revenue opportunity

If it is in the Small Business segment but not classified as Clover, then the Small Business growth rates are overstated but the Clover growth rates are not. In other words, non-Clover TPV generates even less revenue

If it in the Processing segment, it has no impact on this discussion

Overall conclusions

Small Business is the highest margin acquiring segment and it is quickly adopting the ISV model (Software + Payments + VAS). Clover is the right strategy for Fiserv and they started down this path far sooner than all their incumbent rivals. Fiserv also has the broadest distribution channels and those channels need good product – which Clover is.

However, from the limited data Fiserv makes available, it isn’t really working. Yes, Clover is growing fast, but mostly at the expense of Fiserv’s legacy small business services, not by taking share from other ISVs. Fiserv simply reroutes leads to Clover and at the expense of the the legacy products. That is why overall Small Business TPV growth is only 4% compared to say Toast at 26% and Square at 9%. Clover’s 14% TPV growth is at the expense of legacy Fiserv products, not at the expense of the competition.

Where Clover is helping is as a better platform for cross-selling VAS, particularly Clover Capital. That raises revenue per merchant even if the merchant base were not growing much — and VAS revenues are not subject to revenue sharing. However, some Clover merchants are using Clover hardware just as acceptance devices, and are not engaging with the software or the VAS. Further, some of the most popular VAS (surcharging, digital wallet acceptance), don’t generate any revenue. So the 22% VAS penetration is less important than the mix of VAS it represents. However, the 78% who don’t use VAS are huge go-forward opportunity.

Finally, while Fiserv is advantaged due to its distribution channels, those channels are also under pressure. Bank of America left the Clover family and Wells may follow that path. PNC bought a Clover competitor in the key restaurant vertical. It will take time for natural churn to reduce the Clover base at these banks, but at the very least, these channels may not be as productive for boarding new clients.

My overall point is that Clover growth is a distraction from the stagnation of Fiserv’s overall Small Business segment. Clover helps stem the decline, but Fiserv overall is still losing TPV share. Without a change in distribution dynamics it will continue to do so. VAS growth can offset slower TPV growth, but not forever.

I believe Fiserv is looking to international growth for Clover with expansion in a few markets like Brazil during 2025, utilizing the same GTM model as in the US. Their US focused competition isn't at that stage yet, so should have the ability to win some share.

As a platform, VAS options that generate revenue seem limited. The Clover site hints at but doesn't clearly emphasize how new channels are enabled beyond split the check, manage tables, CRM "insights. What about a mobile app/order ahead, BNPL, Uber Eats, loyalty/miles partnership, etc.