PayPal Investor Day ignored competition

But PayPal competes with a who’s who of payments royalty who are not standing still

Key insights in this post

PayPal outlined its strategy in an extensive Investor Day presentation. But that presentation doesn’t discuss competition in any detail. In fact, PayPal has hyper- growth competitors in each of its four Strategic Imperatives.

Win Checkout — Competitors have “home fields” while PayPal Wallet does not

Major eCommerce ecosystems have proprietary wallets and discriminate against third party wallets (e.g. Shop Pay on Shopify, 1-click on Amazon)

Apple Pay is advantaged in the In-app venue and at the POS by its control over the iPhone hardware, App Store, and terms of use

Paze is coming to market with the same proposition as Fastlane, but far more cards. It is free to merchants where Fastlane has signaled it will charge

Scale Omni — Stripe & Adyen process more volume and have higher growth

Stripe & Adyen already have modern technology focused on global Omnichannel, often starting with an online merchant that wants POS support

Incumbents like Fiserv Carat, Worldpay and JPM also emphasize Omnichannel, starting with a POS merchant that wants eCommerce support

PayPal’s Braintree lost momentum with its “price to value” strategy

Grow Venmo — Zelle is bigger and growing faster while Cash App leads in the debit centric population

Zelle added almost as much TPV last year as Venmo processes in total

It has more than 2x the customers and is growing 3x faster

It processes more volume to/from small business than Venmo total volume

Zelle customers already have debit cards and many have credit cards

Cash App has almost as many customers but far more debit card users

Venmo’s monetization strategies compete with what Zelle provides for free

Pay with Venmo has not resonated with consumers who lose credit card rewards and grace periods if they use it

The Venmo debit card has volume, but competes with bank-issued debit and credit cards that customers already have; its volume may reflect 5% rewards that may not be economically sustainable

Revenues gains have offsetting financial impacts: Instant fee reductions, reduced interest on balances, and rewards costs

Accelerate SMB

PayPal Open will integrate many disparate elements of PayPal’s SMB services

Open is a payments service when SMBs now expect business functionality

Platforms like Shopify provide full eCommerce storefronts plus VAS in addition to payments

Marketplaces like Amazon carve out volume from the merchant’s store front and provide both payments and VAS

ISVs like Square & Toast provide both POS and eCommerce services to POS-oriented businesses

Even where pure payments might be in demand, Stripe is the runaway market leader and continues to invest in payments functionality and VAS

The strategy is moving in the right direction but doesn’t reveal how PayPal will out-compete all these insurgents; yet, to grow faster than market it needs to win against all of them.

Introduction

I promised an update on PayPal after their investor day, and this is that update. They released an extensive presentation outlining their strategy that included a lot of new information. For payments geeks like me, this transparency is like Christmas coming early.

I was impressed by the clarity of thought behind their strategy, and the strides they are making to modernize their technology. However, the strategy doesn’t address the strength of their competition nor the market dynamics. It treats the entire ecosystem as white space, when it is anything but.

The competition is not standing still while PayPal remediates its technology. Most key competitors are outgrowing eCommerce overall and are unlikely to let up. In order to meet its growth goals PayPal must take share from them. That is what doesn’t add up for me.

In this post I will walk through each of PayPal’s four strategic thrusts with a focus on competition and market dynamics. To repeat, I think the strategy is sound, but the competitive headwinds make growing above market very challenging.

PayPal Strategy

PayPal outlines their vision early in the presentation:

“PayPal is the commerce platform powering the global economy”

This is an admirable North Star, but unrealistic. I will only comment on the US here, but I suspect my points would apply globally as well. On page 21, they outline how much TAM there is to grow into:

Online Payments: They claim less than 20% eCommerce penetration; but, share of eCommerce store-fronts is virtually zero: Shopify dominates independent SMBs and Amazon dominates marketplaces. The biggest merchants are outgrowing the market. These models are 60%+ of Commerce. Amazon doesn’t take wallets at all and Shopify has a proprietary wallet and payments service that it favors. Most big merchants take PayPal wallet, but it accounts for 5-20% of their sales after 20 years. This group accounts for 60%+ of US retail eCommerce volume, yet PayPal has few levers to increase growth within them.

