Why is Apple Pay outgrowing PayPal?

Apple Pay is formidable, but structural headwinds hurt PayPal more

Key Insights in this post

Digital wallets lower friction, reduce fraud, and raise conversion

All digital wallets share a value proposition, they have different delivery models:

Settlement: pass-through, stored-value, or pseudo-acquirers

Reach: closed-loop or open-loop

Commerce venue: in-person (POS), eCommerce (browser-based), or in-app (mobile commerce)

Wallet starting points and value creation models vary by ownership:

Ecosystem wallets: Start within a closed-loop marketplace where they take the role of an Acquirer, charging merchants an MDR (e.g., Amazon Pay)

Consumer-first wallets are an add-on to a large digital consumer base

Bank-led wallets “monetize” via engagement (e.g., Zelle, Paze)

OEM wallets monetize by anchoring the consumer to the OS, but Apple Pay also charges issuers a transaction fee

P2P wallets, like Venmo & Cash App build a customer base via free P2P and then expand into commerce at an MDR

Merchant-first wallets start within a single merchant and monetize via loyalty (e.g., Starbucks)

PayPal’s growth slowdown is less a function of Apple Pay growth and more a function of structural challenges in their core, browser-based eCommerce market

Apple Pay is modestly eroding PayPal’s core market so much as it is blocking their expansion path into in-person & in-app

Apple Pay control of the iPhone NFC chip blocks the path to in-person

Apple control over the App Store gives it an in-app advantage

Apple is growing in-browser, but must integrate each merchant separately

PayPal faces a series of structural challenges in their core, in-browser market

They started as the ecosystem wallet within eBay, and then lost eBay

This cut off a key source of new consumers and new merchants

Even had they kept eBay, eBay itself has faced slowing growth

Shopify captures most small merchants and has its own payment solutions

eCommerce growth is slowing, reducing a PayPal tailwind

Large merchants like Amazon are outgrowing the market and rely on card-on-file or proprietary wallets rather than guest checkout. They also promote co-brand & PLCC cards which tend to be on-file, not in wallets

Omnichannel models split small merchant volumes across marketplaces and a proprietary web site, so even when PayPal drives checkout it won’t get the full merchant volume

PayPal is trying to innovate its way to growth, but while that increases consumer engagement it may not increase the merchant or consumer base

Trying both consumer-side innovation to increase engagement and merchant-side innovations to reduce friction; it is too early to judge impact

PayPal likely needs an ecosystem partner as a flywheel, but none of size are unserved.

Even if one were found, the ecosystem would likely keep the bulk of the payments margin

However, a new ecosystem might generate new customers for off-ecosystem revenue

PayPal could get a growth boost in-person given Apple’s new open-NFC policy, but this is not straightforward

PayPal needs a proposition that induces consumers to leave Apple Pay

PayPal must pay any fees that Apple charges for access, reducing margins

NFC access doesn’t help in-app or with slowing growth in-browser

Introduction

Digital wallets are a frequent topic of discussion in payments. They reduce checkout friction which in turn raises sales conversion. They reduce fraud via authentication. For issuers, there is a downside: wallets intermediate between consumers and merchants – transferring engagement to the wallet owner.

This post will describe a framework for analyzing digital wallets. It explains why some wallets succeed while others don’t. The end purpose is to analyze why Apple Pay is outgrowing PayPal in the US.

Framework for digital wallet analysis

My core framework assesses wallets along three dimensions: Settlement model, Reach, and Commerce Venue:

Settlement model: Whether they are pass-through, stored-value, or pseudo-acquirers

Reach: Whether they are closed-loop or open-loop

Commerce venue: Whether their starting venue is in-person (POS), eCommerce (browser-based), or in-app (mobile commerce)

