Chime vs. Cash App: Who has the better hand?

Cash App: DDA primacy isn’t that good a cross-sell platform

Key insights in this post

Chime & Cash App are the two leading Neobanks but they arrive at that result in different ways

Cash App has 6x as many total customers and 4x as many debit customers

Chime has over twice as many direct deposit customers

These outcomes appears to be caused by distribution differences

Cash App originates via its P2P service, then cross-sells a debit card and finally cross-sells a deposit account with Direct Deposit (DD)

Chime originates a deposit account with Direct Deposit directly

Both convert about half of originated accounts to card users

Both relay on card interchange for the bulk of their revenue

Chime card users are more active as it has more primary accounts

Cash App earns more revenue from its card base

It has so many more card users that it gets more interchange anyway, even though a smaller percentage are primary

Cash App monetizes less active customers in more ways

Cash App monetizes non-card users with fee products, especially Rapid Deposit

The conclusion is that Cash App’s P2P distribution is far more productive than Chime’s direct marketing

Neither of them is able to cross-sell many other services to their card users

Chime has relatively high-cross sell only when the products are free

Cash App cross-sell is mostly coincidental, e.g., when a Cash App customer happens to use AfterPay at a merchant

The lesson seems to be that Primary DDA is not the cross-sell ideal that we all thought it was

Incumbent banks have are similar underwhelming results in cross-sell, as most adjacent products areas are dominated by specialists

Consumer lending is heavily concentrated into specialists

Wealth specialists are mostly monotones

Bank of America and Chase are exceptions

The outlier is Small Business where banks do cross-sell high-balance consumer DDAs to Small Businesses owners; however that channel may be under threat

Incumbents don’t lend much to small businesses – which is the SB’s primary need

ISVs do lend to those businesses via Merchant Cash Advance

Many B2B Fintechs see DDA as a good cross-sell from their offerings and may compete for those accounts in the future

Incumbents should stop chasing cross-sell from the primary consumer DDA as it rarely succeeds:

Focus on originating and servicing high-balance consumer DDAs, and don’t waste resources on active cross-sell afterwards

There remains value in cross-selling consumer DDA to your SB customers, this may require figuring out a way to safely lend to those Small Businesses

Introduction

In a recent post, I assessed the Chime S-1 and name-checked their Neobank competitors, like Varo, Current, Money Lion, Dave – and Cash App. The two biggest of these are clearly Chime and Cash App. I thought it might be interesting to compare them to see what insight it provides on relative growth prospects and the viability of the Neobank model.

Both focus on the low-balance consumer segment, but come at it from different angles. The key difference is distribution: Chime advertises to attract direct deposit customers while Cash App uses its P2P service as an on-ramp to cross-sell banking services. Both then monetize via card interchange.

To my surprise, the P2P approach shows better results than the Direct Deposit approach. This has implications for the rest of the banking industry.

