Key insights in this post

BILL is now the target of an activist investor despite double digit top-line growth in its core AP business, and a growing client base

All the major AP-specialist Fintechs have seen declining growth and sagging valuations – AvidXchange & Melio sold out in the face of these conditions

While BILL’s overall growth is attractive, unit metrics are less impressive

Transactions per client declined, suggesting lower engagement

Transaction fees per client and Fees per TPV (client spend) just kept up with inflation

TPV growth per transaction exceeded inflation by only 1-2%

Transaction Fees per Transaction went up faster that TPV/transaction which may reflect rising rebate levels on virtual cards rather than any client side activity

So BILL’s key AP business is growing largely due to client growth while client engagement is going down

This might be explained by Payee resistance to accepting Virtual Cards which have a high acceptance cost for suppliers

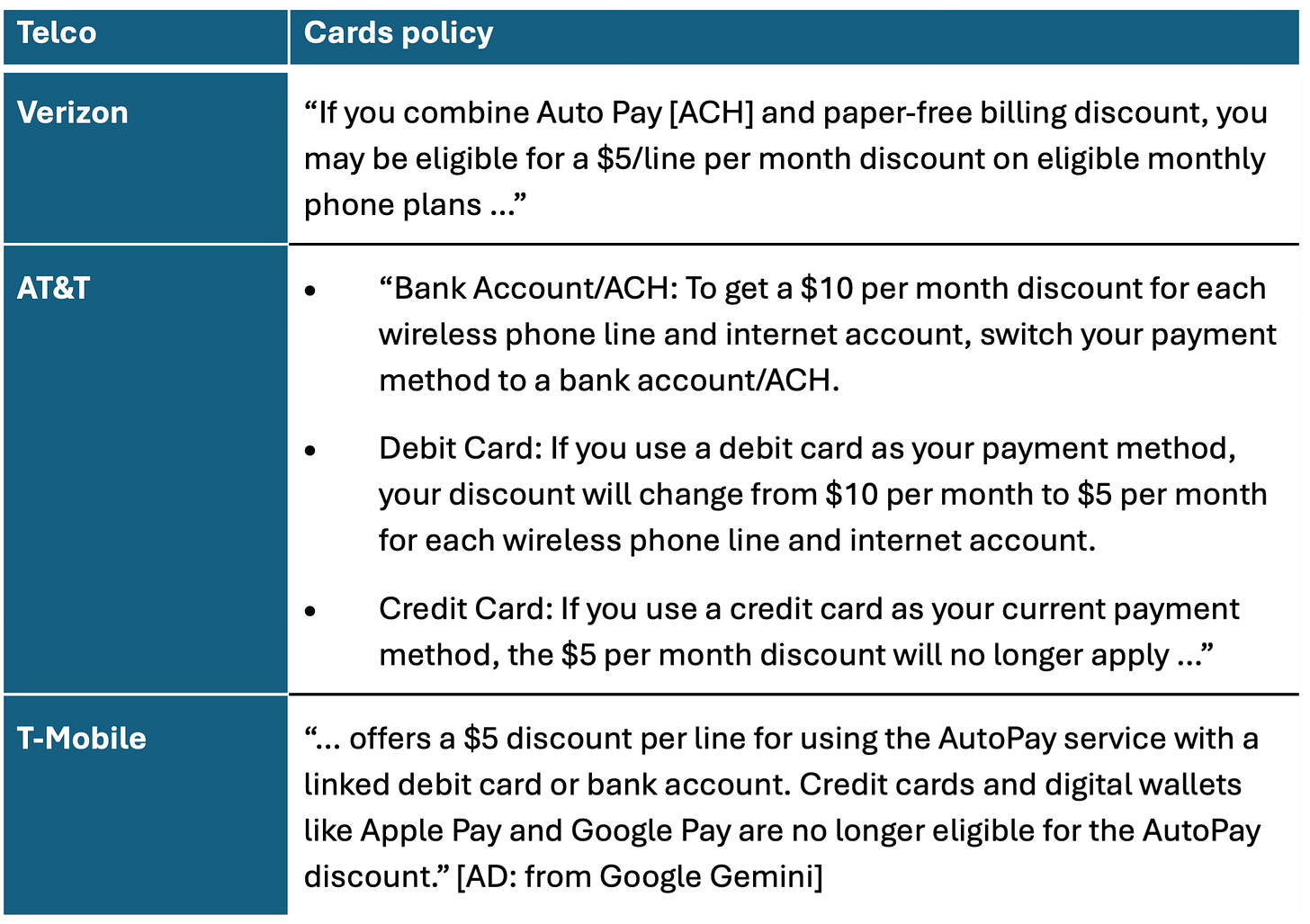

Telcos in particular have repriced to encourage ACH over Card methods

Small merchants are imposing card surcharges for POS payments

Suppliers avoid accepting VCs even when they are accompanied by accelerated payment

VCs likely account for the bulk of BILL AP revenue despite accounting for a small percentage of payments. Losing just a few per month is material.