Offline Payments: They claim less than 1% of POS commerce today, which is true but still exaggerated. ~0% would be closer to the truth. The main strategy to get into this space is the PayPal & Venmo Debit Cards, but virtually all customers already have bank-issued debit cards and many have credit cards on top of that. The PayPal strategy is to get customers to build balances in their wallet and then spend those balances down either online or via the debit card, but why would consumers do that when they already have bank accounts, debit cards and, often, rewards credit cards? Many already use Apple Pay or Google Pay as POS wallets; and some retailers have proprietary wallets, e.g., Walmart, Starbucks. Braintree also plans to become omnichannel and serve POS, but that is a very crowded market with low revenue per transaction. All scale acquirers have the same omnichannel strategy.

Ads, commerce, and credit revenue: I’m not sure what they mean by commerce but ads and credit are markets PayPal can grow in, and fewer of their payments competitors play there; But, the stated TAM overstates the opportunity:

It includes ad markets that PayPal can’t play in — like TV advertising, search, direct mail, etc.

In includes Credit markets PayPal can’t play in, like Auto Loans and Mortgages, and the bulk of commercial lending. PayPal has had a credit card since 2004. This had outstandings of ~$6.8B when they sold it to Synchrony in 2017. In contrast, the Apple Card has ~$17B in outstanding after roughly 5 years in market

How they beat the competition is the core question, but it is only partially answered in the presentation. I will organize my comments to match the key strategic imperatives they highlight on page 25:

Win Checkout [PayPal Wallet, FastLane, PayPal Debit]

Scale Omni [Braintree, Verifone partnership]

Grow Venmo [Pay with Venmo, Venmo Debit]

Accelerate SMB [PayPal Open]

First, a word on data

My post titled The Payments Data Illusion discusses how payments data isn’t always valuable. PayPal claim 500+ petabytes (page 30), but this includes Braintree data that is just vanilla ISO 8583 messages from acquiring clients. My guess is Braintree lacks usage rights to this data beyond what is needed to serve the client it came from. Even if they have data rights, all this data tells you is the merchant and transaction amount – it does not reveal what the consumer bought.

Most of the wallet data likely lacks SKU detail as well. Most merchants do not share SKU with payments processors as they view it as having proprietary value.

PayPal likely does have data rights and SKU level detail when they are the payments gateway for a small business. But this is the market they have been losing to Shopify and similar platforms, as they note on page 142.

Furthermore, SMBs are increasingly splitting their volume over a proprietary site where PayPal could be the gateway, and marketplaces, particularly Amazon, where PayPal is blind. So, they don’t know the full sales of small merchants and they don’t know the complete purchases of consumers.

The predictive value of this data is minimal. Over half of PayPal wallet transactions are recurring payments to merchants like Uber or Starbucks, which don’t reveal much behavioral insight (page 106); while the remaining transactions amount to under 1 transaction a month (see my post on PayPal engagement for details).

For an example, they offer a data profile on page 37 which offer 7 data points on the customer. Only 1 of these could have come from SKU level data (shoe size). The rest are too general to draw any insights that a card issuer, acquirer or network couldn’t find at 10x the transaction volume.

Yet, none of the major networks, acquirers, issuers or processors has been able to monetize their data except for fraud reduction – and that includes other closed loops like American Express. The only business that successfully monetized payments data over a broad base is Cardlytics, which currently has a market cap of only ~$130M and is not profitable. Lecture over.

Now to the four Strategic Imperatives:

1. Win Checkout – Constrained by ecosystems, facing many insurgents

In checkout, the strategy is clear – they want consumers to use PayPal wallet for every transaction, both online and at the POS. They seem to be focusing on the PayPal debit card as the way to tackle POS – both directly and in Apple Pay or Google Pay.

But they face better placed competition in almost every venue and provide no specific plan for how they overcome this.

POS – Competition from bank accounts and Apple Pay

Almost every PayPal wallet customer already has a bank account with a debit card, so they need an incentive to pay from the PayPal debit card and an incentive to keep balances in their PayPal wallet.

That incentive today is a 5% cash back for debit purchases in one merchant category, which can change monthly. If PayPal customers have low balances and concentrate debit card spend in that 5% category it is an economic disaster. So, PayPal needs to encourage customers to hold more balances on PayPal and spread debit spending beyond the 5% category.

