Key insights in this post

Stablecoins are being discussed as alternatives to cards for domestic commerce. Generally, proponents claim three advantages:

Lower cost to the merchant

Faster settlement

Lower fraud

In reality, Stablecoins represent a trade-off with cards that is not always favorable to stablecoins for domestic commerce. Against each major role in the card value chain, Stablecoins may not be cheaper, faster or safer:

Against networks,

Cost: “Gas fees” are moderately less expensive that Network fees but the gap is much narrower for the biggest merchants who get incentive payments from the networks

Speed: Basic settlement is faster on Stablecoins, but settlement in fiat is identical as the coin issuer typically uses ACH to move fiat back to the merchants DDA

Safety: Both core infrastructures (blockchains & network switches) are themselves secure – most fraud occurs in the other roles

Against acquirers,

Cost: Acquiring fees are already as low as a fraction of a penny for larger merchants. For smaller merchants the fees are higher because the acquirers stand in to protect consumers from merchant abuse. Consumers get no such protection in the Stablecoin world

Speed: Settlement in fiat is identical between the two systems except where acquirers hold back certain sums as a form of risk management

Safety: Both systems have incurred publicized hacks that undermine security. These are often inside jobs which makes them harder to police

Against issuers,

Cost:

Relative to credit cards, Stablecoins are more expensive to consumers as they don’t pay rewards, don’t offer a grace period, and don’t allow the consumer to revolve. In fact, since the consumer must prepay for their stablecoins they face an opportunity cost versus investing excess DDA liquidity in an interest-bearing account

Relative to debit, Stablecoins are less expensive, but most of the time the alternative is Regulated Debit at roughly 25-30¢

Speed: Settlement in fiat is identical between stablecoins and debit cards. Stablecoins are only real-time if the consumer wants to keep their excess liquidity in stablecoin. This is similar to Fintech P2P where the transfer seems instant, but the liquidity is stranded outside a DDA

Safety: Both systems have incurred publicized hacks that undermine security. These are often inside jobs which makes them harder to police

Other safety issues:

Both systems are vulnerable to social engineering scams that trick the consumer. These are not technological vulnerabilities on either side.

Stablecoins lack Reg E protections for consumers. Bank instant methods also face this challenge, but the Debit system complies

Stablecoins have unique features that could distinguish them in the future

Smart contracts. They allow for conditional payments, with the release of funds determine by a neutral third-party (human or technology). This holds great promise but has not been deployed in routine domestic commerce

Divisibility. Stablecoins can subdivide down to very small amounts. They could serve as universal micropayments wallets. Today that niche is served by proprietary, prepaid “gold wallets”. Another proposed use case is as a common currency for AI Agents to pay other AI agents in very small amounts

The networks have levers to keep debit volumes in the incumbent ecosystem

Reduce network fees and interchange. They did so to win routing volumes post-Durbin. They will lower prices if it preserves volume

Speed up settlement. They did so to introduce Visa Direct and MC Send (“Push-to-card”) where they mandated “Fast Funds” via rule. That made Push-to-card competitive with Instant for disbursement use cases

Larger merchants get incentives that reduce network fees and interchange at certain volume thresholds. If merchants steer volume to Stablecoins, incentives would automatically be clawed back, offsetting some cost savings

Conclusions

For domestic consumer commerce, Stablecoins are not generally faster, cheaper or safer than cards. The advantages they provide merchants are often at the expense consumers

However, Stablecoins do have unique features to exploit

Smart contracts can make conditional payments as a form of consumer protection and to accelerate certain use cases

Divisibility can help them serve as a universal micropayments solution, displacing proprietary wallets on individual merchant sites

In cross-border payments, Stablecoins have inherent advantages that can be exploited today, without some the headwinds in domestic commerce. That is a subject for a future post

Introduction

Almost every discussion I have these days eventually gets to Stablecoins. No one really knows how this will evolve, including me – so everything is opinion at this point. My outlook is pro-stablecoin but, anti-hype. Today, most Stablecoin volume goes to buying crypto. My view is they are better suited to cross-border use cases than domestic use cases. This post will explain why.