The VC market is growing for other use cases, but may be plateauing for AP

The Buyer/Payer-side is approaching saturation

The Invoice-based Supplier-side is less willing to bear the cost, even in return for payment acceleration

The Card-based Suppler-side (e.g., telcos) are deterring VCs in some cases

These trends are sectoral, not unique to BILL. It is hard to see how a return to the glory days might happen, even with Activist help.

Introduction

Earlier this month, Starboard Value accumulated an 8.5% stake in BILL and offered up a slate of directors for the board. BILL’s stock had declined over 30% YTD while the NASDAQ was up 18%.

But BILL is not alone. AvidXchange saw a similar decline before it sold itself earlier this year and Melio’s acquisition price was below its prior peaks. These were the three biggest AP Fintechs focused on small to mid-sized companies. So, is it the company or the sector that is at issue?

More established companies like WEX and Corpay (who participated in the AVDX buyout) have also seen modest YTD declines although they are more diversified, more global, and more upmarket, so it is not a direct comparison. That still suggests it is the sector, not the companies.

Why now? I will argue that a key revenue source for these companies is facing resistance from payees. As a result, the companies are processing fewer high-fee transactions.

How Integrated Payables work

Integrated Payables consolidates all outgoing payments from a buyer and pays suppliers with the best payment method from the buyer’s perspective. The way an AP Fintech makes money at this is by substituting high fee methods for low fee methods and capturing a share of the arbitrage. By “high-fee” I mean high cost to the supplier. The payment methods used vary depending on the Payee use case

Voluntary: A supplier normally paid by ACH is offered accelerated payment via Virtual Card (VC) or another instant method. For smaller suppliers, taking payment faster can be worth more that the incremental acceptance cost

Involuntary: A supplier that already accepts credit cards cannot turn down a high-interchange card product due to “Honor All Cards” rules. Telcos are a good example. In this use case, there is no acceleration benefit to the supplier, just extra acceptance cost. The interchange revenue is shared among the Fintech, issuing bank, network, merchant acquirer and, usually, the Buyer.

Voluntary: Acceleration at a cost

In this use case, the supplier agrees to take a more expensive payment method in return for accelerated payment.

For invoice payments, small companies will often accept a more expensive virtual card in return for accelerated payment. Small companies have high cost of capital; therefore, getting paid 30+ days early is worth more to them than the lost float to a bigger buyer. The 3% acceptance cost may be lower than the value of 30 days acceleration.

The problem comes when the supplier is as big or bigger than the buyer. They are unlikely to accept the acceleration as they can get working capital in other ways at a lower cost. In fact, the networks now allow large counterparties to negotiate custom (i.e., lower) VC interchange rates to bridge this gap.

I worked with a few large buyers during my consulting days, and they generally couldn’t get any big suppliers to take these terms. The opportunity was in the long tail of suppliers where acceleration was an appealing inducement to participate. The problem here was that each supplier had to formally agree and it was generally up to the buyer to recruit them. The extreme end of the long tail was impractical due to recruitment overheads. This left a modest portion of the AP file as targets – mid-sized suppliers who did enough business with the buyer to justify recruitment.

We saw churn in that group. A supplier might take acceleration initially, realize how expensive it was, and then refuse to take any going forward. Basically, a one-and-done. Others only took acceleration when facing cash flow crunches, but otherwise waited for their contractual ACH.

BILL adds value here by offering a directory of suppliers who have pre-agreed to take VCs. BILL’s directory is over 8MM strong compared to 169K customers where BILL makes the payments. That directory is a key asset for BILL as it can be used to avoid check payments at a minimum – but not all those “members” have agreed to take VCs – in fact most have not.

To summarize, the Voluntary opportunity is in the mid-sized suppliers. The big suppliers can’t get an economic benefit and the smallest suppliers are expensive to recruit. Even in the mid-sized category the buyer may see churn, one-and-done’s, or intermittent take-up. BILL’s ecosystem is advantaged by having a large directory that already knows supplier preferences.