Chime & Cash App are the leading Neobanks

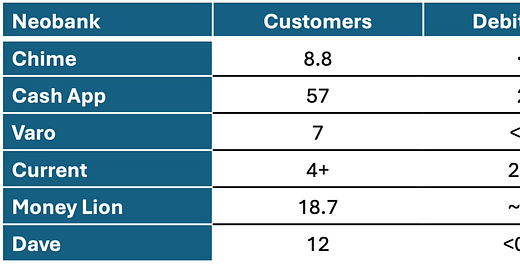

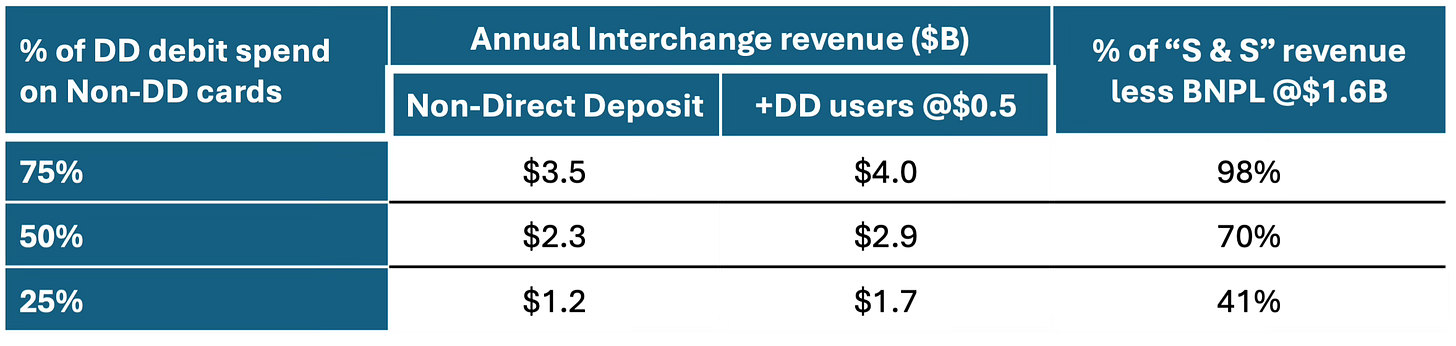

The top two Neobanks dwarf the other contenders:

Neobank metrics

(Millions, some are estimates)

Chime and Cash App have separated themselves from the pack but, the real eye opener is the difference between debit users and direct deposit users:

Cash App has 6x+ as many customers over all

Cash App has over 4x as many card users

Chime has more than 2x the number of direct deposit users

This shows the strength of P2P as an origination channel versus conventional marketing. Cash App converts those P2P users to debit card users at almost a 50% rate -- but only 10% of those debit card users in turn convert to direct deposit.

Given that 85% of Chime revenue is interchange, that raises the question: Is direct deposit the best route to active card use? To answer that we need to examine whether Cash App card users are as active as Chime card users.

How does card spend compare?

Chime is transparent about its card spend. The average active customer does 40 transactions per month and generates roughly $208 per year in interchange revenue (IC). This matches industry averages. We have to estimate the data for Cash App.

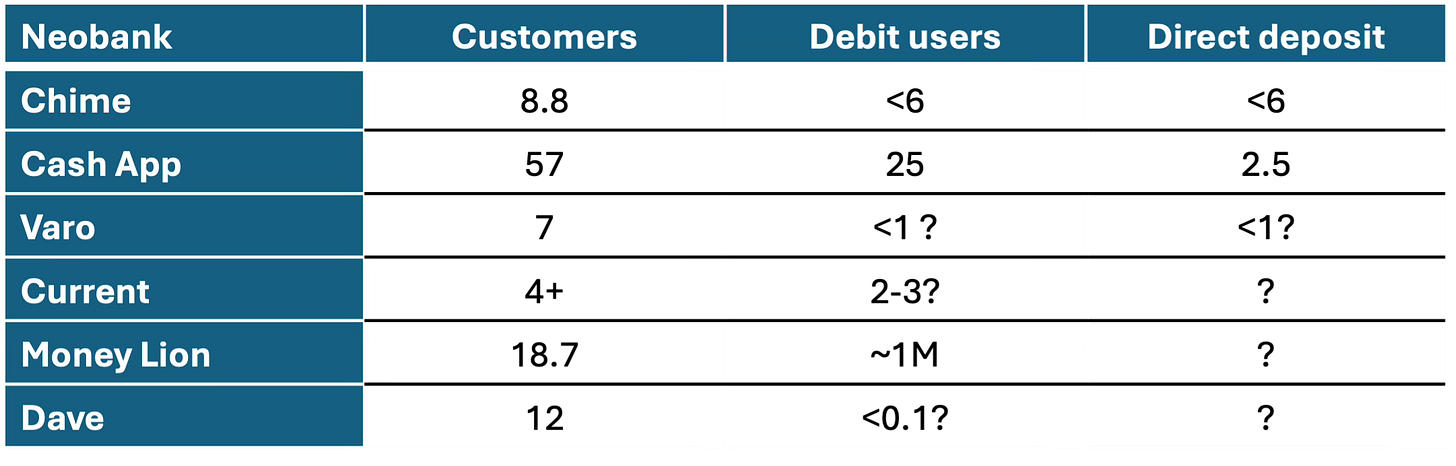

Cash App 2024 “Subscription & Services revenue” was $5.7B. That includes debit interchange, all other fees and AfterPay/BNPL revenue. BNPL revenue is $1.6B. If we assume Cash App’s 2.5M Direct Deposit (DD) customers earn the same interchange as Chime’s, that totals $520M. The Table below estimates the debit spend for non-direct deposit users:

Non-DD customers likely have less card spend less than DD customers. The “% of DD debit spend” column estimates the percentage of debit spend relative to a direct deposit customer’s spend.

