Is “the long run” getting shorter?

Payments innovation adoption is only faster in rare circumstances

Key insights in this post

Consumer payments innovations typically take 20+ years to achieve saturation:

They must overcome consumer inertia

They must get receiver acceptance, typically on a one-by-one basis

Consumer inertia is typical overcome via generational change

Early adopters are typically in their 20s

Each older generation adopts less quickly

As the generations get older, a higher percentage of the total population comes from those early adopting generations

By the 20-30 year mark, the oldest generation has left the market and the high-adopting younger generations account for the majority

This can be derailed if a new payments innovation enters the market before saturation is reached (e.g., Apple Pay following PayPal)

Two 1990s hyper growth payment innovations demonstrate these principles:

PayPal now has roughly equal usage in each generation, but faces competition from Apple Pay and Google in the youngest cohorts, this explains its growth slowdown

Bank Bill Pay (CheckFree) is in long term decline as younger generations use other bill pay methods and older generations are using it less

Of today’s high growth methods, only Apple Pay growth exceeds historical norms

Zelle seems hyper-growth but P2P was introduced before 2000 and Zelle absorbed several legacy bank-centric P2P services; so while Zelle is highly penetrated, the overall time frame was ~25 years

BNPL is hyper growth and only introduced within the last 10 years or so, but Pay-in-4 appeals to a narrow segment of the population and that segment is not expanding to become mass market

Apple Pay is only 11 years old and has high penetration among iPhone users; it benefitted from one-off circumstances that would be hard to replicate

Getting to saturation requires three broad tailwinds:

A starting customer base that has been aggregated for other reasons (e.g. Zelle leveraged bank app users)

A starting acceptance base (e.g., PayPal on eBay)

A compelling initial use case (e.g., in-app payments for Apple Pay)

No emerging payment method meets all three criteria, including the new guest checkout solutions or Stablecoins

My conclusion is that consumer inertia has not changed; Payments innovations will continue to require generational change to achieve saturation

Introduction

Last week I ended my post by quoting Amara’s law:

“We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run”.

I intended to convey that there was plenty of time for incumbents to adapt. The more I thought about it, the more I questioned how much comfort it should give.

I was assuming that consumer inertia has been constant in payments history. My early experience with innovations like ATMs, IVRs, Image Check processing, etc. is that they all took extended periods to impact the industry despite their obvious advantages. Even online banking was relatively slow to catch on.

More recent innovations like Apple Pay and P2P seem to get adopted faster. If the pace of consumer adoption is indeed faster than historically, the “long run” is shorter than it used to be – and incumbents have less time to adapt. This post will discuss whether adoption rates are indeed accelerating.

The generational model of consumer adoption

My mental model is that early adopters of any payments innovation are the newest generation to enter adulthood. Adoption rates decline with each older cohort. As the early adopting cohort and its successors get older, they account for a greater percent of the total population and market adoption rises:

20-30 year-olds are the early adopters with subsequent cohorts following their behavior

Seniors (60+) barely adopt as their payments habits are established and their needs get simpler as they grow older

The middle generations (30-59 year-olds) adopt according to their age – with 30-somethings adopting somewhat, 40s somewhat less and 50s less than that

As time goes by, the 60+ cohorts leave the market entirely and those younger cohorts account for a higher and higher share of the total. Eventually, those who adopted young become 30+, 40+, 50+ etc. and adoption reaches effective saturation. If this model holds, it would take up to 30 years for full adoption.

This pattern is not unique to payments. You can see evidence below for mobile banking adoption (Source: eMarketer)

Each line represents a 15-year generation. Mobile banking adoption started around 2007 with the introduction of the iPhone, so these bars start 8 years after introduction. There was mobile banking before then, via SMS and the mobile web, but it took off when the App ecosystem emerged on smartphones.

Millennials (73M) adopted early and reached saturation (90%) by the right edge.

Gen Z were ages 3-18 on the left edge, and at most 30 years old on the right edge, yet have 70% penetration despite a portion yet to hit 20. The youngest members of Gen Z were only 3 years old on the left edge.

