How should Fintechs add payments?

A broad formula can be applied

Key insights in this post

Fintechs monetize payments differently depending on the use case, segment, and vertical they serve; collectively, the winners provide a roadmap for new fintechs to enter payments

Specialization is the key

Focus on Small Business & Middle Market as larger companies don’t pay enough and don’t use value-added services

Tailor your payments services to the broad use case you serve (P2P, B2C, C2B or B2B)

In some cases, target verticals with unique needs

The payments approach in each use case is different

In P2P, sending and receiving are always free, but Fintechs can monetize the receivers

Charge fees for accelerated funds availability (“Rapid Deposit”)

Convert receivers into C2B customers with debit cards and online purchasing functionality

In B2C (disbursements),

Senders are usually large companies that won’t pay high fees

Fintechs needs to monetize receivers in the same way that P2P Fintechs do: fees for faster settlement or C2B interchange

In C2B, the strategies are different for Commerce & Bill Pay

In Commerce, monetize the merchant not the consumer

Consumers do generate interchange if you can convert them to your payment methods, but most stick to cards

BNPL has been successful with a consumer lending model but most revenue is paid by the merchant

Neobanks & P2Ps have been successful with their own debit cards

No Fintechs has succeeded yet with credit cards or A2A

Small merchants generate rich MDRs provided the Fintech can surmount the distribution challenge

Platforms & ISVs attract merchants with vertical software

Marketplaces attract merchants by aggregating consumer demand

Some Fintechs specialize attract merchants in high-risk verticals by taking those risks at a premium price

In Bill Pay, Fintechs can serve the consumers or the billers

For consumers, Fintechs get paid via a low-cost method but pay the biller via high-interchange Virtual Cards; this is causing a backlash among billers that may short-circuit the strategy over time

For billers run payments portals that help consumers pay via ACH or Card and to process last minute payments; charge the billers an MDR

In B2B, the formula is generally to serve the AP needs of middle market companies and small businesses using high-interchange virtual cards

Usually, those virtual cards come with accelerated payment to offset the high fees; however, suppliers are starting to resist the high costs

The “Expense Management” companies monetize via commercial T&E cards for employees

Conclusion: Focus is the key to success

Introduction

The Fintechs I follow monetize by payments, primarily through acquiring MDRs or Interchange on debit or virtual cards. In some cases, they use payments as a distribution vector a la Venmo & Cash App P2P. Other Fintechs try to monetize payments but fail. Are the success stories just better managed or are the failures just not suited to payments? This post explores that topic.

A word on nomenclature

This topic is rife with ambiguous jargon. I will try to narrow that ambiguity below, but not everyone will agree with my choices:

Platforms & Marketplaces are terms generally applied to eCommerce competitors

Marketplaces bring consumers to a selling venue. Amazon marketplace is the best example. Marketplaces provide only standardized merchant functionality but make up for it by supplying demand. They typically have a mandatory on-site payments solution

Platforms provide store-front functionality so that merchants can operate independently, i.e., find their own consumers. Shopify is the best example. Shopify does not bring consumers to its venue, it arms merchants to compete in the open market. Platforms may require use of their proprietary payments solution or they may set prices so it becomes the default choice

ISVs (Integrated Software Vendors) & Payfacs (Payments Facilitators) are generally POS competitors

ISVs provide software and payments – that is what the “integrated” means. But the payments are typically provided by an outside acquirer. The acquirers call this their “integrated” channel. Some ISVs allow acquirer choice, but most now have a single relationship. Concentrating volume with one acquirer maximizes volume discounts such that large ISVs get acquiring on the IC+ model at a penny a transaction. Smaller ISVs still pay an MDR but their revenue share rises as their volume grows

PayFacs are ISVs that take on certain acquiring responsibilities in return for a lower acquiring fee. PayFacs are usually responsible for pricing, risk, KYC etc.