Involuntary: Virtual Cards at card-accepting suppliers

The situation changes if a supplier routinely accepts cards for bill pay or eCommerce. Then, under the networks “Honor All Cards” rules, the supplier has to accept payment via high interchange VCs. VC growth has increased acceptance costs across these verticals, which has triggered counter-tactics.

A VC costs the supplier almost 3% of the invoice value. The supplier would ordinarily get an ACH, which is generally free on the receive side. If the supplier is a large telco or similar entity, they may not even know that a VC was used to pay a bill, except for a mystifying rise in acceptance costs. As I wrote in this post, many Fintechs built their revenue model on VC interchange (IC), but it is particularly key in Accounts Payable.

Virtual Cards are one-time use prepaid cards that carry a high IC rate. They have been used for Accounts Payable because they allow the buyer to extract an extra 1-2% discount from the Supplier. The supplier pays the ~3% MDR on the card payment and the card issuer rebates the 1-2% back to the buyer. The VC issuer usually keeps 1-2% as well. And, of course, the network gets its usual stake (13bp + 1-2¢). Smaller suppliers also face meaningful acquirer fees. BILL earns a share of the rebate as its revenue.

Rising VC usage has raised acceptance costs at big billers, some of whom are now deploying VC countermeasures. Telco is the best example. All the major mobile providers take cards for their consumer bill pay and therefore have to take VCs for B2B bill pay. They have all taken steps to limit usage:

All three offer discounts for ACH, usually with paperless billing. At $5 per line, my 4-line family plan earns discounts of $20-40 per month. Small Business plans may save more. Using ACH earns the Small Business a discount but doesn’t generate revenue for an AP Fintech. Some of these terms are designed to deter consumer services like PayGo which also use VCs. Note that these savings are well above any rewards that a typical card offers.

For recurring payments where VCs are not an option, BILL offers options for last minute payment that are paid for by the buyer:

Instant Payment: 1% fee with a minimum of $9.99 and a maximum of $100

Same-day ACH: $11.99 per transaction

Both SD-ACH & RTP/Fednow likely cost BILL ~5-10¢ per transaction. These both use standard RT+Acct payment credentials that are likely in BILL’s directory so they are not an exception process for the supplier. These methods are likely used as last minute payment options, to avoid biller late fees.

How this impacts BILL

BILL is the most transparent Fintech I have ever encountered. They provide all the data we need to see if their headwinds are related to VC resistance. I will focus here only on their AP/AR business:

Their “embedded” business has the bulk of their clients (~57%) but tiny revenue share (6%). This is mostly indirect distribution through banks and other partners

Their Divvy business has revenue share of 21%, net of rewards costs, and is a more traditional T&E card product

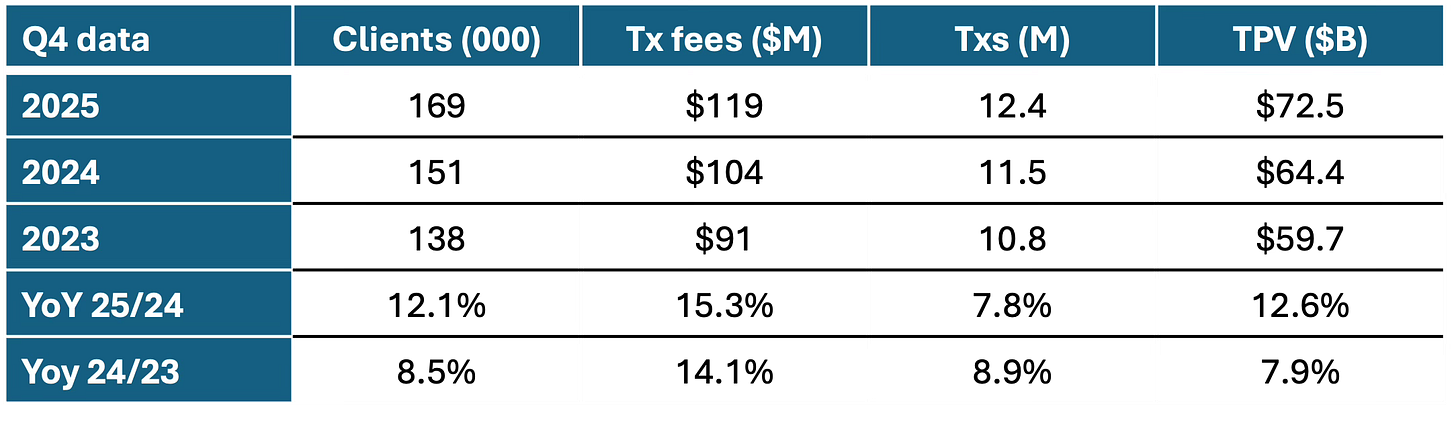

I am also going to focus on Transaction revenue as Subscription revenue is both modest (18% of total) and unrelated to engagement. For the basic AP/AR stats, growth is positive on all metrics, but particularly transaction fees:

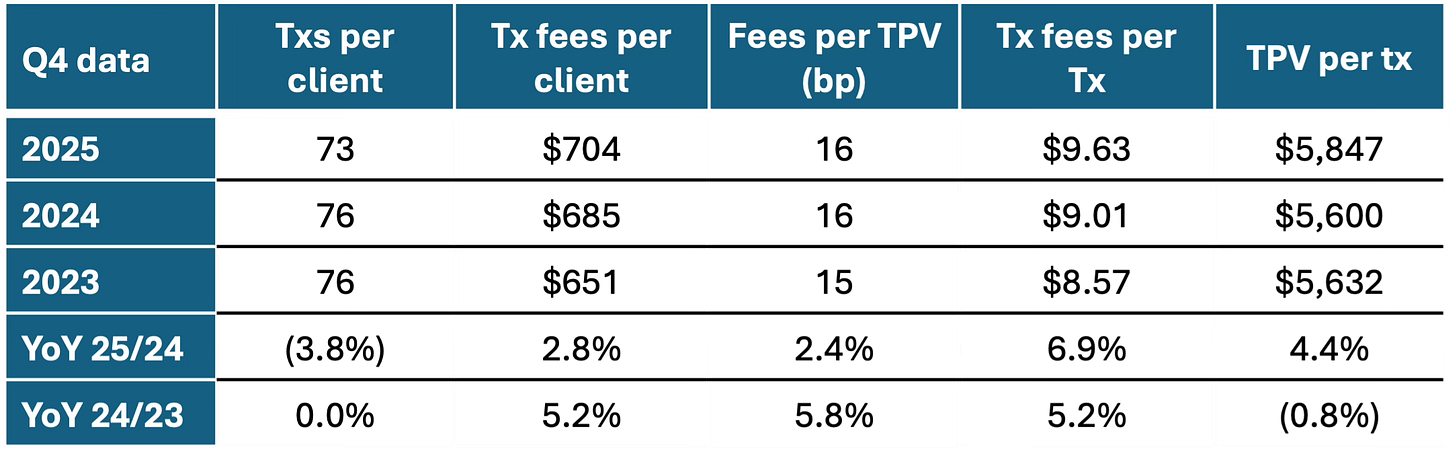

Client & TPV growth accelerated nicely from last year, but transaction fee growth ticked up while transaction growth decelerated, despite robust client growth. I calculated some second order metrics that are not as rosy:

Transactions per client are declining. Transaction Fees per client & Fees per TPV are effectively flat on an inflation-adjusted basis. Fees per transaction are up, mostly a result of inflated transaction size, but perhaps reflecting a rise in Virtual Card rebate levels as TPV rises.

Overall, revenue is up largely because BILL is booking more clients, but client engagement is stagnant to down. Revenue per transaction is getting a tailwind from inflationary TPV growth, and perhaps the accompanying rise in rebate levels from issuers