We can see that 75% of DD customer spend is unlikely as Cash App has other sources of revenue. I think 50% is the best estimate. That would put non-interchange revenue somewhat higher (30%) than what Chime claims (15%).

Cash App’s biggest source of revenue after Interchange (IC) may be Rapid Deposit fees to move funds back to the customer’s checking account in real time. Rapid Deposit customers generate Cash App revenue when they are not using the debit card. Such customers are rare at Chime – Non-card, Non-DD customers are likely savings-only at Chime and generate minimal revenue.

Chime earned $1.6B in 2024 revenue of which 85% was Interchange or $1.4B. The middle/50% row on the chart shows that Cash App could generate twice as much IC although 90% of debit card customers don’t have Direct Deposit.

But are Direct Deposit customers better platforms for cross-sell?

How does lending compare?

Both neobanks offer loans tailored to the needs of their low-income customers:

Until recently, Chime’s lending products were free, but they recently introduced Instant Loans as an unsecured product with a high APR. In contrast, Cash App acquired AfterPay and has gradually linked it to Cash App usage. Cash App also has a “Borrow” product equivalent to Instant Loans; Cash App offers no lending products that don’t earn revenue.

The bulk of lending revenue is likely from AfterPay which targets the same demographic as Cash App but is not dependent on it for distribution. AfterPay mostly distributes through merchants. Block is trying to create a channel offering AfterPay loans through Square merchants. It also allows consumers to convert Cash App Card purchases into AfterPay Pay-in-4 loans where the consumer pays a fee instead of the merchant.

The key difference is that Cash App loans all earn revenue while the bulk of Chime loans do not. While Chime claims high “Attachment” rate on its loans, it is somewhat irrelevant when they are free. Customers will always take “free”. So, Cash App seems to do an equivalent job of revenue-earning cross-sell even though it has fewer direct deposit customers.

Other products

Neither neobank offers many products beyond cards and loans. Both have high-yield savings accounts, but only with Direct Deposit (DD). The DD requirement keeps APY Optimizers away.

Cash App famously offers Crypto trading, but its enormous revenue is offset by similarly enormous costs without generating much gross profit. Cash App also offers the ability to make conventional investments, but this can’t be that popular for the target, lower-income demographic.

P2P

The respective P2P services operate at different scale. Cash App P2P has such deep penetration in this demographic that the bulk of transactions will be one member to another. Such on-us payments cost Cash App almost nothing.

For Chime’s “Pay Anyone” P2P service, it is more likely that the counterparty is a non-member, and therefore Chime uses Visa Direct to push the money out. That costs Chime ~15¢ per transaction. They don’t charge the customer anything. Chime claims that P2P is an origination source, just like Cash App, but it has to be much less productive given the scale difference.

Relying on Visa Direct makes it less likely to recruit the counterparty as a customer since every P2P receiver already has a debit card. That means the recipient is banked somewhere – either at a conventional bank, a competing Neobank, or a GPR card. Chime’s S-1 mentions Pay Anyone as an origination channel, but its structure makes that challenging.

The Cash App model is more effective at recruiting new members because the recipient generally creates a Cash App account to receive money. That account may only be used for P2P, but it provides a channel for Cash App to upsell a debit card and, potentially, a deposit account with Direct Deposit. Cash App manages to sell a card about 50% of the time. For the other 50%, it can monetize via Rapid Deposit.

Direct Deposit vs. P2P as a marketing channel

This analysis changed my mind about how to think about banking relationships. I went in thinking that Chime’s approach would be superior and left thinking Cash App has the upper hand. Why?

It may be a function of the target segment. Low-balance consumers don’t have much financial services wallet, so there isn’t much else to sell them. That means the value of being the primary DDA is mostly about debit.

In fact, we see many credit products for the low-balance consumer, but they are distributed on a monoline model:

BNPL via merchants

EWA via employers

Debt consolidation & Student Loan refinancing via direct marketing

Sub-prime credit cards via ranking services (e.g., Credit Karma) & direct marketing

Even retail stores are a channel for certain products, like payday loans, title loans, & pawn shops via retail stores. Rent-to-own furniture stores are another example.

None of these are typically a DDA cross-sell. For example, Chime only has a 26% attachment rate for its free EWA service (MyPay). As many as 70% of middle market employers offer free EWA through payroll. Advances and overdrafts, like Chime’s SpotMe product, are attached to incumbent DDAs, but usually for a fee.