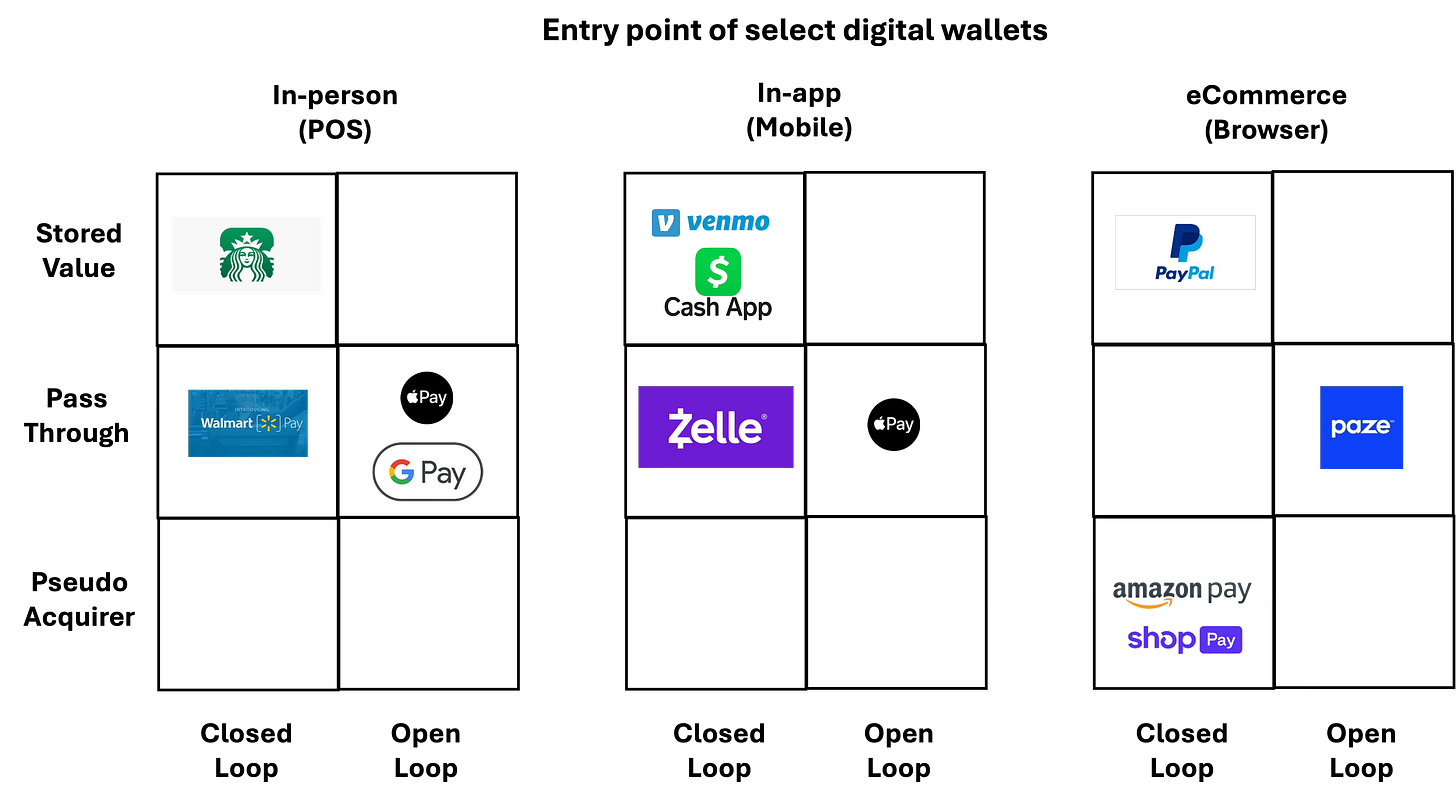

The chart below positions select wallets in the framework based on their entry point.

I emphasize entry point because most wallets are expanding into other cells. As one example, Apple Pay started In-person and in-app, but later entered eCommerce. While Apple Pay transactions are primarily pass-through, they now have a stored-value element from Apple Pay Cash. Within the App Store and iTunes, it is a Pseudo-acquirer. Apple is largely open-loop, but is closed-loop within Apple properties. This is what makes Apple so interesting! As another example, the Starbucks app started in-person, but became key to order ahead — an in-app venue.