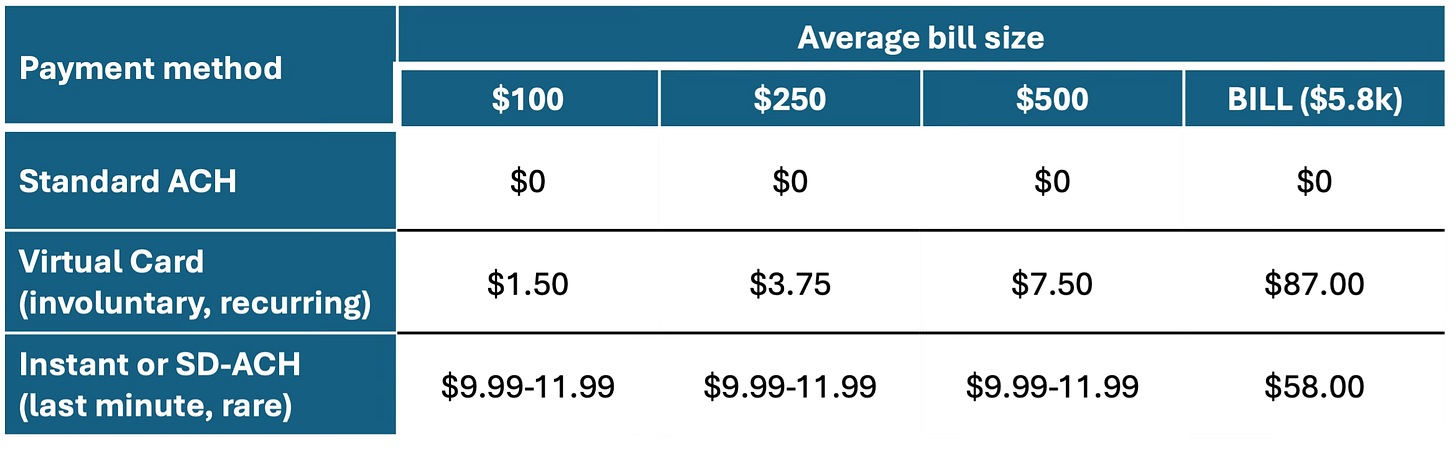

How is cost resistance from buyers impacting all this? Consider the table below:

Bill payment revenue by payment method for a single payment

If this is a last-minute payment, the client may opt for Instant or SD-ACH, creating a windfall for BILL given the cost to them is likely under 10¢. Paying BILL $10-12 may still be cheaper than paying late fees to the biller. But, these kinds of transactions should be infrequent. Perhaps to avoid late fees or more positively, to earn an early payment discount.

For recurring bills paid on time, the VC vs. ACH difference is substantial. The annual impact per client is $18, $45, or $90 dollars depending on the size of the bill. That represents 1-3% of annual revenue per client – from a single biller. If more Billers adopt the telco tactics, the revenue impact will be larger.

For larger bills (fourth column) the loss of even one per month represents a substantial share of annual revenue. Even if that bill moved from a VC to Instant the revenue loss is significant.

Note that the reported quarterly decline in transactions per client is 3, or 1 per month. This may be a coincidence or it may be an indication that monthly telco bills at least are moving to low revenue methods.

The other side of this phenomenon is credit card surcharges, which about a third of small businesses now impose. BILL pushes VCs into Apple Pay for POS payments but if the merchant surcharges the typical 3%, the client is worse off. If it is no longer economic on a card, it will revert to another method.