One hyped aspect of Digital Currency (DC) punditry is the constant comparisons to incumbent consumer payment methods – Stablecoins are supposed to be cheaper, faster, more secure, etc. But these comparisons are rarely apples-to-apples. For example, cards are usually criticized for charging merchants 2-3% while DCs are much less. Of course that doesn’t account for key differences:

2-3% is a credit card rate when DCs don’t provide a credit line or grace period. DCs should compare to debit rates of about ~30¢ per transaction for “Regulated” debit (70% of volume) and ~100bps of value for “Exempt” debit (30% of volume)

If we do use the credit rate, half or more goes to the consumer as rewards, so while DCs reduce merchant cost they simultaneously reduce consumer benefit

Debit cards are governed by Reg E for consumer protection, which is not yet implemented for DCs

Security is also an open question as fraud vectors are different, but present in both methods.

In this post, I will compare the card value chain to Stablecoins in each role. I was inspired to do this after reading the Circle S-1 which is admirably “un-hypeful”. They don’t call out these differences but neither do they trash incumbent methods as we have seen in other recent S-1s. Thank you!

What may be new here is to look at how Stablecoins shift costs among ecosystem participants. I will focus on domestic commerce payments, where I have a hard time finding stablecoin advantages. I may cover the more relevant cross-border use cases in a future post.

The domestic card value chain

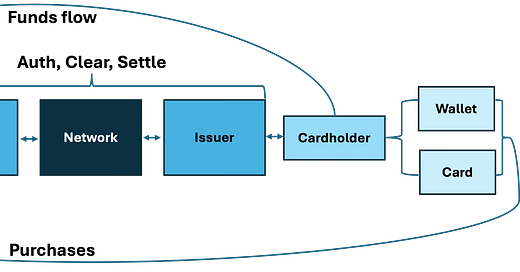

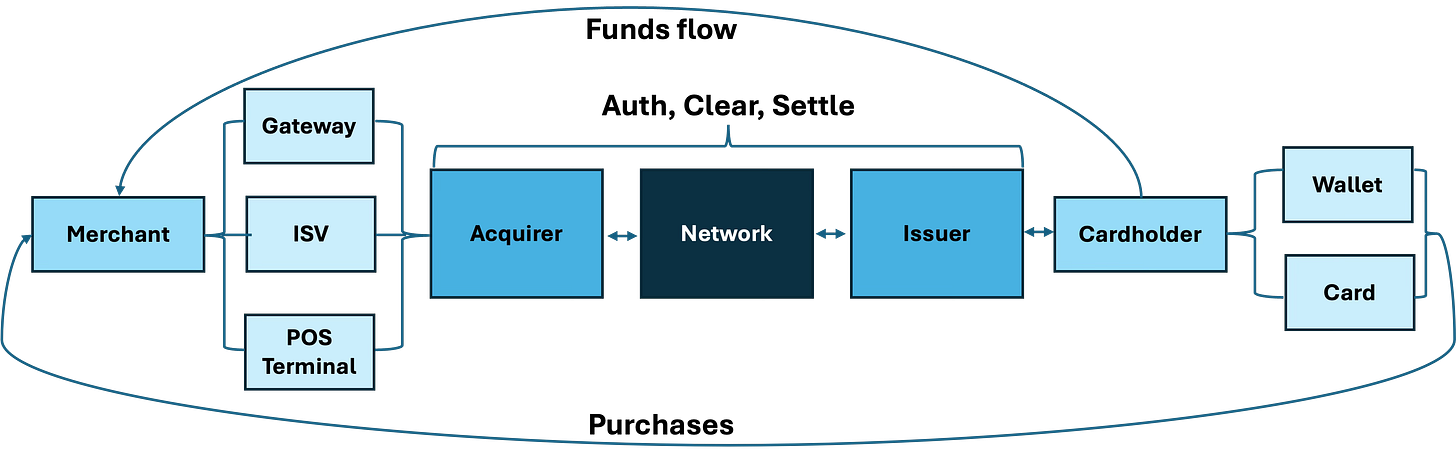

The Mastercard/Visa ecosystem has three broad roles with some front- and back-end attachment points.