Let’s review the dimensions before moving on to the Apple vs. PayPal analysis:

1. Settlement model: Pass-through versus stored-valued versus pseudo-acquirer

In pass-through, the wallet simply passes card credentials to the merchant who then processes through their incumbent acquirer. This is commonly a token rather than the actual PAN (Payment Account Number) to help with security. For the most part, Apple Pay is a pass-through wallet. It can be difficult to monetize the pass-through model as merchants don’t want to pay extra for basic card data. Apple Pay solved for this by charging the card issuers instead

In stored-value, the wallet becomes an intermediary that collects payment from the consumer and then settles with the actual merchant directly. These wallets often have a P2P element which helps build a balance that can later be used for Commerce. PayPal is the poster child here. These wallets charge a margin above their own acceptance costs, if they are paying from the cash balance, all revenue is profit

In pseudo-acquirer, the wallet takes payment from the consumer, but does not build a cash balance — acting more like a merchant acquirer. Unlike stored-value, there is no P2P functionality. Shop Pay and Amazon Pay are examples of this model

2. Reach: Closed-loop versus open-loop

In closed-loop, the wallet is only accepted at proprietary locations. The Starbucks wallet is the best example, although Starbucks has occasionally tried to get acceptance beyond its own stores. The advantage here is 100% acceptance in the target footprint, the challenge is getting the customer to download a wallet app if they visit that merchant infrequently. Closed-loop wallets are therefore most popular at merchants with lots of return visits, like mega-merchants (Amazon, Walmart, Target) and QSR (Quick Service Restaurants like Starbucks). Often, the wallet induces usage with a loyalty program, a la Starbucks. These wallets can also reduce acceptance costs by steering to low-cost payment methods

In open-loop, the wallet is widely accepted. Apple Pay accomplished this by riding the card networks NFC standard for tap-to-pay. They could do this because Apple controlled the NFC chip in iPhones. It is very hard to get wide, open-loop acceptance without access to this kind of industry standard. Just ask PayPal!

3. Commerce venue: In-person vs. eCommerce vs. In-app

For in-person, the wallet must be accepted at physical points of sale. That favors the closed-loop model since only one merchant integrates. The other route is to leverage the NFC standard. We may see more attempts at this if wallets take advantage of iPhone NFC under Apple’s new, open access policy

For eCommerce, the wallet requires one integration per merchant or merchant platform (e.g., Shopify). Wallets in this venue also face the “NASCAR” problem: So many payment logos at checkout that it can be hard to stand out. The other problem is competition from closed-loop wallets at major platforms like Amazon (one-click) and Shopify (Shop Pay). Between those two, more than half of eCommerce volume preferences a proprietary wallet. Many large merchants promote card-on-file. That focuses wallet competition on Guest Checkout at mid-sized, in-frequent merchants – a fraction of the total market

For in-app, integrations are per merchant, giving OS owners an advantage. In-app venues include ride sharing, order ahead, transit tickets, and general mobile commerce. The OS owners (Apple & Google) have preferred positioning due to the App ecosystem and control of handset UX. At inception, I watched Apple Pay rapidly overtake PayPal in all in-app venues. It wasn’t that PayPal wasn’t growing, it was that Apple Pay was growing 3-4x faster

Recurring payments are a fourth venue consisting largely of bill pay. Wallets are not really a factor here although PayPal has tried. The key challenge is that many billers don’t want to accept cards so the revenue model is a challenge. ACH and Card-on-file are the two primary payments methods here. Within in-app we find some recurring use cases, for example reloads into the Starbucks app, but these are modest relative to loan repayments, telco bills, utilities, etc.

Operating model

Other key differences among digital wallets are how they launch and how they monetize:

Launch model

Wallets are a two-sided product: They need to aggregate both consumers and merchants. The most common launch tactic is from a closed ecosystem where both consumers and merchants are incented or required to use the wallet. Less commonly, it can start with a big consumer aggregator or a big merchant aggregator:

Ecosystem wallets: Wallets usually start within a closed-loop at a single large merchant or ecosystem; once critical mass is achieved, the wallet can venture off-us. PayPal followed this path on eBay. In its earliest days, if you wanted to buy or sell something on eBay you needed to join PayPal. Having aggregated small merchants and consumers on eBay, PayPal then supported those merchants off eBay. Later it moved to larger merchants with no eBay nexus.

Consumer first: Apple Pay is an exception to the ecosystem model. Almost half of Americans have an iPhone and these affluent consumers account for as much as three-fourths of consumer spend. Apple didn’t have to aggregate in-person merchants because it relied on the Networks’ NFC standard, and Apple Pay was the easy choice for in-app since Apple controlled the OS, handset & App Store. Only in browser-based eCommerce did Apple have to recruit merchants the hard way – and this went much slower. But it has progressed, because so many Americans had iPhones and use Apple Pay in-person and in-app.