So where will the incremental PayPal balance come from?

More PayPal-brand P2P usage. PayPal-brand P2P TPV shrank 4% in 2023 and only grew 5% in 2024. Growth here competes with growth on Venmo, which grew 9%. In contrast, Zelle grew 27% from a much higher TPV base. Cash App grew ~10%. So, how can PayPal claw back P2P volume from Zelle and Cash App without impacting Venmo? The strategy is silent

More SMB gateway users. When an SMB uses PayPal as their checkout gateway the daily settlement ends up in a PayPal wallet. Those merchants can move the money back to their bank or spend it using the PayPal wallet or debit card. Their “Accelerate SMB” strategy” addresses this, but doesn’t grapple with competition from Shopify, Amazon Marketplace, ISVs and similar platforms. It is unclear how PayPal raises SMB share in the face of this kind of competition and gets the merchants they have to spend out of their wallet balances

More direct deposit. This is mentioned in the presentation but without explanation for why someone would do it rather than deposit to their bank account. I may be unimaginative, but I can’t think of one. Cash App is more like a Neobank but only has about 5% penetration of direct deposit despite almost 50% penetration of their debit card.

Further, accelerating these revenue sources reduces other revenue sources:

Fees for instant payouts to a customer’s bank account -- 1.75% of face value

Interest on the idle balances

These are lower than the revenue from a debit card or wallet transaction, but they are not nothing; therefore, the net impact won’t be as high as the gross impact.

The biggest challenge in my mind is preventing optimizers from concentrating debit card spend in their 5% categories. My exposure to other cards with similar propositions, like Amazon Prime Rewards Cards or Target Cards or cobrands cards in general is that the optimizers come out in force. Temporary promotions have a similar impact – the optimizers switch behavior for as long as the promotion runs and then switch back when it is over.

Finally, Apple Pay has a substantial lead in in-person transactions. They serve the same target segment as PayPal and control the hardware that prevented other wallets from launching. However, they have now committed to opening up the NFC chip and Secure Element so that other wallets can offer mobile NFC. PayPal is the most likely beneficiary, but so Paze and even some individual banks might take advantage as well. Apple will charge for access, so this is not a free lunch. Further, other wallets will need consumers to switch off Apple Pay Settings and switch on their own solution. Overcoming that friction may be tough.

I cover this topic in this in more detail in my post on Apple NFC.

eCommerce — Cantonized by proprietary wallets

The presentation doesn’t address emerging wallet competition and the concentration of merchant spending into ecosystems. PayPal originally scaled because it was the default payment method on eBay. Today, other wallets have copyied that formula.

Shop Pay & Shopify Payments are the defaults on Shopify

Link is the default when Stripe drives checkout off Shopify

Apple Pay is the default in-app and on Apple stores

“One-click” is the sole option on Amazon and Amazon Marketplace

Further, eBay is still the #5 eCommerce property. It has a proprietary payments solution supported by Adyen. PayPal wallet is still allowed, but TPV on eBay declined 4% in 2024 and now represents ~7% of wallet usage. Share will continue to erode.

All these wallets are trying to infiltrate commerce sites outside their home territory, with Apple Pay being the most successful. Shop Pay is available on Facebook. Amazon Pay is accepted at some specialty retailers. All these wallets have similar frictionless features that PayPal rightly brags about.

On top of these, Paze is coming to market to compete in the same guest checkout use case, where PayPal has aimed FastLane. Paze is backed by a card issuer consortium that has access to the vast bulk of V/MC-branded credit & debit cards – far more than are boarded in the PayPal wallet (or any other wallet). Paze has limited uptake at present, but is free to merchants. FastLane is free through June, but may start charging afterwards at an unknown price. Any FastLane fee will give Paze an economic advantage.

To summarize, big portions of eCommerce are dominated by proprietary wallets or payment solutions; the open real estate outside of these fiefdoms is subject to increasing competition. This makes growing engagement challenging.

BNPL specialists have better positioning in the purchase path

PayPal rightly highlights Pay Later as a tailwind. However, pure-play lenders compete from a better position in the purchase path. Affirm, Klarna, AfterPay all have agreements at major merchants, marketplaces, and wallets. For example, Affirm is in Apple Pay and Amazon while Shopify supports several in-path lenders.