The two older generations did adopt, but are not near saturation – and adoption has plateaued.

Less than half of Gen X had adopted at the left edge and they are still below two thirds on the right edge.

Boomers can’t be bothered: Only 22% adoption on the left edge growing to 34% on the right edge.

Overall, market adoption went from 30% to 62% over this period. As the final Gen Zers hit adulthood and the Boomers fade away, the market will fully saturate despite the plateauing of the older two generations.

We see these usage patterns in Bank Bill Pay (Checkfree) and PayPal Wallet. Both were new around 2000 and grew rapidly from inception. Today, the average user for both is 40+. They started as 20-somethings and kept with it. But newer generations adopted differently:

PayPal Wallet

At the dawn of eCommerce. PayPal Wallet delivered unique consumer benefits:

It was the main way to pay on eBay -- at the time the biggest marketplace

It was quicker than typing a card number

It was safer in an era when eCommerce fraud was widespread

Over time, conditions changed:

Amazon became the biggest eCommerce merchant and didn’t accept PayPal

PayPal lost eBay as a source of new consumers and new merchants

Apple Pay emerged as another quick way to pay online. Now there are others

eCommerce became safer with technologies like CVV, and Apple Pay

According to survey data, only 20% of PayPal users are under 30, which roughly matches their share of eCommerce shoppers overall. So, PayPal has reached the terminal stage where all cohorts use it equally. That may be why PayPal wallet growth has slowed so much.

Bank bill pay

This method is past the terminal stage. The average user was in their 50s when I was at JPM -- and the number of payments each user made was declining. Younger demographics pay recurring bills via cards or direct debits. For ad hoc bills, they use biller direct rather than bank bill pay. Early adopters from the 2000s have stuck with it, but newer generations didn’t join up.

Conclusions on the generational model

It is hard to go faster than the generational model given consumer inertia. You generally have to wait for early adopters in younger generations to replace their elders in the market.

Another lesson is that one reason payment methods don’t reach saturation is that newer methods take their market niche first. Going forward we may see this with Instant replacing Visa Direct or Stablecoins replacing Instant in some use cases.

What payments methods are in hyper-growth today?

If we use the benchmarks established by mobile banking, best-in-class would be around 30% adoption after 10 years and 65% adoption after 20. If adoption is accelerating, we should see some innovations beating these milestones.

When I started this post, I thought that two methods might be adopting faster: P2P & Apple Pay.

BNPL could be a contender, but it has a small, in-scope market and is more of a lending product than a payments product. BNPL is primarily used by credit-constrained consumers. Recall from this post that Pay-in-4 accounts for under 30bps of credit card spend. Not material. It does only slightly better relative to Debit spend. It is indeed growing rapidly, but in a small niche.

This brings up a key point: Some payments technologies appeal to a narrow niche. Adoption in that niche may be very rapid, but that only matters if the niche eventually expands to include the broader market. In other words, BNPL may reach saturation in under 20 years, but it is saturating a small niche. Neobanks and GPR cards also face this challenge. I am looking for mass market innovations in this post.

So Apple Pay & P2P are our two contenders.

P2P

The reference case here is Zelle because of its data transparency and my familiarity. It went live in 2017 and now has 151M users sending over $1T in annual transfers. That would be around 60% penetration of 20+ adults – and Zelle is still growing users at double digit rates.

However, while 2017 is Zelle’s start date, it is not the start date for P2P:

Large banks all had P2P services before Zelle was launched:

Chase, BofA, and Wells had proprietary P2P services prior to Zelle. Chase launched theirs (QuickPay) in 2008, BofA in 2002

Fiserv supported PopMoney, a bank-centric P2P service introduced in 2010. Most other large banks were members

ClearXchange was founded in 2011 to provide interoperability among bank P2P services. Chase, Wells, and BofA were all founding members

Venmo was founded in 2009 and Cash App in 2013 (as Square Cash)

PayPal was the granddaddy, launched in 1998; P2P still generates ~10% of PayPal wallet volume

Zelle absorbed ClearXchange and the three bank systems when it launched and converted all the POP Money banks relatively quickly. Cash App, Venmo, & PayPal still compete, albeit their growth has slowed substantially. All three would have been on hyper-growth list prior to Zelle launch, but Zelle grabbed all that growth.