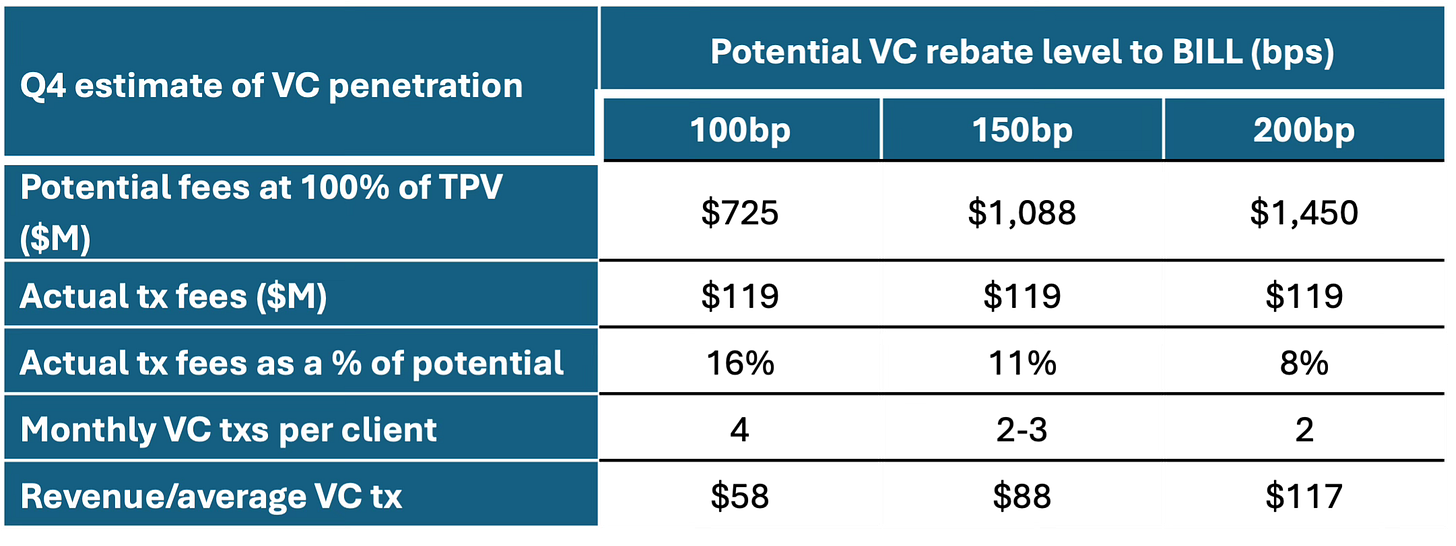

The change in voluntary transactions is also interesting. The average fee per transaction is $9.84. Since most payments will go out on standard ACH, that means a disproportionate share of revenue is associated with a small share of VC transactions. Given the high average ticket on these transactions (~$5.8K) and the low average fee per transaction (16bps) we can triangulate to a VC share.

This overstates the VC share as most Instant and SD-ACH fees are in the $10-12/tx range. Any volume that moves at these price points lowers the actual transaction fees available in the numerator and reduces the VC share.

The loss of 1 VC transaction per month at the average ticket is worth 25-50% of fee revenue depending on rebate rate. In other words, it doesn’t take a lot of VC resistance to have a disproportionate impact on revenue. VC resistance matters.

The introduction of Instant & SD-ACH may itself have been a reaction to VC resistance. BILL introduced these fees in September of 2024.

VC market volume is growing, so where is the resistance?

Virtual Card growth projections consistently exceed 20% annually through 2030, so, how come all these AP vendors are seeing slowing growth? The answer lies in the use cases.

The involuntary use case in C2B payments has unabated growth, particularly at the physical POS. For example, Marqeta is the go-to processor for VCs used at the physical Point of Sale, usually pushed into Apple Pay. Marqeta reported 29% YoY TPV growth in its most recent quarter. Much of that growth came from C2B VCs, for example:

Door Dash and other delivery Fintechs push virtual cards into Apple Pay for their shoppers to pay merchants

BNPL lenders push virtual cards into Apple Pay so their customers can borrow at the physical POS

These use cases account for material VC growth but have nothing to do with B2B AP. The merchants are typically large retailers that are reluctant to impose consumer surcharges on regular, direct consumers. Further, their POS systems can’t distinguish whether a customer is using a high-IC card or a low-IC card. These merchants are defenseless, unlike B2B suppliers.

On the B2B buyer side, I have seen estimates that up to 70% of larger companies use virtual cards for AP. The bigger the company, the more likely they are to use VCs, so buyer adoption may be reaching saturation – at least partially from supplier resistance. Recall that large suppliers generally won’t take VCs at all, so VCs are primarily used to pay middle market and small business suppliers – usually in return for acceleration. But, the smaller the buyer, the less likely they will accelerate payment as they have their own cash flow concerns.

VC growth overall is fueled by C2B involuntary use cases like delivery and BNPL and not B2B use cases. In the B2B involuntary use case, some suppliers are erecting defenses; if these tactics spread, growth will decline.

This explains why most of the AP specialists are facing growth headwinds while the networks continue to report robust VC growth.

Conclusions

B2B AP Fintechs have seen robust growth since their foundation, and they continue to grow fast by any conventional measure other than their own historical record. But growth is flattening as all trajectories eventually do:

The Buyer side is saturating as the biggest companies have already adopted integrated payables while the smaller ones have less to gain

The Supplier side is resisting virtual card payments, reducing the revenue potential

The smaller buyers that BILL serves can’t afford the acceleration inducement that can overcome supplier resistance, keeping more volume on low-revenue ACH

Competition has heated up among Fintechs, banks & incumbent processors;

BILL’s own embedded business competes with its direct business and has almost twice as many clients while producing a fraction of the revenue

BILL’s own Divvy business, and its competitors, may erode the core BILL opportunity as those cards can also be used for the recurring, involuntary payments at high IC rates

Despite all this, BILL still grew clients and revenue at double digit rates; but, we can see warning signs going forward:

Competition

Supplier resistance

Lower client engagement (transactions per client).

Avid and Melio sold out in the face of these market conditions. It is unclear whether that is what Starboard wants for BILL or whether they see a way to improve performance organically; the market headwinds suggest accelerated growth will not come easily.