SaaS vendors provide cloud software that solves business problems. I will restrict this term to providers that don’t serve “merchants”. For example, my wife works at a nonprofit that uses a SaaS donations solution. The provider has card acceptance integrated with their solution – and makes a margin on the payments processing. But the non-profit is only a merchant in the technical sense – they don’t sell anything to the public. Many SaaS solutions serve verticals like professional services where a minority of incoming payments use cards, so the volumes may be low but with high average tickets

All three classes are SaaS as their software is cloud-based, but I will restrict the term to non-merchant software solutions that may extend payments capabilities. There is also some migration across models, for example Shopify (platform) now has a POS solution (ISV) while Square (PayFac) has an eCommerce solution (platform).

Specialization is key

Whether a Fintech can be successful at payments partially depends on the segment they target and the use case they serve. Vertical may matter as well.

Segment

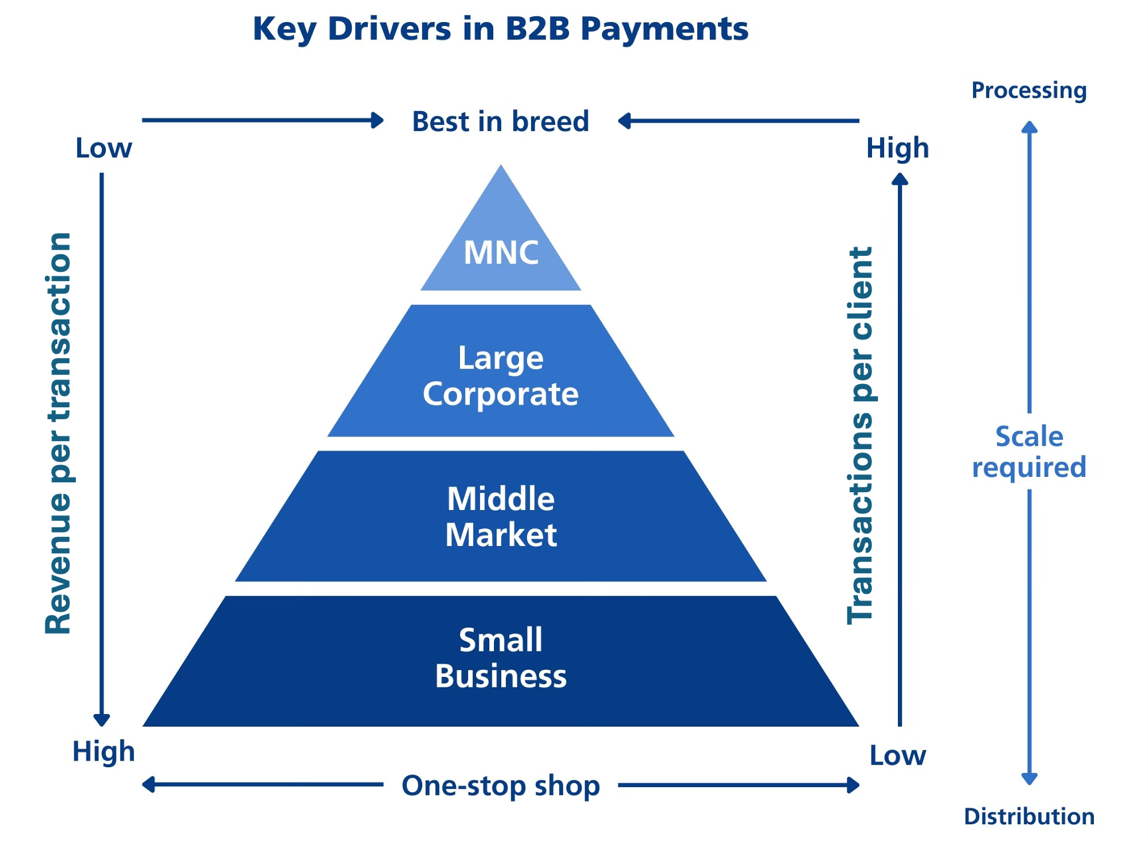

I have pointed out in prior posts that larger companies pay lower prices for payments and typically don’t take bundles:

Large Corporates negotiate low rates that are hard for a Fintech to service. The big companies also won’t take value-added services that increase ARPU. So Fintechs typically target Middle Market and Small Business – where distribution is the primary challenge. The larger companies will occasionally use a Fintech as a point solution in a particularly hard-to serve use case. Many of the best examples are in cross-border.

