Can ISVs conquer global acquiring?

Not likely given lower margins in enterprise and global

Key insights in this post

The last round of restaurant ISV earnings reports included common themes:

Software upgrades to serve more complex restaurants

Up-market client wins (in chains)

Progress in global footprint

Software upgrades: Toast’s upgrades differed from Square’s & Clover’s

Square & Clover focused on helping restaurants become more efficient

Toast focused on how to help restaurants grow their revenues

Upmarket: All three announcement wins in the chain restaurant space

Chain restaurants typically use the software but not payments or VAS

When they use payments it is on IC+ pricing with no bps

They never use ISV lending (MCA) as they can borrow less expensively from banks or capital markets

Growth in chains decouples revenue metrics from operating metrics

TPV is not linked to revenue as IC+ is priced on transactions not volume

Locations is not linked to revenue as chain locations generate less ARPU than single-locations restaurants

Fiserv/Clover already solves for this by reporting Enterprise as a separate segment where the key operating metric is number of transactions

All three face new incumbents in chains

NCR Voyix and Oracle Simphony are incumbents on a software only model

GPN & Shift4 process for QSRs and Stadiums respectively

Global: None disclose results but, progress seems to be modest

All three are targeting the same countries in roughly the same order

Clover is the furthest along, leveraging Fiserv’s local bank relationships

Square has been at it the longest

Toast is just getting started in Canada and the UK, and needs to build distribution

New competition in some of these markets

Lightspeed is an incumbent in Europe & Canada

GPN has good distribution in Europe and elsewhere via bank partners

Som countries have local champions

None of the three disclose non-US metrics on any dimension

Verticals: Toast is behind

Clover, Square, GPN, & LSPD are all multi-vertical

Toast is just beginning to build out one adjacent vertical

Multi-vertical capabilities make it easier to go global as there is more TAM in each country to help cover local overheads

Conclusion: If successful, the upmarket and global strategies may require more disclosures

Upmarket will reduce ARPU and decouple TPV and Locations growth from revenue growth

Global will have higher selling costs and overheads even if ARPU is similar across single-location restaurants

This may require a shift in revenue reporting from the “cost of revenue” model to the “contra revenue” model to avoid relentlessly declining margins

Introduction

The last round of restaurant ISV earnings reports included common themes:

Software upgrades to serve more complex restaurants

Up-market client wins (in chains)

Progress in global footprint

These developments may reflect saturation of the US, single-location restaurant market that I noted here. Whatever is driving it, the downstream consequences of will impact performance indicators and growth.

I still believe Toast is advantaged in the US due to its direct sales model, relative scale and market-leading functionality. But upmarket and global favor different factors and may have different outcomes. This post will explore those arenas.