The flow is almost identical for credit & debit transactions, although the issuer economics are different:

Issuers represent cardholders. They originate and service all the card accounts whether debit or credit. They switch transactions from the networks to the cardholders and they switch money from the cardholders to the networks

For credit, they fund via a revolving credit line

For debit, they fund from DDA accounts

Networks switch and settle transactions between acquirers and issuers and move money from issuers to acquirers. They also set ecosystem rules, within government regulations

Acquirers represent the merchants. They originate and service all merchant accounts. They switch transactions from the merchants to the networks and switch money from the networks to the merchants

Technically all issuers and acquirers must be banks, but non-banks can play through a BIN-sponsor bank that represents the nonbank to the networks. Full disclosure: My employer, Fifth Third, is one such BIN-sponsor through our Newline unit.

Two other sets of actors sometimes sit in front of issuers or in front of acquirers.

ISVs & Gateways front-end Acquirers

ISVs provide software and services, mostly to small merchants, to help them accept cards. Well known ISVs include Square, Clover, Toast, & Shopify

Gateways are an entry point for alternative payment methods that merchants want to accept

Wallets front-end Issuers

Hold payment credentials which are presented to merchants, e.g., Apple Pay

Authenticate the consumer(e.g., Passwords on PayPal, FaceID on Apple Pay)

Protection against fraud and abuse is a distributed function across all these actors. Some solutions are hardware-based, like EMV, and some are software/analytics based.

The stablecoin value chain

I could not find a stablecoin value chain that provided meaningful insight. I suspect that is because several of the roles are consolidated into the coin issuer (like Circle).

Provide on-ramp (fiat-to-stable) and off-ramp (stable-to-fiat) services

Create coins at one end and retire them at the other

Transfer ownership of a coin token from the sender to the receiver

Work with a trustee to safe-keep the underlying fiat assets backing the stablecoin

Provide connectivity to the underlying Blockchain protocol

The “Network” role is replaced by a blockchain like Ethereum or Solana. They leverage the public internet rather than private telecom networks, so it needs no dedicated infrastructure as in V/MC. Rules are embedded in software on the blockchain itself. But for each Stablecoin, coin issuers set rules. Therefore, the coin issuer performs aspects of all major card system roles.

Front-ends provide similar services on both the consumer and merchant sides, although the wallets are typically dedicated to DCs.

Comparisons by role

Blockchain technology changes the roles relative to debit.

Networks

Card networks look like the narrow point of an hourglass while blockchains look like a like a ring (or Circle!) – with every actor attached to the chain. The two key differences in how they work are cost and rules:

Rules

Card rules are set by Visa & MasterCard, sometimes in concert and sometimes independently.

An in-concert example was the EMV standard, known as “chip-and-PIN” that reduced POS fraud

An independent example was the FANF fee (“fixed acquirer network fee”) that Visa imposed on merchant outlets

Some rules are introduced in parallel but not coordinated. For example, the exempt interchange schedules of MC & V look very similar but are not developed in concert

Blockchains typically have a decentralized rule setting framework governed by consensus. In Ethereum this is done through EIPs (Ethereum Improvement Proposals). In stablecoins the coin issuer sets rules for their protocol, e.g., Circle sets rules for USDC.

Card networks and blockchains take a long time to develop and implement rules because the whole ecosystem needs to implement simultaneously – including the smallest participants. Coin Issuers can go faster as they have end-to-end control.

Cost

Card Networks set the economics for most of the card ecosystem: They set the interchange rates for the issuers (except where Durbin caps debit rates) and they set various network fees to get themselves paid. For domestic debit the per transaction network fee is 13bp + 1.5¢. That works out to 8¢ for the average $50 debit transaction. The biggest merchants earn volume incentives that reduce their network fees, so for the Walmarts and Amazons of the world, the cost is lower.