Middle Market has lower price points than small business, but fewer distribution challenges. They may take some VAS, but typically not the whole portfolio.

Providers have only modest pricing flexibility for payments. Price points are well known and competition is fierce. As a result, aggregating many smaller clients is the path to success rather than capturing a few and driving up prices.

Use Case

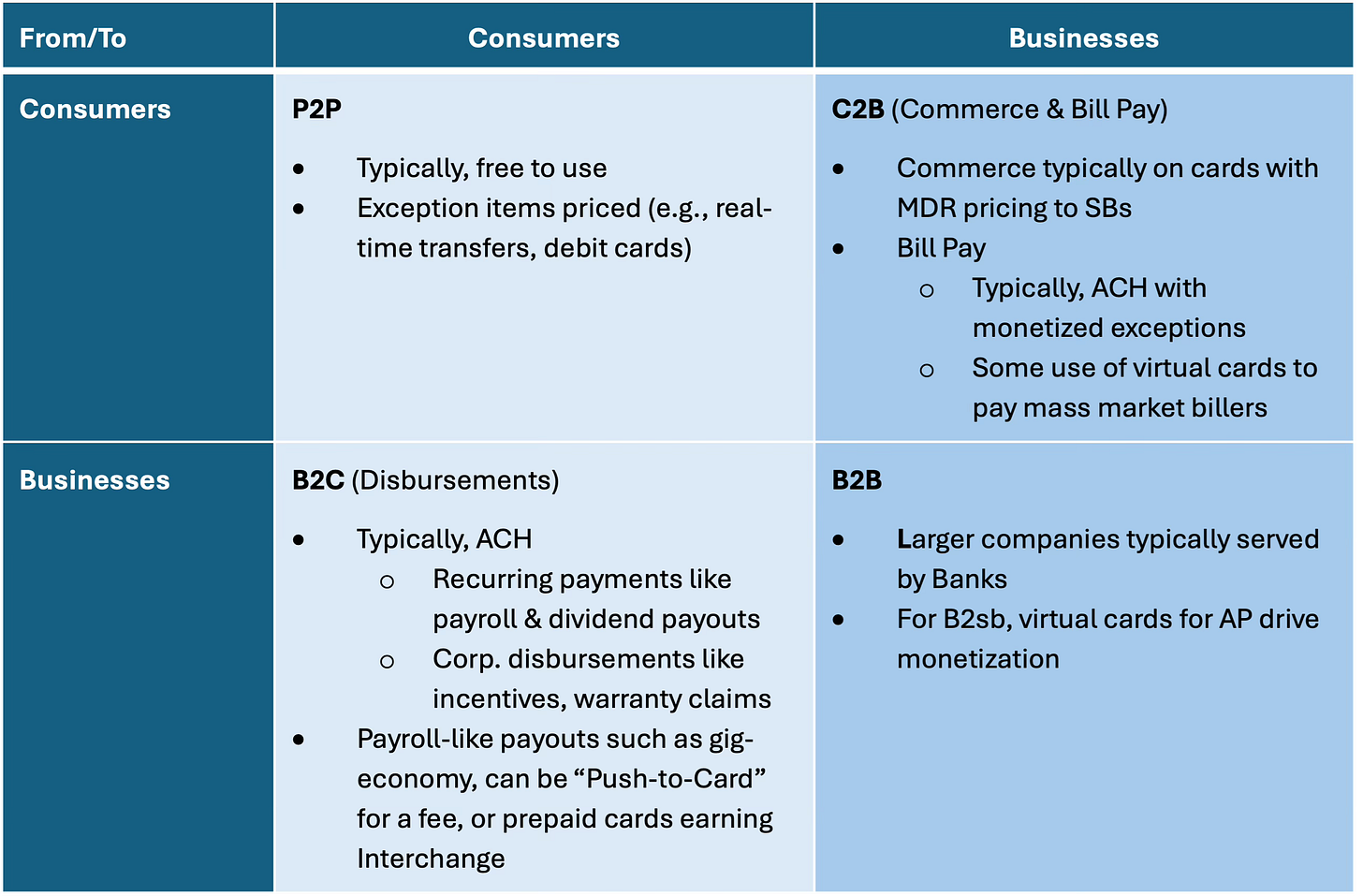

Fintech payment solutions depend on the use case they target. The chart below summarizes the payments services that are common in each major use case.