The ecosystem accelerant was the shift from online P2P to mobile P2P. PayPal dominated online but Venmo and Cash App were the initial leaders in mobile. Zelle is the new leader in both venues. This is the fate of many innovations: They lose to the next innovator before they reach saturation.

if 1998 was the launch date for P2P, it took 26 years to go from 0% penetration to over 60% penetration. This is about par for prior payments innovations as outlined in my model. Adoption clearly accelerated with the launch of mobile P2P, but PayPal had already captured P2P early adopters.

So for P2P, the long run is still the long run we always knew.

Apple Pay

This may be the reason observers believe payments innovations get adopted faster now. However, the circumstances suggest we should treat this as a one-off.

Apple Pay launched in 2014, so is a bit over 10 years old. There really wasn’t a POS payments app any earlier, except the closed-loop, Starbucks App. Like BNPL, Apple Pay appeals to a niche (iPhone users), but Apple’s niche is very large – ~60% of consumers have iPhones. Apple Pay also faced ecosystem barriers in its early years which makes subsequent growth even more impressive:

Apple Pay started with the iPhone 6 – the first NFC iPhone – but it took years to migrate all Apple users to subsequent, NFC-capable models

Apple Pay started before the EMV mandate required all merchants to upgrade their POS terminals. In the early years, there weren’t that many places to use NFC

Measuring Apple Pay penetration requires excluding the ~42% of US Android users from the in-scope market. Apple Pay has roughly 60-65M users in 2025 representing ~45% penetration of the iPhone adult user base. Frankly, I was surprised at how low that is. I see it everywhere. It beats my 10-year benchmark by 50%, but it doesn’t blow it away.

Apple skews younger and more affluent than Android, so a greater proportion of its customers are in the early adopting segments. But the success of Apple Pay has as much to do with distribution advantages as it does with demographics.

In payments, we always confront the chicken-and-egg problem. Consumers won’t use a payment method unless lots of merchants accept it and merchants won’t accept a payment method unless lots of consumers want to pay with it. Apple had the unique ability to deliver the chicken and the egg simultaneously:

Merchant acceptance. Normally, aggregating merchants takes forever, just ask Chase about Chase Pay. Apple leveraged independent ecosystem advances to get acceptance:

Apple Pay launched during the great re-terminalization wave in US Retail.. The EMV deadline was October 2015. Almost every retailer replaced almost every terminal to meet that deadline. A side benefit of this swap was that every new EMV terminal came with NFC installed. So shortly after initial Apple Pay launch, every POS could accept it. Banks were slower to add NFC chips to their cards, so if the consumer wanted to tap-to-pay, Apple Pay was the only option

Another acceptance tailwind was that Apple Pay was just a form factor for cards; it passed a “token” to the terminal which was cleared and settled just like any other card transaction. So, Apple didn’t have to integrate with merchants and merchants didn’t need to change their processes much.

Apple also got the issuers to pay for it, so merchants didn’t pay extra for acceptance. They had no good reason to say no

In-app purchases were a new category at launch. In my view, this was a major trigger as Apps like Uber & Starbucks were just taking off. Apple’s control over the app ecosystem and the iPhone UX allowed it to solve a big problem for both the App publishers and iPhone users. Very soon after launch, in-app use of Apple Pay surpassed NFC usage and was still growing 2x as fast 3 years later (when I could no longer see real-time data). In effect, Apple created its own demand via the app ecosystem

Consumer acceptance

Apple introduced its first NFC iPhone with the 6-series in 2014. The natural consumer upgrade cycle led to proliferation of the technology – you had it whether you wanted it or not. Similarly, Apple put the Wallet and Apple Pay technology into the OS – it just awaited consumer adoption

Many card issuers promoted Apple Pay because they wanted their cards to be first in wallet – so Apple got help on marketing. All Apple Pay needed was a good use case beyond novelty value – and that was in-app payments

So Apple Pay really did beat the odds. It grew close to saturation faster than other innovations.