It is far more complex in stablecoins. The equivalent to network fees are “Gas fees”. Gas fees vary on factors like how fast the transaction needs to settle and how much data accompanies the payment. In the Card system, every clean transaction has exactly the same data (an ISO 8583 message) and settles overnight. A nuance is that authorizations happen in real-time – so the merchant knows they will be paid and can release the goods to the consumer.

Tracking down the gas fee for a $50 transaction was very frustrating. To start with they are much less expensive on L2 protocols than on L1 protocols.

L1s are the core blockchain protocols like Ethereum or Solana

L2s sit on top of L1s to optimize for speed or cost. Coin’s USDC can run over L2 protocols

L2s are less expensive. I saw L1 transaction fees of $10 or amore while some L2s are free or under a penny. Broadly, I conceptualized L1 networks as wholesale systems like wires while L2s are more retail systems like ACH. Stablecoin experts are free to make fun of me for this. But the $10 fees tend to apply only on L1s and for large dollar transactions while the lower fees are typically for smaller-ticket L2s and may be under a penny. Gas fees are complicated, so I have vastly simplified this discussion.

The key is that the comparison point is 8¢! Card networks do extra work for their fee including consumer protections, like chargebacks, that are absent from DCs at this point. So, for consumer debit transactions, card networks are more expensive than stablecoins, but not by much – and they do more for their premium. The gap is smaller for big merchants that get network incentives.

At bigger transaction sizes, the gap widens as Gas fees tend to be fixed while network fees have a bps component. But large, consumer debit transactions are rare. It could make sense for the merchant to steer to Stablecoins for these rarer but larger debit transactions, but even so, network fees are modest in aggregate, i.e., under 10% of acceptance costs.

Another difference on the network side is settlement. Stablecoins are a real-time method, similar to Instant Payments (i.e., TCH RTP, FedNow). The complication is that settlement is not for fiat. If the merchant wants to spend a received payment, they need to redeem the stablecoin and transfer the fiat it to their bank account, usually via ACH. That means settlement in fiat is exactly as fast as Cards. If we get to a level of ubiquity where merchants can routinely buy things with their inbound stablecoins, that equivalence will disappear. But for today, settlement speed in fiat is identical.

Issuers & Acquirers

In the card world, Issuers earn debit interchange while acquirers earn “net discount”.

Issuer interchange (IC) depends on issuer size

For Issuers with $10B+ in assets, IC is capped by law at 22¢ + 5bp. These are the Regulated issuers. This segment accounts for 70% of volume

For Issuers with <$10B in assets the networks set interchange. These are the Exempt issuers. Interchange varies by vertical and merchant size but, can be approximated at 1% of spend. This segment accounts for 30% of volume

Acquirer fees vary by merchant size, with larger merchants paying less

Smaller merchants pay a percentage of spend known as the MDR (Merchant Discount Rate). The acquirer then passes interchange and assessment to the network and keeps the “Net Discount”

Larger merchants pay on the IC+ model. Interchange and network fees are passed through at cost and the merchant pays a flat fee per transaction – as little as a fraction of a penny. The IC+ acquirer gets no bps of spend

It is hard to compare these fees to their Stablecoin equivalents. Coin issuers may have on-ramp fees or off-ramp fees for fiat, but there is no equivalent to interchange. That may be because Stablecoin issuers monetize the fiat collateral. Those balances are invested in low risk government securities. Circle shows these earning 4.5-5.5% during 2024 and accounting for “between 95% and 99% of our total revenue”.

That represents an opportunity cost for the merchant who pays card interchange. They could otherwise invest fiat for their own benefit. To be fair, checking accounts don’t pay interest either. However, companies apply cash management disciplines to minimize excess DDA balances. The cash flow benefit may be worth the 25-30¢ of interchange on regulated transactions versus holding the balance in Stablecoin.

In the near term, the incentive is to exit stablecoin balances as quickly as possible to consolidate liquidity into a bank account and invest any excess. Some of this is evident from Circle’s S-1:

Started 2024 with $24B in USDC in circulation

Minted $141B in new USDC

Redeemed $122B in USDC for fiat

Ended the year with $44B USDC in circulation

The value of USDC outstanding doubled, but ~85% of the newly minted USDC was redeemed within the same year. So, most stablecoin users don’t strand liquidity for long.