A model for evaluating the market

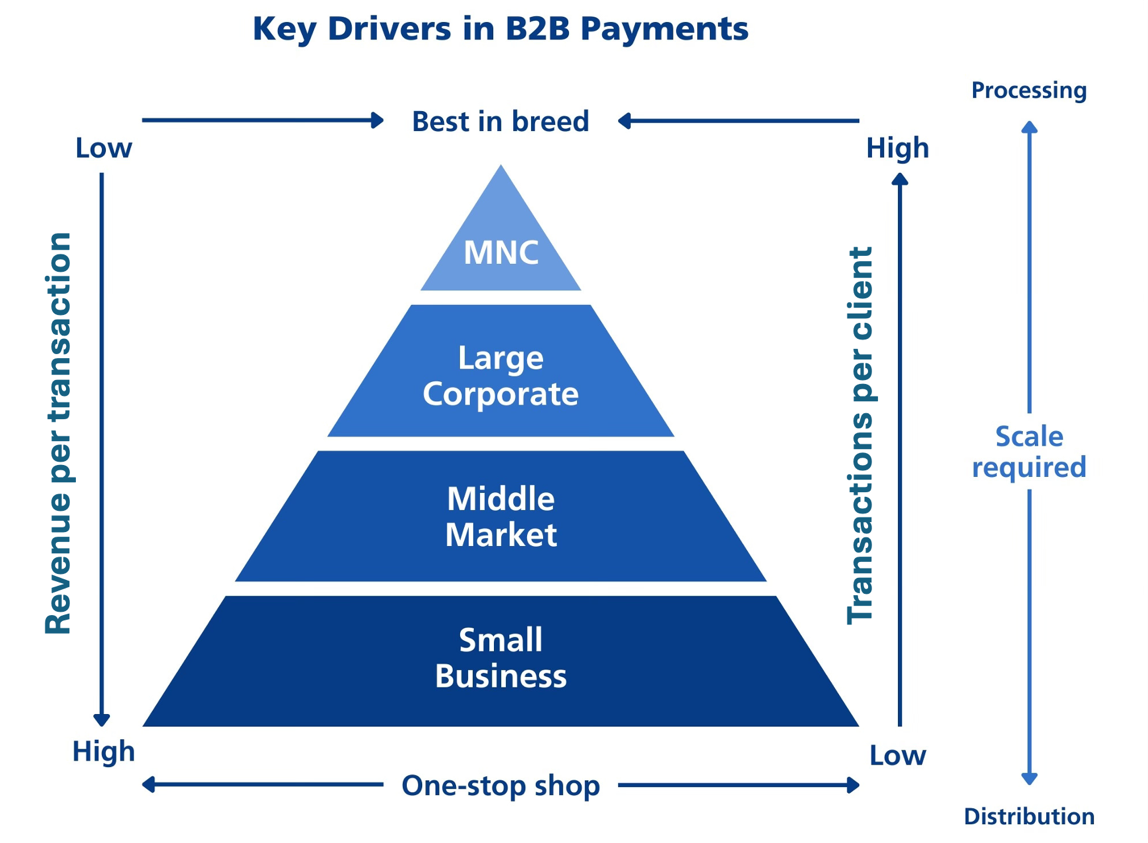

I introduced a model for wholesale payments (B2B) markets in one of my earliest posts. That post has only 400 views since September so most of you won’t be familiar with it – or will have forgotten it.

You can see that small business has high revenue per transaction and likes bundled solutions (“one-stop shop”). The trade-off is relatively little revenue per client and high distribution costs. This segment is where the ISV bundle of Software + Payments + VAS resonates.

In contrast, Enterprise (MNCs & Large Corporate) buy best-of-breed point solutions and pay low unit prices for everything. These large segments will likely only take software from the ISVs. They will buy acquiring from the scale providers, based on price, and they won’t buy much VAS at all.

In particular, only Small Businessses will borrow from their acquirers via Merchant Cash Advance (MCA)

Large Corporate merchants will borrow from capital markets using debt and commercial paper. Their other VAS needs are served with point solutions (e.g. AP, AR, Payroll). What matters is price, for the software and everything else

Middle Market is a mixture. They will buy a bundle of software + payments, but at much lower price points than small business. If they buy payments, it will be on the IC+ model where Interchange & Network Fees are passed through at cost while the acquirer is paid a flat fee per transaction – no bps. They may buy select VAS, but generally not MCA as they can borrow cheaper from banks

The MNCs have some unique needs. They often want global footprint to serve them in all the markets they operate in, rather than just a handful. That excludes ISVs. This is where Adyen & Stripe thrive