The next section will cover this in more detail, but at a high level the chart shows monetization happens on the receive side when paying consumers. Business-payers will pay fees, but these use cases are usually scale driven and led by incumbents. Fintechs generally cluster on the receive side using Virtual Cards or taking MDRs.

Verticals

Some verticals simply don’t have the kinds of payment needs that Fintechs can solve for. In small business, the outliers will usually be non-merchant categories like professional services or wholesale trade or non-profit. In these cases, payments can be a modest add-on but won’t be the revenue driver they are for retail trade.

Among Middle Market companies, vertical may matter because of market structure. For example, Drug Stores are extremely concentrated so a pharmacy-specific payment solution may have limited TAM among the attractive segments. A counter-example is health care where the market is fragmented and rarely gets above middle market. A concentrated market has fewer potential clients who all tend to be large.

How do Fintechs monetize payments in each quadrant?

Fintechs on the “to consumer” (left) side of our chart monetize differently than Fintechs on the “to business” (right) side of our chart; on both sides, Fintechs monetize more off the receiver than the sender:

P2P & B2C Fintechs monetize by selling add-ons to receiving consumers.

The originating send often earns little to no revenue.

The trick for both use cases is to lure customers into some kind of revenue generating service – usually accelerated settlement or debit cards

One of the advantages of these use cases is their low distribution costs:

In P2P the inherent virality recruits users

In B2C, consumers sign up to receive funds without an obligation to pay fees or use other services — they need to be convinced

C2B & B2B

C2B sender-side revenues are typically lending, not transactions (Interchange is paid by the merchant not the consumer). Fintechs generally monetize the receive side:

For incumbents, Commerce is a card-centric use case while Bill Pay is ACH-centric

For insurgents the opposite often holds: “Pay-by-bank” (ACH or Instant) in Commerce and Virtual Cards in Bill Pay

Stablecoins and Instant payments are wild cards in the future

B2B sender-side revenue is typically a low, Treasury Services fee per transaction. Fintech monetization typically happens via virtual cards on the receive side

So the answer to the question posed in the title of this piece is that a Fintech should monetize payments by providing something of value to the receiver beyond just money; but, the distribution challenge is typically to recruit payers. The sweet spot is to do both together.

The remainder of this post reviews each quadrant in more detail.

P2P

All widely adopted P2P services are free. The biggest is Zelle, which is attached to a bank checking account. The bank monetizes no differently than any other bank account – with debit interchange, fees and spread on deposits. Zelle anchors the depositor to their bank through digital engagement.

Fintech P2Ps can’t monetize the send side, so they need to appeal to receivers:

Charge “Rapid Deposit” fees to move received balances back to bank accounts – something that is free with Zelle. Rapid Deposit is a real-time transfer back to a bank account using push-to-card

Get consumers to spend down balances in C2B transactions. Debit cards earn interchange while eCommerce wallets earn MDR

As we saw in this post on Cash App, Fintech P2P services also try to get customers to sign up for direct deposit on a Neobank model. Direct deposit typically doubles the amount of debit card spend. This strategy is ineffective for high-balance customers who typically spend on credit cards and already have bank accounts. Venmo & Apple Pay Cash both skew affluent and will not see as much debit card spend.

All major Fintech P2Ps have followed this playbook:

Cash App offers debit cards and “Rapid Deposit”. Rapid deposit charges 50-175bps of transfer value. Cash App has 2.5M direct deposit customers and is promoting this heavily. Cash App is also trying to become a spend wallet in eCommerce

Venmo offers debit cards and an equivalent to Rapid Deposit at roughly the same price as Cash App. It also has “Pay with Venmo” for eCommerce which leverages the PayPal merchant network to earn an MDR

Apple Pay Cash offers a version of Rapid Deposit at 150bps. Users can also put balance on a virtual debit card to spend in Apple Pay — both at the POS and in eCommerce

Cash App is successful at all this, Venmo less so. Apple Pay Cash is an opaque unknown. It is very challenging to build new P2P systems both because the incumbents benefit from network effects. This post describes X’s challenges in P2P.