Another flavor of consumer-first is P2P. Zelle, Venmo & Cash App all started with free P2P services, whose viral quality built a consumer base fast. P2P can also be thought of as an ecosystem where the senders and receivers are both consumers.After attaining critical mass with consumers, the P2P wallet can recruit merchants for commerce payments (C2B). All three major P2Ps are moving to commerce, but getting merchant integrations is a long, slow process. Instead, P2P services get POS access via debit cards. PayPal/Venmo & Cash App issue debit cards while Zelle customers already have debit cards from their bank. All those cards are tap-and-go, just like Apple Pay. Paradoxically, customers may put those debit cards into Apple Pay or Google Pay, shifting engagement away from the P2P service.

Paze is another example of a consumer-first wallet. Paze members include all major MC/V card issuers who collectively account for 75%+ of credit & debit cards. The merchant proposition is that Paze can authenticate this huge consumer base through the issuers – reducing fraud without increasing friction. It is too new to draw conclusions on success.

Merchant first: This is the model Starbucks pioneered. Starbucks linked its loyalty program to mobile payment at least partially to reduce acceptance costs. Consumers then flocked to their app to get “Stars”. Effectively, Starbucks is just a small ecosystem where loyalty benefits incent usage. Other merchants emphasize convenience, security, or the absence of other options. Merchants need frequent visits to even attempt a wallet as consumers don’t want to download a wallet app they rarely use.

Economic model

No wallet I know of charges the consumer. How wallets monetize aligns with who their owners are:

Merchant-owned wallets monetize via loyalty and lower acceptance costs. Merchant wallets don’t want to earn a margin on payment as their parent would just have to fund that; They do try to reduce payment costs, particularly in low-ticket QSR where they can use stored-value accounts to pre-fund a payment account

Bank-owned wallets monetize via higher engagement. As I write this, neither Zelle nor Paze charge merchants. Each member bank is allowed to charge, but none do. In theory, digital engagement improves retention and facilitates cross-sell, but both these benefits are hard to quantify. Paze generates indirect economics since a transaction via Paze avoids an Apple Pay fee or ACH-steering from PayPal. Authentication also reduces fraud-related costs

Ecosystem-centric wallets monetize like acquirers, charging an MDR to marketplace merchants for processing card payments. The wallet earns a margin between that MDR and the Interchange & Network fees paid out to issuers and networks. This is very similar to what ISVs like Toast do for physical merchants

OEM/OS wallets differ between Apple & Google. OEM wallets anchor consumers to their OS, but only Apple monetizes via an issuer fee. Apple can do this because iPhone has high share among affluent, high-spending consumers

Apple Pay versus PayPal

Now that we have an analytical framework, we can move to the main event: Why is Apple Pay outgrowing PayPal? To key is commerce venues served. Apple Pay started out in complementary venues to PayPal: its has advantages in POS and In-app but lags in browser-based eCommerce. Apple Pay is only marginally erodes PayPal share in eCommerce, but it blocked PayPal’s expansion into in-app and in-person. PayPal’s key challenge is its core eCommerce venue now faces structural headwinds that slows growth.

In person (POS)

Apple Pay can be used at physical points of sale while PayPal historically couldn’t. PayPal tried in a number of ways, but could never get the seamless experience that Apple Pay offers. Even in Android phones, where it could access the NFC chip, it couldn’t match the Apple Pay experience.

Since POS accounts for over half of retail sales, Apple had the biggest venue largely to itself. It still competes with NFC cards and some retailer-specific wallets, but no other NFC wallet has meaningful share. This venue is growing slowly, but Apple Pay spend share is rising.

In-app (mobile commerce)

Both Apple Pay and PayPal are active in-app, but Apple Pay has higher share and is growing faster. In-app is the smallest but fastest growing venue. I attribute Apple advantages to controlling the OS and the App Store. When I left JPM in 2019, Apple Pay (AP) in-app already had higher share than PayPal and was growing 2-4x as fast, on average. In-app AP volume was already bigger than POS AP volume.