Is faster adoption just Apple Pay?

As I was writing this, it occurred to me that another of my favorite quotes might be appropriate here:

“The battle between every startup and incumbent comes down to whether the startup gets distribution before the incumbent gets innovation.” – Alex Rampell.

In the success stories I cite above, distribution was what distinguished the hyper-growth players:

Zelle. The biggest banks embedded Zelle in the banking apps consumers already had on their phones. The competition was either online (PayPal) or in standalone apps (Venmo & Cash App). Automatic distribution won. Of course, Zelle also settled real-time into a checking account, but distribution via bank apps and the use of captive bank marketing channels likely won the day. P2P is also inherently viral: consumers are both the chicken and the egg. That eliminates ordinary acceptance barriers

Apple Pay. Apple was fortunate to control the consumer side of its ecosystem and leverage an open standard (NFC) on the merchant side. Apple created the egg and the card ecosystem created the chicken. Apple controlled App store rules which ensured primacy within the in-app venue

Both these innovations had favorable distribution channels working for them. That is rare for payments innovations and doesn’t always win the day. For example, Instant Payments benefits from some of the same advantages as P2P but is still not scaling as fast as these two. So distribution advantages are necessary but not sufficient.

New innovations

The key takeaway is that hyper-growth payment innovations need cheap, ubiquitous distribution on both the consumer side and the acceptance side. If you can develop both you get hyper-growth and if you can’t you face the 20+-year slog – or failure. Opportunities to get both sides are rare. Let’s look at few trying now.

Guest Checkout

Several payments companies are trying to solve Guests Checkout by automatically popping up payment credentials and shipping details in checkout. They also authenticate the shopper. Typically card credentials and identity are linked to an email address:

Paze. Paze has the consumer side nailed. Its bank members account for the majority of consumer credit and debit cards. When Capital One converts Discover that will add another big pool of cardholders. Only American Express is missing. But getting merchant acceptance requires one-by-one integrations. eCommerce is concentrated into the top 10 merchants plus Shopify (an SMB aggregator). Amazon likely won’t’ play and Shopify has a similar offering in Shop Pay. Together that reduces the market by over half.

Shop Pay. This can become ubiquitous within the Shopify ecosystem but will face a steeper hurdle outside that ecosystem. Shopify accounts for ~15% of eCommerce spend and only has some card credentials for its shoppers. Making Shop Pay ubiquitous is as steep a challenge as Paze faces

Link is Stripe’s answer to Paze & Shop Pay. It adds the additional wrinkle of pay-by-bank payments. The open question is whether non-Stripe merchants will accept it and whether Shopify will allow it on-us to compete with Shop Pay. Like all the others, it likely won’t show up on Amazon – taking a big chunk of the market away

FastLane is PayPal’s guest checkout solution. It benefits from PayPal’s merchant relationships and customer base, but still needs merchant-by-merchant integration. Further, PayPal has suggested it will eventually charge for FastLane while several competitors are nominally free. Fees will stall merchant uptake

Of course, Apple Pay also competes in Guest Checkout. It transfers payment credentials & shipping details and authenticates identity. Apple Pay dominate in-app checkout due to app store oversight, so consumers are trained to use it. Google Pay has many of the same attributes.

In such a crowded market it is unlikely any one solution will dominate. I expect all these solutions will see success in their narrow dominions, but none of them will sweep the field. In particular, Amazon is out of reach for all given its proprietary one-click solution. Without their 40-50% of eCommerce share, it will be hard for others to get scale.

Stablecoins

Stablecoins are used in payments, although the main US use case is buying Crypto! Outside the US, stablecoins see more diversified uptake.