B2C (Disbursements)

Disbursers pay transaction fees, but the bigger the company, the lower the fees. The big Treasury Services banks serve the disbursers for pennies per transaction, so, monetization is mostly on the receive (consumer) side.

The most successful B2C Fintechs focus on either global payments or payments to prepaid cards rather than bank accounts:

Push-to-card

For low-value cross-border payments, push-to-card is the only global solution as ACHes are national. Global B2C Fintechs like Payoneer can charge a premium and earn FX income along the way

Domestically, the Rapid Deposit approach is common – free for 1-2 day ACH, a fee for real-time push-to-card.

Prepaid cards

Earn interchange when the balance is spent. This converts an inbound B2C into many outbound C2Bs – all of which earn interchange

“Breakage” revenue may happen if the consumer doesn’t spend the full balance. If the card goes dormant the Fintech can often claim the residual balance

Advances. A final way to monetize receivers is “advances”, where the Fintech pays the receiver now in anticipation of the receive. The consumer may be charged a small fee. Earned Wage Access (EWA) is the most common example of this. Both Cash App and Chime have advance products that work with direct deposit relationships

C2B (Commerce & Bill Pay)

The challenge is this use case is that the payers (consumers) generally pay nothing for the payment. They may even get rewards for spending. Monetization must happen on the receive side (from merchants and billers) or by lending to the consumer (which is not a payments service).

One interesting phenomenon is that Cards are the dominant incumbent method in Commerce while ACH is the dominant incumbent method in Bill Pay; the Fintech insurgents are often the opposite: they monetize via non-card methods in commerce and virtual cards in Bill Pay. That shouldn’t surprise me, but it did.

Commerce

All three of ISVs, Platforms, and Marketplaces monetize via acquiring MDRs. The leaders usually mandate the use of their payments solution. When usage is optional, some merchants defect. Shopify solves for this by charging 1-2% fees if a merchant uses a third-party payment solution. Lightspeed introduced payments late in its ramp up and still doesn’t have majority uptake. That has a big impact on their earnings potential.

BNPL lenders like Klarna and AfterPay also monetize on the merchant side via MDR. Fintech Installment lenders like Affirm monetize both via MDRs from the merchant and interest from the consumer — but charge no transaction fees to the consumer.

The bulk of MDR revenue is available from smaller merchants. Middle Market pays lower fees and Large Corporate pays very little. As a result, the bulk of Fintech payments revenue in Commerce is in serving small business via ISVs (e.g., Toast, Square), Platforms (e.g., Shopify) and Marketplaces (e.g., Amazon).

The downside is that smaller merchants incur high distribution costs and risk.

Distribution:

Platforms & ISVs use superior software as a differentiator. Shopify provides a superior web store, Toast provides superior restaurant software, etc.

Marketplaces provide consumer demand to attract merchants, e.g., Amazon Marketplace merchants have many customers to sell to

Risk: Some merchants and verticals are inherently higher risk, so specialists emerge who earn scarcity pricing. This has always been the case in legal online gambling and more recently with Crypto. If a fintech has superior risk management it can earn higher margins – even at larger merchants. An example is online fraud where Fintechs like Signifyd, Riskified and others have differentiated

Of course, neobanks monetize via debit card exempt interchange, but all of that is paid by the merchants.

Bill Pay

Bill Pay is dominated by incumbent methods:

Large Treasury Services banks provide direct debit services to large billers (ACH)

The scale acquirers provide card-on-file recurring payments support

Fiserv offers its CheckFree service to support bank-centric bill pay, although this is waning in popularity. CheckFree is largely ACH-based. All but a handful of banks offer Checkfree

Big providers serving big billers drove down biller-side fee opportunities and makes them unattractive to Fintechs. The only way to monetize a consumer in Bill Pay was with last minute payment fees — basically the reverse of Rapid Deposit. Of course card issuers also monetize via interchange when you pay your bill via card — but Card is dominated by commerce spending with bill pay generating ancillary interchange.