In segments like mobile gaming, App Store policies conferred exclusivity as Apple required in-app purchases use its payment technology — creating a closed loop.

eCommerce (browser-based)

PayPal’s bastion is browser-based eCommerce. Given consumer and merchant inertia, it is unsurprising that Apple Pay is smaller here. PayPal has first mover advantage and it serves Android users where Apple Pay does not. That helps in many global markets where Android is dominant. In those countries, PayPal likely sustains its lead.

Apple Pay differentiation in US eCommerce is mostly around friction and fraud. AP biometrically authenticates each transaction, leading to virtually no fraud. PayPal authenticates via User ID & Password, so it is more secure than key-entered cards, but PayPal itself sometimes incurs fraud – and User ID and Password cause friction. PayPal has one-click checkout technology but is still higher friction than Apple Pay.

One Apple Pay advantage is that it is free to merchants, since card issuers pay. Surprisingly, some merchants think AP is expensive despite being free! What they are seeing is that AP’s affluent customers use high-IC credit cards. Those customers would use the same expensive cards without AP, so this AP-premium is an illusion.

Some merchants also see PayPal as expensive because they know some share of volume is debit or ACH. PayPal margins come out of their pocket. Merchants keep accepting PayPal because some customers prefer it and it is more secure and lower friction than keyed-in cards. When I interview mid-sized eCommerce merchants, PayPal has 5-20% share of their volume.

PayPal headwinds in eCommerce

So why has PayPal growth slowed so much? To me, the answer is structural changes in the eCommerce market, not any particular thing they did wrong. Apple Pay did not directly erode PayPal’s core venue, but in dominating in-app & POS it blocked PayPal’s natural expansion paths as browser-based commerce plateaued.

eCommerce has evolved to PayPal’s disadvantage. Here’s how:

The decline of eBay as a proprietary ecosystem

eBay was once the leading marketplace for small merchants, and consumers followed them there. PayPal rode the wave. Since those days, eBay lost significant share to Amazon Marketplace and Shopify among others. This impacted PayPal’s market position with merchants and consumers

eBay cut ties with PayPal in favor of a proprietary solution from Adyen. eBay now accounts for only 2% of PayPal volume. The volume loss was a headwind, but more important is that PayPal now has no ecosystem to originate consumers and merchants – it needs to source them via direct marketing

The emergence of Shopify

Shopify occupied the niche that eBay used to lead. This shifts volume away from small merchants that used PayPal as their checkout solution. Shopify today may have as much as 15% of eCommerce traffic — almost all of it from small and medium sized merchants. Merchants can accept PayPal (and AP) as payment methods, but Shopify steers to Shopify Payments as the overall checkout solution and Shop Pay as their wallet. Both are powered by Stripe.

Omnichannel fragments small merchants and concentrates large ones

SMBs split volume across platforms, like Shopify, and marketplaces, like Amazon & eBay. So even if PayPal does drive a small merchant’s checkout, it doesn’t get 100% of that merchant’s volume

Enterprise merchants want a full service acquirer. Until recently PayPal offered Braintree to big merchants at a steep discount if they agreed to take PayPal wallet. That strategy faced several challenges:

It was not economically sustainable

It ran into Stripe & Adyen momentum in eCommerce

It ran into the general trend for a single omnichannel solution rather than separate acquirers for in-store and eCommerce

It couldn’t originate new accounts as it gave consumers no reason to engage

PayPal has since backed away from the Braintree strategy to restore margins.

eCommerce concentration

eCommerce is concentrating into the biggest merchants that are collectively outgrowing the market, and those merchants often emphasize card-on-file:

The top 10 have 60%+ share and negotiate the lowest MDRs, squeezing PayPal margins. Apple Pay doesn’t have that issue as it monetizes through issuers, not merchants

Amazon doesn’t accept wallets and Amazon alone has ~40% share. It was a surprise when Amazon started accepting Pay-with-Venmo, but not surprising at all when they soon dropped it

Many large merchants emphasize card-on-file rather than guest checkout. Amazon one-click is the best example , but most of the top 10 have frequent enough visits to establish card-on-file accounts. These merchants also have active cobrand and PLCC programs that concentrate card spending and checkout (e.g., Amazon Prime Rewards). Guest checkout is still popular at smaller merchants and merchants with infrequent visits

eCommerce growth has slowed

At under 10% YoY, eCommerce is still growing faster than POS, but much slower than historical levels. Mobile Commerce is growing far faster but that is where Apple Pay has the advantage.