The pure-plays expose a buyer to Pay-in-x or Installment offers as they shop rather than after they get to checkout. The PayPal lending product is just as good, but not positioned in the purchase path. It has plenty of uptake, but likely has a ceiling given the pure-play’s better positioning. This is a double-whammy, because the BNPL provider not only gets the loan, but the payment revenue as well.

I covered this in more detail in my post on POS Lending a few weeks back.

Rewards, ads and offers

This is unique proposition that could lift PayPal uptake. None of the other wallets offer rewards beyond the credit card rewards from underlying cards. PayPal’s rewards are merchant funded (beyond the debit card), so they don’t cost PayPal anything. They mostly derive from the Honey acquisition I expect.

This has to become the secret sauce that drives everything else. It is the only material differentiation I can see compared to other wallets.

2. Scale Omni – Braintree is up against Stripe, Adyen, and incumbents

Braintree is usually labeled “unbranded” in PayPal materials.

The presentation is silent on competition, but Braintree are up against two of the fastest growing and most innovative Fintechs on the planet: Stripe & Adyen. Both are within reach of PayPal’s overall market cap, but their services compete with Braintree alone – so their entire investment budget is focused on omnichannel acquiring. Both are as big in TPV terms and growing faster. Braintree notes that 70% of TPV is outside North America, but that is also where Adyen is strongest and regional processors like Checkout.com concentrate.

TPV growth is a tricky concept, because some of the growth represents organic client growth and some represents new clients. For example, Braintree processes for Uber and Airbnb, so it gets a tailwind from their organic growth. Stripe has Shopify among others providing a similar tailwind, and Adyen has its own high-growth customers. We don’t know which providers are winning new logos except anecdotally. But we do know that Adyen and Stripe are outgrowing Braintree today.

The other issue is that TPV growth does not translate directly to revenue growth. Enterprise revenues are not a percent of TPV but a modest fee per transaction – as low as a penny or less. The mix of high-ticket and low-ticket customers and the mix by client size can translate TPV to revenue in different ways. This is not a PayPal issue, but simply a fact of life that makes comparisons tricky.

All these processors have roughly the same suite of services that PayPal lists on pages 123 & 127 of its presentation. They are however differentiated in other ways:

Adyen’s banking license allows it to offer embedded banking products in addition to payment processing. That includes deposits, loans, and payouts

Stripe does embedded banking through partnerships, previously Goldman and soon Fifth Third Newline (I had nothing to do with it). Stripe is growing its Link wallet and is the engine behind Shop Pay. These wallets operate just like Fast Lane.

Both have other sources of differentiation that has led to their rapid growth, in particular modern tech architectures that facilitate easy integration and agile innovation.

The scale incumbents, Worldpay, Fiserv Carat, and JPMorgan, are not sitting still either. All have the same omnichannel strategy and have introduced alternative payments gateways. Worldpay in particular has meaningful share in digital goods which is the global vertical that most needs diverse APMs.

Under prior management, Braintree undercut market pricing in return for acceptance and promotion of PayPal wallet. That led to margin issues, but it also juiced Braintree growth. Under new management, pricing policy refocused on profitability (“price-to-value”), which restored earnings but cut growth in half (30% growth in 2023 vs. 14% growth in 2024).

One other point worth making is that Omnichannel strategies actually reduce average revenue per transaction. eCommerce transactions charge a premium over POS transactions. In eCommerce, the acquirer can add value through fraud improvements, alternative payment methods (APMs), better auth rates and other VAS while at the POS, EMV took out most of the fraud and APMs are less common. So a move to POS reduces revenue yield on TPV.

The presentation calls for growth at market (“ecommerce levels”), while increasing VAS revenue. Since VAS is a cross sell, it doesn’t require new customers to be sustained. But given the “price-to-value” strategy, the question becomes, will clients who onboarded at those below-market prices stick around when their contracts expire? And how will Braintree take clients from Stripe & Adyen?

3. Grow Venmo – Strategy doesn’t even name check Zelle

Disclaimer: As most of you know, I was JPM’s point person on Zelle at inception, so I am a big supporter. I try to be objective below, but keep my priors in mind.