When there is a high-value product, like exempt debit cards, distribution model matters.

Cash App converts about half its P2P customers to debit card users and about a tenth of debit card users into direct deposit users

Chime tries for the banking relationship first, rather than the card itself; it also converts half of originated accounts to Active debit users (S-1, page 100)

The Cash App model is more productive, although many of its Debit Cards are not primary, it still generates much more aggregate spend.

Block (parent of Square & Cash App) spent almost $2B on 2024 Sales & Marketing compared to Chime’s ~$0.5 – almost four times as much, but that includes Square and AfterPay. Cash App marketing generated 4x as many Debit Cards. According to one source Block, “… tripled Cash App’s marketing spend YoY in the second half of 2024 to build awareness of Cash App’s banking capabilities”. Having anchored a customer with P2P & Debit it is now going after the primary relationship. It is also pushing BNPL through the Debit Card channel by allowing users to convert a purchase into installments for a fee.

Cash App also includes items in “Sales & Marketing” that I didn’t think of as such, (bolding is mine):

“Sales and marketing expenses are aggregated into two main components. The first component consists of traditional advertising costs …

The second component … consists of costs incurred for services, incentives, and other costs that are not directly related to revenue generating transactions that we consider to be marketing costs to encourage the usage of Cash App. These expenses include, but are not limited to, Cash App peer-to-peer processing costs and transaction losses, card issuance costs, customer referral bonuses, and promotional giveaways that are expensed as incurred.”

So, Cash App marketing includes operational costs that are not in the Chime figure. On an apples-to-apples basis, Cash App likely has much lower CAC for its interchange revenue.

P2P is a lower-friction entry point and entails lower marketing expense. When Cash App doesn’t convert a P2P user to a card user, it still monetizes them via Rapid Deposit and can serve them separately via AfterPay. Cash App finds revenue independent of Primary Account relationship.

Conclusions on Cash App vs. Chime

Chime’s focus on primary DDA is unusual. Most Fintechs move from wealth to DDA or from lending to DDA; or, like Cash App, from P2P to Debit to DDA, e.g.:

Lending to DDA: SoFi, Klarna, Affirm

Wealth to DDA: Schwab, Robinhood, Wealthfront, Betterment, etc.

P2P to debit to DDA: Venmo, Cash App

For example, SoFi, bought a bank that mostly raises interest-bearing deposits (90%+); but, it also has $2.5B of transaction account balances (DDA) from cross-sell to its borrowers. Most Fintechs target high-balance DDAs not the low-balance customers targeted by Chime & Cash App.

The conclusion must be that targeting Primary DDA as the lead product is hard and expensive, and it doesn’t privilege cross-sell for other revenue-generating products. Yet, this is precisely what most incumbent banks try to do.

Implications for incumbents

Targeting primary DDA is much more valuable for higher balance consumers. High-balance DDA is one of the highest ROE bank products since it bears no interest cost and has low credit costs. That is reason enough for incumbents to keep at it.

But the industry takes it on faith that having the primary DDA relationship is key to cross-sell; I have shown above that is not the case in Fintechs and Neobanks. But is it even the case for incumbents?

I no longer think so. Banks’ record on consumer DDA cross-sell is unimpressive:

Lending products

Most banks don’t cross-sell much consumer credit:

Credit cards: most are monoline sales, particularly cobrands. But bank brands also don’t depend on DDA cross-sell:

American Express and Discover have combined 25% card share but don’t have competitive DDAs

Capital One & Citi each have ~10% share of card spend but only ~1% share of consumer DDA

Chase and Bank of America have similar bank-branded card share as their DDA share (after eliminating Chase’s giant cobrand portfolio)

Mortgages: When a consumer originates a mortgage with their primary bank it is often a coincidence, not a cross-sell

Goldman Sachs is #2 Morgan Stankey is #10

Bank of America & Wells are much smaller than US Bank & Truist but with 3x the DDA share

Auto loans: Most new car loans are not a cross-sell:

The top 4 originators are all Acceptance Corps associated with OEMs

Chase is #5, but some of its volume is white label lending for smaller OEMs

Credit Unions are 54% of the top 100 lenders, but not primary DDA as often

In many cases, a bank’s auto lending business is indirect (through dealers) where bank relationship is irrelevant

In credit cards, all but a few incumbents are underweight on Card share relative to DDA share:

Chase & BofA have equivalent Credit Card and DDA share (after removing cobrands)

Citi & Capital One are overweight on cards (10% cards vs. 1% DDA)

The regionals are all underweight on cards by a lot

The best regionals I know of have only 10% penetration rates for their credit cards. When they do cross-sell a card, that card often ends up as second or third “in-wallet”. It counts as a cross-sell without getting much engagement or revenue.