US Single location restaurants

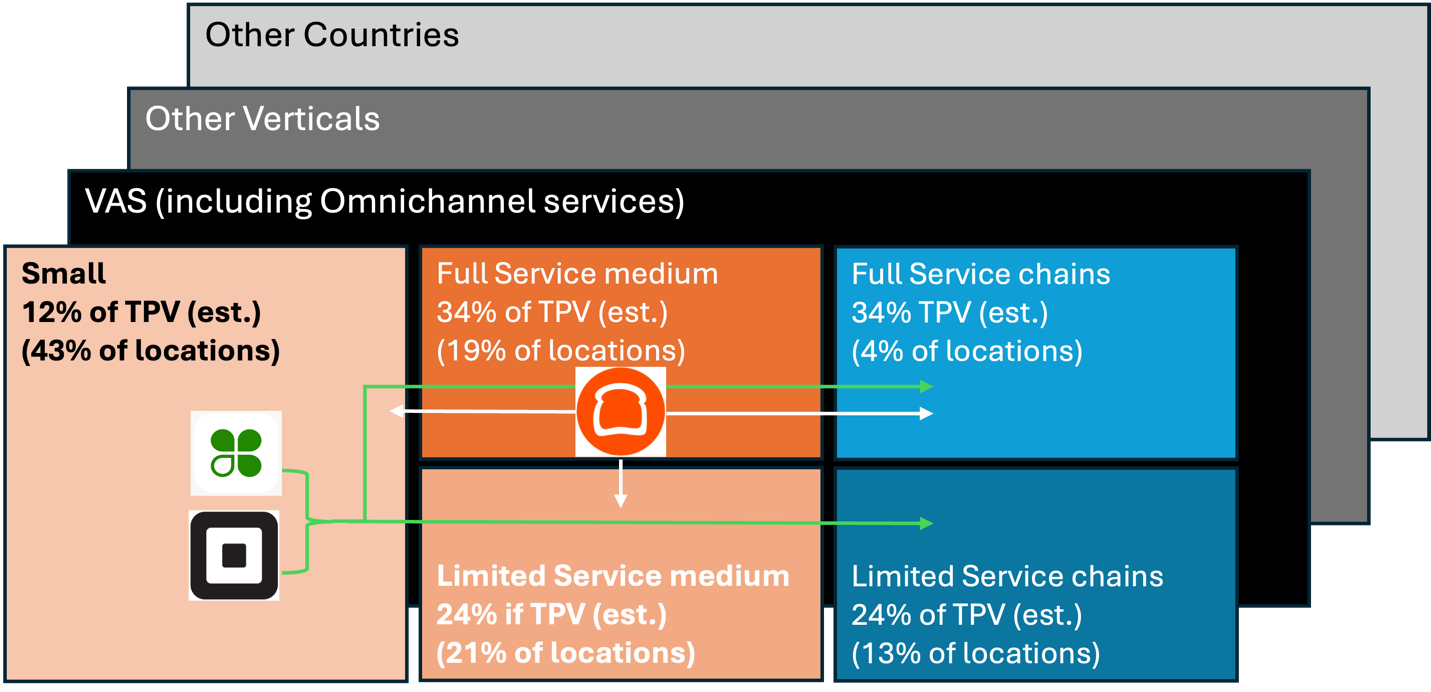

In a prior post I illustrated the competitive situation in the US restaurant market:

You can see that Toast, Clover, & Square initially focused on the single location cells; Toast expanded out from the Full-Service box and the others from the “Small” segment.

Both Square & Clover announced enhancements to their restaurant platforms to compete better with Toast domestically (italics indicate extracts from company press releases):

Clover:

…Clover Hospitality technology includes omnicommerce capabilities from BentoBox … and enables restaurants to build their online presence, diversify revenue, engage with diners while increasing operational efficiency through websites, ordering, reservations, marketing tools and more.

Checkless Payments … empowers diners to pay for their meal without the disruption of asking and waiting for the bill, ensuring a memorable, friction-free dining experience. The feature is … being rolled out to restaurants leveraging the Clover Hospitality system.

Clover is now able to support a broader range of restaurants, from small neighborhood spots to the world’s most distinguished dining experiences.

Square:

Square handheld: take orders tableside or from the bar, with a splash-resistant touchscreen, long-lasting battery, and barcode scanner

Unified orders tab: consolidates all orders from different channels (in-person, online, third-party delivery) into one place, making it easier to manage orders

Pre-authorized bar tabs: pre-authorize bar tabs for customers speeding up … ordering … and simplifying checkout

Scan-to-Pay: … pay by scanning a QR code on the printed bill

Enhanced Square Kiosk: Kiosks now feature table ordering

Dashboard App: … a comprehensive view of back-end business operations, including payroll, team management, banking, and sales analytics

Toast announced ToastIQ: “an intelligence engine delivering timely prompts, personalized recommendations, and automated workflows designed to transform daily restaurant operations.”. Initial features are aimed at “… attracting new guests and helping foster long-term loyalty”. Those features include (paraphrased from press release):

Menu upsells – Recommends additions to the guest’s order

Shift at a glance – Delivers updates to Toast Go handhelds (e.g., specials, low-stock items)