But the question remains: Can stablecoins achieve hyper-growth as a US domestic payment method? While I am bullish on Stablecoins over the true long term, I don’t think we will be giving up our incumbent domestic methods any time soon. The main challenges, as we saw above, are distribution-related:

No entity with a big customer base is promoting Stablecoin usage. Each consumer needs to enroll in stable coins on their own. PayPal is trying, but uptake is unclear

Unlike the Apple Pay/EMV example, there are few venues that accept Stablecoins. Paradoxically, Crypto regulation may undermine the need to use stablecoins to buy it. In historical terms, Crypto exchanges act as the eBay to stablecoins PayPal

The other issue is fragmentation, similar to guest checkout. Stablecoins effectively grant “seigniorage” profits to the issuer since they can invest the fiat without paying interest on the Stablecoin. Free money! As a result, many entities have announced plans to issue stablecoins. Because all stablecoins are backed by fiat assets, it is hard to differentiate them. The more fragmented the issuing market, the lower the resources available to promote acceptance. The attitude seems to be “if we build it they will come”. If a dominant issuer does emerge they will have the same acceptance incentives and challenges as Amex or PayPal.

The other challenge domestically is that Instant Payments have roughly the same advantages: low cost, real-time, rich data, irrevocable, etc. Instant Payments also allow users to consolidate their liquidity in a central DDA account rather than splitting it among DDA and one or more Stablecoins. Domestically, there is no advantage to doing so.

The same things that make Stablecoins attractive to merchants makes them unattractive to consumers for commerce. Stablecoins face the same Reg E challenges as ACH, Instant Payments, Zelle, etc., but don’t yet offer chargebacks, returns, refunds, etc. Relative to credit cards they don’t offer rewards, borrowing or grace periods. All technically possible but all of which require investment – raising costs and complexity.

Cross-border use cases should grow faster, particularly remittances and B2B payments, but cross-border is a small share of the US consumer payments market. It is also not clear whether AML/KYC compliance overheads will slow down Stablecoin‘s settlement speed advantage or reduce its price advantage.

Today, crypto purchases are the killer use case for Stablecoins, but that may not last. Unless a new use case emerges that compels adoption, my guess is that Stablecoins are on the 25-year+ plan. Note that Instant isn’t moving much faster despite all its distribution and compliance advantages.

Overall Conclusions

Consumers are slow adopters of new payments technology. In general, a payments innovation requires generational turnover to be fully adopted – which can take 20+ years. Before that happens, the next innovation can capture the target use case.

The exception cases are black swan events that meet a few key requirements:

They start with a big consumer base aggregated for another reason

They leverage other means to get receive-side acceptance

They have a use case that compels adoption

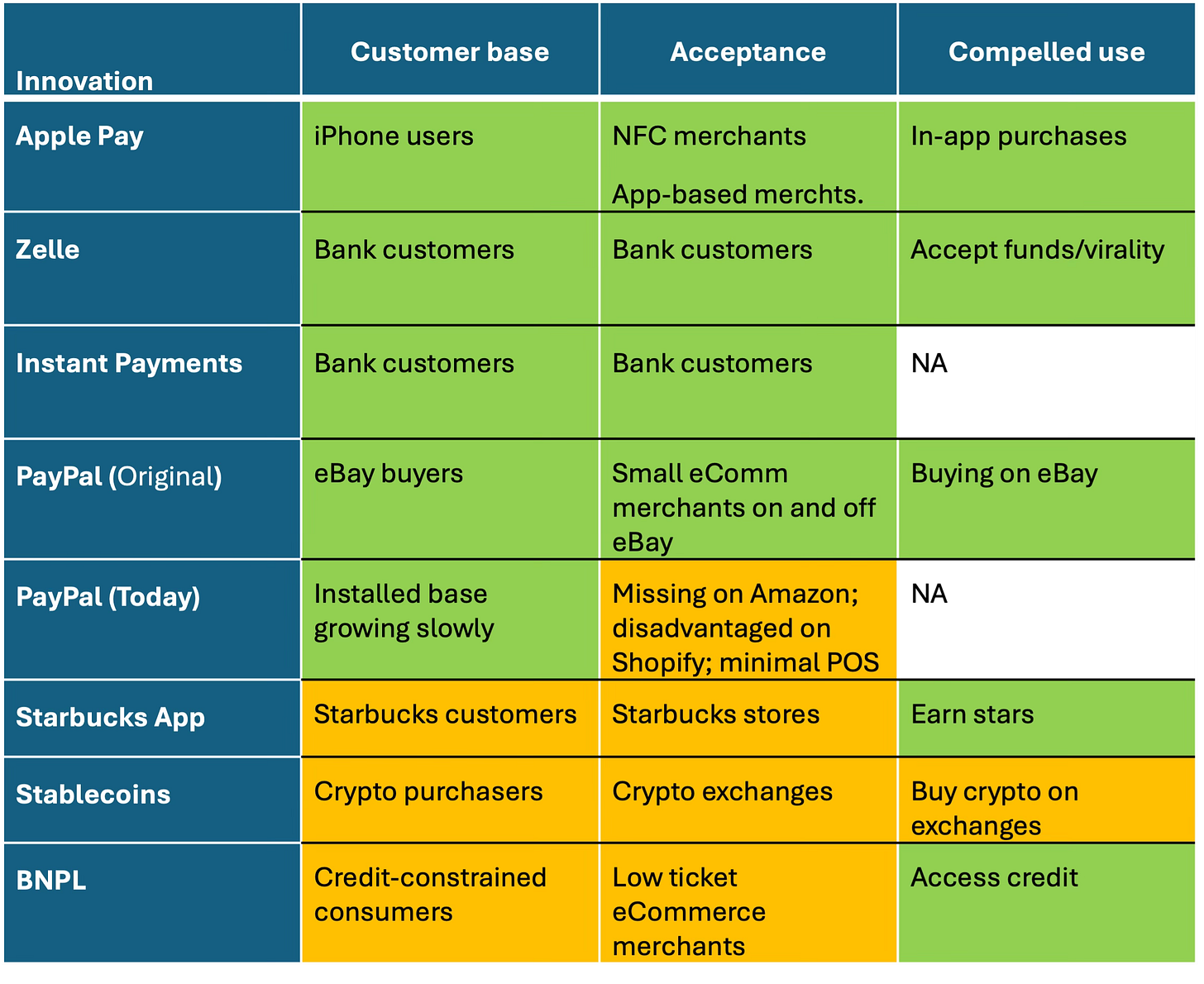

Here are how a few of the fast growing categories stack up against these criteria:

This table shows the problem: Towards the bottom, the market sizes are too small, and in some cases compelled use is absent. PayPal originally met all the criteria, but then lost the eBay relationship and was unable to replace it with another compelled use case. They are excluded from Amazon & Apple and deprioritized on Shopify, which together are more than half of eCommerce. Instant payments just lacks a compelled use case. P2P serves that purpose in many countries, but the banking industry chose to build Zelle instead of building P2P on Instant rails.

Zelle meets the criteria, but the P2P use case started over 20 years ago, so Zelle is a late entrant to an established use case.

So Apple Pay alone meets all the criteria. Of course, its compelled use case, in-app purchases, is under global antitrust attack. Just last week a US judge forced open Apple’s walled garden. And Apple itself recently opened its NFC chip to third-parties. Apple will likely retain leadership within the iPhone ecosystem, but competitors may erode growth.

This post set out to answer the question: Is consumer adoption of new payment methods accelerating? My conclusion must be that it is not. Hyper-growth payment innovations are rare because the chicken-and-egg problem is hard to crack (pun intended). Breaking from the 20+-year path requires the rare circumstances that helped Apple Pay. Stablecoins don't meet the conditions for domestic payments but could get there for cross-border. The long run is still long.

Wilson -- perfect example of a compelled use case! And history may repeat itself. One of the things FedNow may do that TCH RTP can't do is force the Federal government to pay-out via Instant Payments. They may just be waiting for more take-up among smaller banks.

Love the timeline comparison and the proposed framework. I came to a similar conclusion when studying ACH a few years ago — though I didn’t consider age cohort adoption.

In that case the catalyst for receiving bank adoption was the federal government saying, “you’ll sign up for Fed ACH or you won’t receive Air Force payroll or entitlement payments.” The role of top down mandates might be the compelling case for instant as well — particularly in light of the EO pushing to digitize government payroll.