Wealth Management

Wealth Management shows similar dispersion away from primary DDA banks. Names like Fidelity, Vanguard, Morgan Stanley, Blackrock and UBS figure prominently in the wealth league tables but don’t have material DDA share. Again, Bank of America & JPM are exceptions — partially via acquisitions.

In general, DDA is a cross-sell from Wealth, not the other way around. Schwab is the best example – it has almost $200B in total deposits and $14.5B of DDA by leading with Wealth. The original Merril Lynch Cash Management account was an early example of a “Wealth to DDA” strategy.

Conclusions on bank cross-sell

The high-balance DDA is a very profitable product, but not a great cross-sell platform. Most Incumbents aren’t cross-selling much to their DDA customers. Lot’s of effort goes into cross-sell, but the results are often random and based on the relative attractiveness of the underlying products – not the relationship.

What can incumbents do?

This analysis suggests that high-balance Consumer DDA should be an end in itself, not viewed as a cross-sell platform – unless you are Bank of America or JPM. I exclude Wells here given its unfortunate history with cross-sell. It likely could match the other two, but is rightly gun-shy of trying.

In commercial banking, regional banks do cross-sell from lending to DDA. Borrowers are obligated to use the Treasury Services from their lenders, so, the lenders get DDA because of their lending.

That commercial strategy isn’t particularly useful in consumer DDA because affluent consumers only borrow from banks via mortgages and do that very rarely. First Republic used cheap, high-balance mortgage lending to capture high-balance DDA customers and followed with Wealth Management. I did that with them. But that isn’t a generally replicable strategy as the segment is too narrow. This worked really well for First Republic … until it didn’t. No one has followed.

Small Business might fit the bill. Small Businesses need credit and are willing to keep their DDA at a bank that lends to them. They have other needs that a bank can serve. The best incumbents bank not only the Small Business, but its owners; they start with the high-balance Small Business DDA to get the high-balance owner DDA, i.e., SB DDA to Consumer DDA.

Small Business lending may be a better entry point for cross-sell. The challenge is that most banks don’t lend much to small businesses.

One of the hottest products in Fintech is “merchant cash advance” (MCA) from ISVs. MCA makes short term loans collateralized by daily credit card settlements. The lender-ISVs repay themselves out of those daily settlements – which already flow through them. It is relatively low risk, but banks shy away because the calculated APRs can be high.

Most banks have also exited acquiring so don’t see the daily settlement details. Regionals usually partner with Fiserv for acquiring, and Fiserv offers Clover Capital (an MCA product) directly to the merchant, not through the bank partner. The bank’s clients are using MCAs, just not from their bank!

Many banks aren’t active SBA lenders because of the compliance burdens. Most regionals don’t even have a competitive small business credit card like Chase Ink or Capital One Spark. In fact, the biggest SB Card issuer is Amex, who doesn’t typically bank its small business customers at all.

Many B2B Fintechs plan to offer DDAs in the future – particularly as it becomes easier to get a bank charter. Square offers a checking account through Sutton Bank, but could migrate that to its own bank charter in the future. Shopify offers a similar product called Balance. And Stripe has Stripe Treasury. Whether Fintechs can succeed at this is an open question as many small businesses want local access. But without lending, it may be hard to anchor a small business to your bank in the future, and without the SB account, it is harder to get the owner’s personal account.

Still, the direction of travel should be Small Business DDA first, then cross-sell the owner a DDA and wealth management. To get that SB DDA, regionals may need to revisit their SB lending policies before they switch to ISVs and Fintechs.

The overall message here is that Cross-sell even from the primary consumer DDA is usually unsuccessful. Incumbents should figure out how to create more value in bundles, or spend the marketing dollars more directly on high-balance origination.

How do you explain that cross-selling does not work for DDA at fintechs? It's kind of counter-intuitive... I would have assumed this was the strongest position to cross sell, as people get their paycheck from it, and probably check their balance weekly...