Digital chits – Pulls guest details, like special occasions and guest requests onto Toast Go, helping staff personalize service

AI-marketing assistant – Builds detailed, personalized marketing plans in a few clicks for email, SMS, and social media. Outputs include pre-designed and pre-written campaigns for holidays and events, promotions and happy hours

Advertising – Connects ad performance directly to transactions across online, in-person, and catering orders, giving operators visibility and transparency into how digital ads drive real dollars, as opposed to just clicks and impressions

All three sets of enhancements are aimed at more sophisticated, table-service restaurants. Toast’s announcements push the envelope more than the other two:

Square & Clover focused their updates on closing the gap with Toast on restaurant management tools, i.e., to manage cost

Toast focused its updates on helping restaurants grow revenue. It already had most of the features the other two introduced

Furthermore, this doesn’t address the fundamental distribution differences among the three:

Toast is advantaged by its direct distribution model with a captive sales force

Square is largely self-service but is building out captive sales

Clover is largely indirect, via bank branches, ISOs & VARs

Given the importance of distribution in the single-location cells, this represents a sustained advantage for Toast.

Other providers

GPN wasn’t even on my radar in prior posts as it had no meaningful software solution, but has now introduced “Genius”. GPN had a direct sales distribution channel (ex-Heartland) and a number of indirect channels, like ISOs and VARs, but no product. With Genius, they can at least compete in “Small”. “Medium – Limited Service” may also be in reach. I think it still lags the others for more sophisticated table-service situations.

Since the solution is untested, it is hard to know if they will get traction in the Table Service segment. The solution is already in North America and headed to a global rollout. It is also multi-vertical – like Clover and Square.

In contrast, Lightspeed has retreated from the US restaurant market. They still compete in Retail with a strong solution and they are the market leader in the Europe restaurant space according to my friends there. They lacked US distribution so failed to catch on. They also started with software and only added payments later, whereas leading ISVs bundle from day-1. Lightspeed had been playing catch-up ever since.

Upmarket (US)

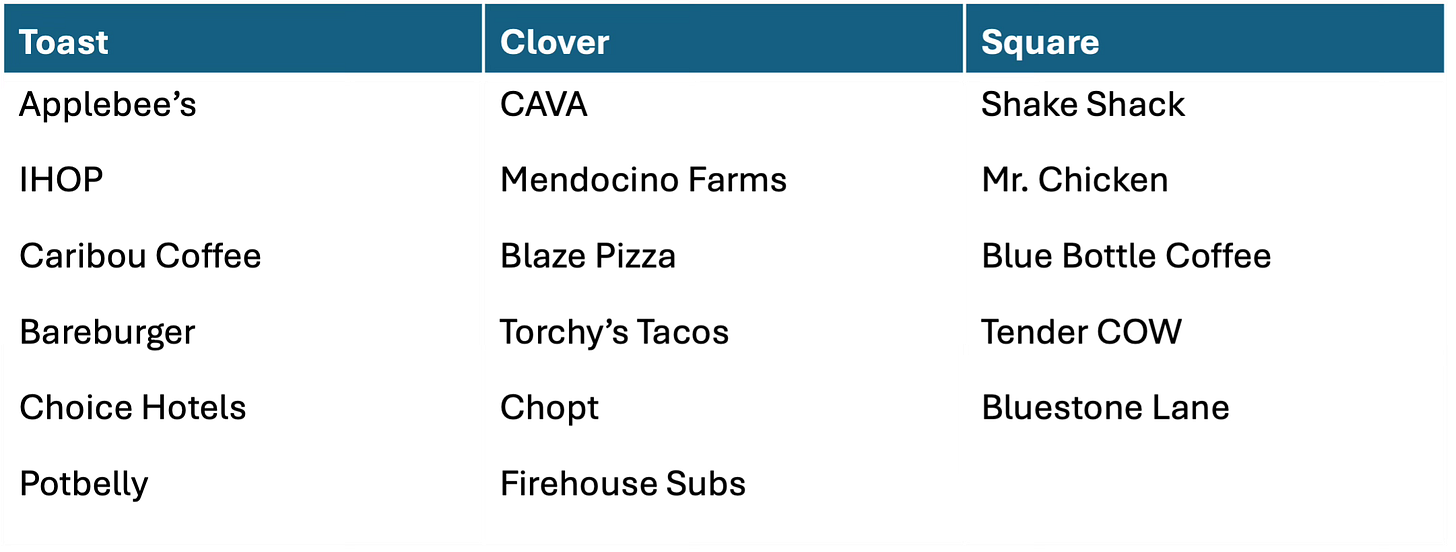

All three are making the move upmarket, generally to middle market chains. Here are some of the announced chain clients:

In middle market and enterprise, distribution is a very different challenge. Direct sales forces are required and the process is more bureaucratic – RFPs run by Procurement departments. Here Clover is in its element as Fiserv is one of the four market leaders in enterprise acquiring. Square has been at it longer and originally had the unhappy experience of serving Starbucks. Toast is just starting out. It may still have solution advantages, but they are behind on targeted distribution.

To the degree these three are successful, it changes the operating metrics we typically focus on in Small Business:

TPV (Total Payments Volume, also known as GPV, GMV and Sales Volume). In the IC+ model, fees are per transaction not per sales dollar, i.e., no bps. The key metric is number of transactions not transaction value

Locations. Toast is the only competitor that reports locations, and historically, this closely aligned with TPV growth and revenue growth. But, large companies only buy software, so locations will no longer link to revenue growth directly. The larger the company, the less they will pay per location, so winning big chains will cause revenue growth to trail location growth by a lot. Locations also won’t link to TPV at all

Fiserv solves for this by reporting Enterprise as a separate segment. Fiserv’s investor reporting uses transaction volume as the key metric for the Enterprise segment and TPV for the small business segment. It doesn’t report locations at all. It also doesn’t break out VAS and Software. But separating IC+ merchants in the Enterprise segment is the more transparent way to go.

Square reports TPV, even though some of its customers are larger. It has a software & services line item that mixes software revenue with VAS revenue. It doesn’t report locations. Toast has a similar approach but does report locations.

Both Toast & Square are on the “Revenue – Cost of Revenue = Gross Profit” model. Interchange and Network fees are the bulk of Cost of Revenue, so IC+ merchants crater gross margin. Clover solves for this by treating Interchange & Network fees as a contra that is already netted out of the “Net revenue” line item.

I suspect Square & Toast will be forced into the “contra” model if they are successful going upmarket; otherwise, their reported margins will keep dropping which is not a good look. If they don’t, gross revenue/TPV will start dropping and revenue growth will trail TPV growth substantially.

Marqeta went through this in Q3 23 when their biggest client (Square) started processing some services in-house. Marqeta had to start reporting Square’s cost of revenue as a contra so that effectively Revenue = Gross Profit. In the month they did the switchover, Net Revenue dropped by over 50% but Gross Profit only dropped by 15% and was back at Q2 levels by Q4. Gross margin almost doubled.

More competition in Chains

The Chains segment has incumbent software providers:

NCR Voyix reports its Aloha system is used at 100K+ restaurant locations

Oracle Simphony does not report a location count, but is a common sight for me in larger chains. It is a rebranded version of the Micros platform that Oracle acquired

Neither of these provide their own payments processing. NCR partners with Worldpay while Simphony provides a gateway to a variety of processors. These systems are customized for large chains and battle tested in the field. The do operate on an older technology architectures but are upgrading to more modern platforms.

Also worth noting is that GPN & Shift4 are native to the chain restaurant space. Shift 4 has particular success with Stadiums and other multi-merchant venues. GPN’s Sicom acquisition focuses on QSR.

In other words, this segment is not white space and it needs to earn its ROI almost entirely from the Software component of the ISV bundle. Furthermore, it needs a direct sales approach that Square and Toast do not have off-the-shelf.