The first point to mention here is that Venmo chooses to compare itself only to Apple Pay Cash and Cash App, but completely ignores Zelle (page 80). Yet Zelle moves 4x times more money than Venmo ($1.1T vs. $270B) and is growing 3x faster from that higher base (27% vs. 9%). Zelle added almost a full Venmo’s worth of TPV in 2024.

They seem to exclude Zelle because it is not a standalone payment app, like Venmo and Cash App. Earlier in the presentation they focus on app downloads as a metric. But since Zelle is in every major Bank app, the proper comparison would be the sum of all major bank-app downloads versus Venmo downloads. That would not look favorable at all. There was a standalone Zelle app, for non-member bank customers, but that was recently retired and was never a good measure of Zelle popularity.

In fairness, Venmo users are more engaged on average, transacting more often per month. But the “on average” part may be deceptive, given Zelle’s gigantic base (150M users vs. 62M Venmo MAAs) some subset of Zelle users are likely just as engaged as the Venmo base.

Venmo also claims to have the best experience, but if so, why is Zelle so much bigger and growing faster? I covered this in my post on Digital Experience. Zelle CX may indeed be less slick, but the overall solution has two features that Venmo can’t match:

Zelle is built into the bank app that digitally-engaged consumers already use

Zelle settles directly into the primary checking account rather than an external stored-value account

While the Venmo CX may indeed be slicker, the overall proposition has proven less appealing to 150M+ consumers — and the gap is growing.

Venmo actually monetizes their settlement disadvantage! Consumers can move money back to their bank account via ACH for free, but it takes a couple of days — or they can move it instantly for 1.75% of face value. This creates an incentive to empty any excess balance via the Venmo Debit Card or Pay-with-Venmo. The arguments here are the same I offered for the PayPal wallet: Most customers already have a debit card and many have credit cards. You can avoid all this friction and cost by using Zelle – and the growth data suggests many are doing just that.

PayPal provides some new disclosures to help us gauge the importance of this. 2024 Pay with Venmo TPV is $8B and Debit Card TPV is $13B. If we assume roughly 4% MDR on PwV and 2% interchange on the Debit card, that gives us $560M in gross revenue. This is out of $32B in PayPal 2024 revenue, under 2% of the total. Further, to the degree these services displace Instant Payouts, the net increase in revenue is half that. If this also reduces idle balances, interest income goes down. Also, debit card use creates rewards expense, which is a contra-revenue.

One more point worth making about Pay with Venmo: It is unfriendly to credit cards. While they charge almost 4% to the merchant, they surcharge consumers 3% for using credit cards as the funding source. If the cardholder funds via a bank account or debit card instead, they lose their rewards. Since the Venmo demographic target is “18-29 year olds with mid- to high- income” (Page 82), many likely have rewards credit cards. That should make growing PwV hard: It is expensive for the merchant (higher than credit) and unfriendly to the consumer (discriminates against rewards credit). Of course, if most users fund via ACH or Debit it is a windfall for PayPal.

Pay with Venmo started in 2017 and still has only $8B in TPV — consumers clearly aren’t buying the proposition. In contrast, Zelle reported $283B in payments to or from small businesses – more than all Venmo volume combined. The key may be that Zelle is free to small businesses, while PwV incurs a ~4% fee.

I spoke to a farmers’ market vendor recently which emphasizes this point. They accepted both Zelle & Venmo and when I asked how much they pay Venmo, their answer was “nothing”. I asked how that was possible since they are a business, not an individual. They said they told Venmo they would stop accepting it at all if they had to pay fees, so Venmo waived them. “Free” is a pretty powerful marketing pitch for Zelle, especially when every banked consumer has access. Turning off Venmo doesn’t lose a customer or a sale where Zelle is also accepted.

Given all this, it is hard to see how they grow Venmo as fast as estimated. Venmo MAAs grew 4% in 2024 but are predicted to grow a bit higher through 2027. Debit Card expected TPV CAGR is 20%+ and Pay with Venmo expected TPV CAGR is 40%+. PayPal is also trying to grow PayPal P2P as well, which is fishing from the same well. Since new users are growing modestly, they must be expecting ever more engagement, which is already 10+ visits per month (page 80).