Can PayPal energize growth?

In my early years at JPM (2014-2016) I watched PayPal routinely grow volume and consumers in the JPM base by 20%+ per year. According to PayPal’s Q3 24 financials, branded volume grew 6% YoY (not inflation adjusted) and Active Accounts grew by 1%. Apple Pay is growing at ~10%, from a larger base.

PayPal seems to be trying to innovate its way back to historical growth levels:

On the consumer side, they have become a consumer lender and a card issuer. At one point they tried a “super-app” strategy to deliver a portfolio of financial services. They bought Honey to help consumers capture online coupons. They are now paying 5% debit card rewards on one merchant category per card. These efforts are trying to increase consumer engagement and total actives

On the merchant side, they introduced Fastlane to streamline guest checkout. It is similar to Apple Pay & Paze in transferring card credentials and shipping data to the merchant. All are free to the merchant at present, but Fastlane may introduce fees in 2025. The aim is to improve guest checkout conversion while reducing fraud. The challenge is that the biggest merchants rely on card-on-file while the smallest merchants favor Shopify, which does something similar with Shop Pay. PayPal’s big advantage is that is can leverage PayPal wallet integrations to accelerate Fastlane adoption

Without the tailwind from an embedded ecosystem, PayPal lacks low-cost distribution to new merchants and new consumers. This is why Venmo is no longer the P2P leader. Zelle is in the bank app of most banked Americans, so getting consumers to take & use Venmo as well is harder than it once was. YoY TPV growth for Venmo was 8% in Q3 compared to 27% at Zelle – which starts from a higher base. Zelle has an ecosystem with low-cost distribution (banks), Venmo doesn’t.

But, ecosystems want the payments profits for themselves. Just look at the ISVs, like Toast, which is creating a restaurant ecosystem. The majority of Toast revenue is from payments and lending. Their back-end acquirer likely makes a basis point or two. The story is similar at Stripe/Shopify and JPM/Amazon. The front-end gets the retail price while the back-end gets a wholesale price. PayPal would be in the wholesale role at any large ecosystem.

PayPal’s carve-out deal from eBay likely allocated a generous margin to PayPal as payments company multiples were higher, so it made sense for shareholders to put more earnings into the payments entity. But when that deal expired, eBay moved to Adyen at better economics. Even if PayPal kept that deal, its margins on eBay volume would have declined; However, eBay would still have served as a low-cost channel for new merchants and consumers, later generating off-eBay growth.

In the absence of an ecosystem, PayPal has raised marketing spend. Q3 spend was up 17% YoY after declining for several previous quarters. Apple Pay (commerce) and Zelle (P2P) have captive distribution channels. Both are also free to merchants and consumers. It is hard to compete with captive and free!

Could PayPal partner with emerging ecosystems to restore low-cost distribution? It would have to place a lot of bets to end up with a winner. But, there is competition for this role: Both Stripe & Adyen focus on “platforms”. This competition would narrow margins, but PayPal alone could monetize through off-us wallet growth. That could position it to win.

Another wild card is Apple’s new policy to open NFC access on iPhones. PayPal could then offer a ubiquitous in-person solution without merchant-by-merchant POS integrations. The challenge would be convincing consumers to use the PayPal NFC app rather than Apple Pay or a bank solution or another wallet solutions — or just tap an actual card. Apple will also charge for NFC access, so the economics may prove unattractive. This also wouldn’t solve for the in-app venue where Apple is not sharing.

Conclusion

There are no easy solutions. PayPal’s eCommerce growth is slowing because the guest checkout market is not growing as fast as it once did. The biggest merchants & platforms are outgrowing the market and they preference proprietary solutions. PayPal is disadvantaged in the fast growing in-app venue given Apple control over the App Store. In the in-person market, Apple will share its NFC technology soon, but at a cost; PayPal still needs a value proposition so consumers preference its NFC wallet over Apple Pay and any other new NFC competitors.

The biggest challenge is that PayPal lacks an ecosystem to feed it new customers. While PayPal once offered both higher security and lower friction, other big wallets now offer the same benefits. It may need a new ecosystem to recreate a flywheel.

I will post an update on this analysis after PayPal’s Investor Day in late February, which might disclose more detailed data. I promise to own up to any flaws in my thinking.