Global

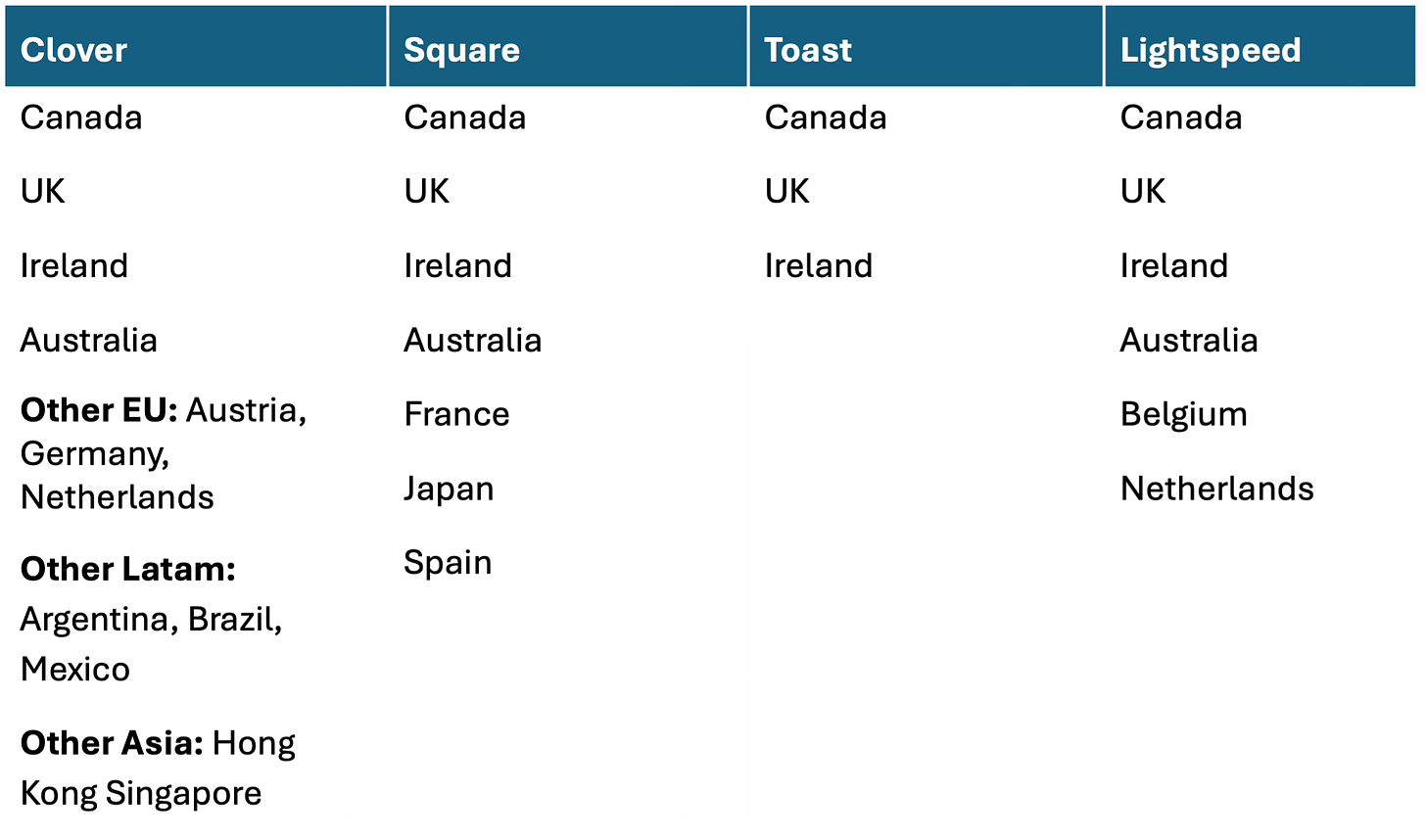

Square & Clover are established globally, while Toast is just getting started. Lightspeed enters the equation as well:

The issue here is saturation. Most of these countries started the ISV-model migration later than the US, but most have some local champions not mentioned in this list. Toast’s US conquest started when many restaurants had no legacy software – but in many of these countries, the market is already on an ISV model.

Fiserv’s global distribution model for Clover resembles its US model. In most countries, it has bank partners and distributes through their branches. Since non-bank acquirers are rare outside North America, more small merchants use their bank as their acquirer. The Clover distribution model is likely more effective in these countries than it is in the US.

Square & Lightspeed are already in all the countries Toast has targeted and have built local distribution models already. It’s not that Toast can’t win, just that the competition got there first and is better prepared than it was in the US. The functionality gap is narrower than it once was.