PayPal is the outlier here. Their PYUSD coin invests the fiat just like other stablecoins, but PayPal pays most of income to the coin-holder. PayPal can do this because when the coin-holder spends their PYUSD, PayPal earns an MDR from the merchant. In this case, the stablecoin is definitely not cheaper to merchants than debit cards because PayPal’s MDR mimics a credit rate at over 3%+. For consumers, it creates an incentive to keep balances in PYUSD rather than move them back to checking accounts. Hat tip to Ben Isaacson of TCH for schooling me on this point.

A final point is that banks lend their DDA balances to consumers and businesses while stablecoins invest their collateral in government securities. So, one question is: do you prefer lending your liquidity to the government or to the private sector?

Wallets & Gateways

These providers have roughly the same role in both ecosystems:

Gateways allow merchants to accept stablecoins as tender. Stripe’s Bridge acquisition does this, although they call it a “Stablecoin Orchestration Platform”. They seem to be focused on cross-border payments

Wallets hold the idle stablecoins until the consumer is ready to spend them, they then transfer them to the counterparty. Coinbase is a wallet. Note that they charge 1% to merchants to accept payments – higher than debit

Other differences between Debit and Stablecoins

Stablecoins have some functional advantages over debit, but lack one key feature:

Advantage: Smart contracts. All DCs can embed Smart Contracts that can make conditional payments. This is the most fascinating feature of digital currencies; unfortunately, I have never seen it in action for domestic commerce.

It could be used in escrow transactions where the buyer doesn’t want to release payment until the goods actually arrive in the expected condition (think collectibles). But, who gets to decide when the contract terms have been satisfied? That is known as the “Oracle” problem. For collectibles, the transaction may route through an authenticator who verifies condition. If their rating matches the rating in the smart contract, payment is released. If their rating is lower, some dispute mechanism is initiated. The authenticator is the Oracle in this case.

Oracles don’t have to be humans. They could be databases or algorithms or some other technological solution. A smart contract gets it logic from the blockchain but its authority from the Oracle. Some day I hope to see one deployed.

Advantage: Divisibility. Micropayments remain a problem for conventional payment methods, but Stablecoins can subdivide down to tiny amounts. They have been suggested as the ideal way for AI Agents to pay other AI Agents for their services, which makes sense to me; but, again, I have not seen this in the wild yet.

A more tangible use case could be a universal “gold” wallet to make small payments such as individual articles on news sites or in-game items on a gaming platform. The incumbent solutions are usually proprietary prepaid wallets – think EZPass or the Starbucks App. The transfers are generally settled in bulk via ACH. Stablecoins are a general-purpose solution for a widespread problem whereas today’s micropayment wallets are specific to a use case or merchant and inefficient for everyone.

Disadvantage: Irrevocability. Merchants think this is a feature not a bug. They want control over refunds and chargebacks rather than be subject to network rules that favor consumers. Reg E disagrees – under certain conditions the merchant must pay back the consumer. Stablecoins lack features to deal with Reg E disputes. Missing Reg E support has gotten Zelle in trouble and is why Instant Payments are not used much in retail commerce.

A word on fraud

Blockchains on their own are secure. They use cryptography to make themselves almost impervious to 3rd-party fraud. But so are the card networks themselves. There have been occasional incidents over the last 20 years, but typically on peripheral systems, not the core switches.

The underlying protocols for both systems are secure, but the surround systems in both ecosystems are more vulnerable.

Many of the biggest DC names have had public breaches including Coinbase & Circle

Card ecosystem actors like Target (merchant) & Heartland (acquirer) & Capital One (issuer) have all had incidents

Breaches are often “inside jobs” rather than cybercriminals – making it harder to police for either system.

Both systems are also subject to social engineering scams. This is not a flaw in the ecosystems themselves and are very hard to police. I still get at least 5 texts a week telling me I owe money to EZPass – from a Philippines country code! I keep reporting them as spam, but they keep coming. Zelle has been a petri dish for addressing scams – which have been reduced but not eliminated.