Fintechs like Paymentus have figured out how to serve some billers through Biller Direct offerings, including a payment portal. They accept card payments in the portal and earn an MDR in the process.

For consumer bill pay, Fintechs monetize via virtual cards. The Fintechs takes consumer payments on ACH or cards, but pays the billers via high-cost VCs. The billers see this in rising acceptance costs and have responded:

AT&T & T-Mobile offer per line discounts for using ACH or Debit but not Credit

Verizon only offers per line discounts for ACH or the Verizon co-brand credit card

Smaller billers are beginning to adopt such steering strategies as they realize the cost impact of Fintech VCs. See this post for more insight.

Some biller categories are immune from this arms race as they never accepted cards in the first place (e.g., all lenders and most utilities).

One advantage of the Bill Pay use case is that billers handle consumer distribution. As I noted in this post, FlyWire does this too. In their Tuition vertical, universities offer their foreign students a convenient way to pay Tuition in local currency; Flywire then moves the money from those countries to the university’s bank accounts. Flywire gets a consumer margin on the send side and wholesale margin on the receive side – it gets consumer revenue without the typical consumer distribution costs. This C2B2B model is ideal when it is available.

B2B

This is the mother lode for Fintechs. They have targeted B2B for Accounts Payable & Receivable, using Virtual Cards to monetize. However, larger counterparties either won’t accepts VCs at all or they simply raise prices to compensate.

As a result, the bulk of VCs are paid to the middle market and small business segments. Frequently, those segments are offered faster payment via VC in return for a discount on the receivable. That trade-off can be attractive for a small business given their cash flow challenges, but is a hard sell to larger businesses. Once suppliers realize the cost of such payments many turn them down on subsequent invoices.

The steering we discussed above from major telcos is partially because Fintechs are pushing VCs from small business accounts. The networks Honor All Cards rules prohibit billers from banning VCs if they accept cards of any kind. To respond, billers steer away from cards in general to offset those higher acceptance costs.

One other model that works is expense management. Effectively this is a B2C2B method where businesses provide cards to their employees to fund purchasing. It earns the fintech interchange which may be shared with the employer. The distribution challenge is solved through those employers.

Fintechs have a harder time serving large corporates paying other large corporates. Generally, large suppliers won’t stomach VC costs. It is possible to negotiate VC interchange rates in such circumstances, but that is difficult to scale. So, the B2B large corporate space is hard for Fintechs to monetize; they may sell software, but payments are just not worth it.

Conclusions

This post has analyzed where Fintechs have succeeded in payments services. The forward-looking lessons from this can be succinctly summarized:

1. Pick your use case well

Start with business software solution that is payments adjacent – usually for CFO-type functions

Focus on Small Business & Middle Market as the revenue per transaction and VAS opportunities at the top are not attractive

Target verticals with high volumes across fragmented market structures

2. Solve real pains points for the client

Focus on payments adjacent software

Tailored to a specific business problem within the CFO orbit

Vertical-specific where practical

Bundled with payments from day one

Accelerate cash flow

Charge a premium for settlement speed

Advance funds in return for fees or interest

Steer to cards

Get consumers to spend receive balances through tied card products

Get businesses to accept virtual cards to satisfy open receivables

Get businesses to use push-to-card for payouts and corporate cards for purchasing

3. Distribute economically

Through a viral method like P2P

Through an aggregating SaaS model like Platforms or Marketplaces

Through an intermediary in a B2B2C model (e.g., disbursers to prepaid cards)

Through partners with large small business customer bases, like banks

Ticking all the boxes is rare. Furthermore, the focus required makes it difficult to diversify down the road – into other segments, verticals or use cases. Payments are not a panacea to generate returns unless they are material to ARPU and have attractive unit economics.

So most entrants will find it hard to succeed at payments, and even harder to get to critical mass.