None of these companies break out their global performance from their US or NA performance. Fiserv is otherwise fairly transparent in its investor reporting, but this is all they say about international Clover in their latest earnings presentation:

“Advanced Clover international strategy with new presence in 5 countries including Australia, Singapore, Brazil, Mexico, and Belgium”

One third-party estimate is that 14% of total Fiserv revenue is non-US, but, Clover is only one component of that. The only other commentary on non-US operations is how currency fluctuations impact revenue. Similarly, Square is not open about its non-US operations. In 2022 a third-party estimate said international accounts for 10% of gross profits. The US continues to account for the bulk of revenue and these companies are not entrenched elsewhere.

Toast will face similar challenges as it travels further afield – but without the leverage Clover gets from Fiserv’s bank partners and without the head start that Square has. Those competitors are also multi-vertical so can leverage overheads into a bigger TAM.

Verticals

I won’t dwell on this topic, but vertical is a dimension on my market map. Square & Clover have always been multi-vertical while Toast was a restaurant monoline. Toast recently entered Food-Related Retailers as a second vertical. Lightspeed has a well-regarded Retail solution that supports several sub-verticals. GPN’s Genius also claims Retail support.

That means Toast is the least diversified of its major competitors. It lives or dies on Restaurants for the time being.

None of these players break out their volumes by vertical or even Restaurants versus all other. That makes it hard to measure restaurant market shares and relative growth. In this post, I made an attempt to measure market share in US restaurants.

Conclusions

The overall conclusion here is that future growth at all of these companies is going to be harder to come by:

Functionality is converging as Square & Clover invest to match Toast, while Toast pushes the horizon. The US market is approaching saturation.

Moving upmarket decouples revenue growth from operational metrics

Location count and TPV growth will not longer track revenue growth

Chains don’t take payments and VAS from ISVs, limiting location ARPU

Global entry is challenging as distribution needs to be rebuilt from scratch

Vertical entry faces new competitors who are forewarned

As a result, we should expect to see lower margins, slower revenue growth, and higher distribution costs over the horizon. Yet none of these companies has changed their disclosures to allow investors to anticipate these impacts. The biggest example is that Square & Toast will need to move from the “cost of revenue” model to the “contra” model as they add more IC+ chains. Otherwise, their gross margins will take a beating.

I always want more data, but I am not naïve enough to expect it. In an ideal world, all these ISVs would disclose specific data:

Location count of single-location clients, by major vertical (i.e., Retail vs. Restaurant)

Chain clients as a segment. Fiserv already does this via its Enterprise segment

US versus International, preferably by country, but even the basic split would help

The more these companies expand up-market, globally and across verticals, the lower their reported margins are likely to get – even if their US single-location restaurants businesses are still doing well. Without more disclosure to explain those declines, they should expect more skepticism from the analyst community.

What I meant about chains is that they only take software and not the other parts of the ISV bundle: Payments & VAS. I agree that unit economics on the software can be positive, but ARPU is much lower where the "U" means location. Payments is where most of the profit is in single-location restaurants and bigger chains generally pay much lower per transaction rates. On VAS, the biggest one is Lending (Merchant Cash Advance) and chains won't use that as they can borrow at lower cost from a bank (MCA APRs are very high).

So management is being honest, but not addressing the full picture.

Great analysis!

I'm not sure chains necessarily have worse economics for someone like Toast. It's true they don't have the payment processing aspect but the software spread across more locations seems to lead to attractive unit economics - or at least that's what management stated repeatedly on their call post the Applebees announcement.

It's indeed a competitive market, and Square, GPN and Fiserv are all re-focusing on hospitality specifically, so the competition should increase (if they can execute). This should lead to a shrinking TAM for each or alternatively slower sales cycles/lower prices... However, like you mentioned they're still trying to catch up on feature parity with Toast/Shift4 and due to their newer stack they should be able to stay ahead with AI features and newer value add.

I think this is a market that has almost endless niches of value add for small restaurants (interesting to see that a startup named Owner just secured a large funding round from the same investor who led Toast's series C), so the growth potential and the competitive dynamics keep changing.