Will the networks accept declining share?

Debit displacement is not a foregone conclusion. If it happens at all, it will take a very long time as I described in this post. The networks will of course respond to any debit attrition with measures that either slow down defection or block it entirely.

The first lever is price. In the Durbin debit routing wars, networks discounted both Network Fees and Exempt Interchange to retain volume. Even in credit card, they have discounted to get cobrand deals (Costco) or to settle litigation (Walmart). Most network contracts have a volume-based component such that incentives are higher if volumes exceed thresholds. Therefore, if merchants encourage other payment methods, their network incentives automatically decline, offsetting some of the savings. See this post for details.

Networks can also match some of the distinguishing features of Stablecoins. For example, they launched Visa Direct in 2013 at least partially to capture disbursements volume in the face of Instant. They mandated that issuers give real-time availability (“Fast Funds”) while imposing a low interchange rate (@10¢ per tx) – well below the Durbin cap. They also had low network fees: 2¢ to the issuer and 2¢ to the acquirer. With almost zero marginal costs, Networks can discount heavily and remain profitable. An even simpler counterstroke would be to shift nightly settlement from ACH to Instant, moving settlement from next day to same day.

So do not expect the card networks “to go gentle into that good night”!

Conclusions on domestic Stablecoin prospects

Stablecoins do not have many advantages over incumbent payment methods for domestic commerce:

Relative to credit cards, Stablecoins don’t provide credit – either for revolve or for the grace period. While Stablecoins cost merchants less than Credit Cards, half those savings come out of the consumer’s pocket as lower rewards and no grace period. Good luck getting consumers to give those up

Relative to debit cards, Stablecoins are not significantly less expensive and don’t settle faster if the merchant needs fiat in their bank account. Missing Reg E support makes them unfit for most consumer commerce

Relative to Instant Payments Stablecoins share low cost, real-time settlement and irrevocability; both lack Reg E support. However, Instant payments settle in fiat directly into the DDA – whereas stablecoins are next day for fiat

Stablecoins distinctive advantages lie in smart contracts and divisibility – for which no mass consumer use cases have yet emerged. It seems more likely to me that Instant will win domestic commerce volume from debit over time while Stablecoins will be confined to narrower use cases.

That assumes the Card Networks don’t defend their position. Given their margins, the networks can cut prices in a variety of ways – as they did to win the routing wars, and could even speed up settlement, as they did with push-to-card products. They will not sit idly by as other methods gain traction.

Finally, consumer inertia is a common headwind in introducing new payment methods. I demonstrated that in this post. Today, the core use case is buying crypto which is a narrow consumer base, concentrated in the youngest generation.

I think the outcome will be different in cross-border commerce where Stablecoins have very real advantages over incumbent methods. I will cover that in a future post.

I agree with your analysis below. There is virtually no incentive to keep balances in Stablecoins for very long. The key users today are active crypto traders who use Stable as an intermediate step between fiat & crypto, so they need the ready liquidity, but virtually no one else does. As I pointed in the post, 85% of Circle's coins were redeemed in the same year they were minted.

There are ways to change the incentives: 1)The coin issuer can reward the coin holder in some fashion as PayPal is doing with 3.7% "rewards"; 2) The coin issuer can introduce onramp or offramp fees to make it costlier to go in and out rather than stay in.

Of course, the first solution may cause holders not to spend their coins at all and the second may cause them to avoid coins except for exact amounts when they are required by the receiver. So there is no outcome that keeps everyone happy.

Alaina -- thank you for the comments! I don't get enough of these. You are correct of course that any electronic payment is subject to Reg E or Z. What I meant was not that they weren't subject to the regulations, but that they were not configured to deal with legitimate Reg E disputes like "never delivered" and "wrong item", or second-party fraud or ATO. They just don't have mature chargeback processes to deal with consumer commerce. So the disputes will still happen but the friction associated with those disputes is much higher than the card ecosystem which has been dealing with chargebacks since inception