Cash App is another key competitor but in the same boat relative to Zelle — and its growth has slowed to roughly the same as Venmo. Cash App reported 57M actives — roughly the same as Venmo and roughly the same TPV. The key difference is demographics: Cash App draws from a less affluent population. Just under half their customers are active debit card users and 2.5M take direct deposit; in other words, lower income consumers use Cash App as their neobank. Venmo customers usually have incumbent bank accounts and debit cards.

My core observation is that Venmo are fighting Zelle headwinds with a product that is less convenient and has more friction, and is more expensive for businesses. Zelle is associated with the primary DDA account that already has a debit card. Yet PayPal don’t even acknowledge Zelle competition in their analysis.

4. Accelerate SMB – Ignores platforms, marketplaces and vertical ISVs

PayPal acknowledge that they have underserved SMBs in the past. TPV declined 4% between 2022 & 2023 and rose only 1% between 2023 & 2024 – in a 3% inflation economy (page 142). On a CPI-adjusted basis TPV treaded water at best.

They attribute this primarily to technology failings, which they are remediating through the PayPal Open initiative (“One Platform for all business”). But small merchants won’t be satisfied by just those technology fixes given the functionality available from the competition:

Shopify, supported by Stripe, has aggregated a huge share of eCommerce SMBs and effectively occupies the ecosystem position that PayPal itself used to hold. Other Platforms that provide configurable eCommerce shops rather than just payments are also growing. Some of them are open to a range of payments solutions but the biggest ones, like Shopify, have proprietary solutions

Amazon Marketplace offers an alternative channel for small merchants with its own on-board payments. Many DTC merchants sell more through Amazon than in their own branded shops. Other marketplaces, like eBay, also offer on-site payments. At some of these, PayPal wallet is welcome as a payment method, but PayPal Open will not drive checkout overall

ISVs like Toast & Square help their POS merchants sell online. Toast provides online ordering for restaurants while Square Online provide eCommerce store-fronts for its merchants. These merchants may accept PayPal wallet, but won’t use PayPal Open.

The market is no longer white space for a pure payments solution like Open. DTC merchants generally start with a storefront provider, like Shopify, and those providers are monetizing via proprietary payments solutions. Where a merchant provides their own store-front and sources payments, Stripe is the market leader because it already offers all the features that PayPal Open plans to develop. POS merchants increasingly start with an ISV, like Toast.

PayPal’s Zettle offering is not vertically oriented, but more like Square circa 2010. The market has moved to vertical SaaS “ISVs” like Toast in Restaurants, or Lightspeed in Retail, or Mindbody for Salons & Spas. Square itself now supports four verticals: Restaurants, Retail, Salons, & Invoices (e.g. Caterers) — all with tailored software.

All these providers offer a wide range of VAS including Merchant Cash Advance lending to the seller. They are introducing payouts, BNPL (usually outsourced), accounts payable and other VAS. PayPal Open is catching up, not leading — but without vertical functionality to differentiate.

Conclusion

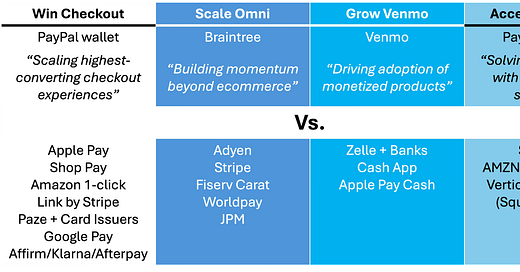

To reiterate, the PayPal strategy is necessary, but doesn’t grapple with competition. In each of its strategic imperatives, PayPal faces hyper-growth competition that are still investing. Here is a graphic showing the imperatives, but with key competitors arrayed against each:

PayPal Strategic Initiatives with competitors (PayPal color scheme)

Military strategy has a phrase for what PayPal faces: “Defeat in detail”, which means: “defeating an enemy by attacking smaller parts of their force instead of engaging the entire enemy force at once”. Not a perfect fit, but instructive. PayPal is emphasizing integration to provide an end-to-end solution to every merchant and consumer’s needs. It’s competition are focusing on narrow use cases in greater depth. So far, narrow and deep is beating broad and integrated “in detail”.

PayPal has assets to leverage in a comeback, especially brand, customer base, ads & offers, and merchant integrations. But it is fighting hyper-growth insurgents on too many fronts. It may need to focus investments in the highest-opportunity imperatives.