Circle Q3: Circle does not control its destiny

Interest rates and crypto trading volatility matter more

NOTE TO SUBSCRIBERS: Given the US Thanksgiving holiday, there will be no Thursday post. Take the time to read all the posts you skipped in the last few weeks! I will publish a weekly post on Sunday as usual. To my US readers, enjoy the holiday!

Introduction

I write this post with some trepidation. I am a payments nerd, not a crypto nerd, and, to date, USDC is not much used for commerce payments. But as I read through Circle’s earnings & 10-Q I realized that a Payments use case may provide a stable revenue stream (no pun intended) to hedge against the volatility inherent in their trading-centric model.

Circle’s revenue model today depends on two basic forces:

Crypto trading volume because traders use USDC as a temporary store of value between trades

Market interest rates, because those rates determine Circle’s reserve revenue

If interest rates and crypto trading volume are high, Circle mints cash (no pun intended again). If trading volume or interest rates go down, the opposite happens. Q3 showed higher trading volume but lower interest rates. Q4 is headed toward lower volume and lower rates.

That volatility is not in Circle’s control.

They can take volume from other coins, which they are doing; but they can’t influence trading volume overall

They can’t raise yield given the restrictions on reserve investments – which will be institutionalized by the Genius Act

Monetizing the on-ramp/off-ramp activity to fiat doesn’t really solve the problem. In a downturn they will see a spike in off-ramp fees and in an up-turn a spike in on-ramp fees, but both of those are temporary. If they can get Stablecoins into consumer commerce, they will be much less exposed to trading volatility – but that is a long way off.

Starting January 6th, mid-week posts will only be available to paid subscribers

Q3 results

In general, Circle has very transparent disclosures. Their version of Gross Profit is RLDC – Revenue less Distribution Costs – which also backs out transaction costs and a few other items. This is key because those “distribution costs” are revenue sharing back to Coinbase, who hold a big equity stake in Circle.

On the other hand, they still put Net Income in an appendix. Net Income was great for the Quarter, but a loss YTD – likely due to IPO-related expenses. So why bury it?

The other Fintech quirk is their focus on “Meaningful Wallets” (MeWs). This stat is up 77% YoY, but like the Cash App and Chime definitions of “Primary” from my last post, Circle’s definition of “meaningful” is permissive:

“The number of onchain digital asset wallets with an amount of USDC above $10. As a single end-user may have multiple onchain digital asset wallets, MeWs do not represent, and we do not use MeWs as a measure of, the number of unique end-users…”

You may have a different view, but $10 is not meaningful in my mind. I would have thought a number in the thousands is more useful given the main use case is active trading.

The other news was on page 11 where Circle reports: “Adoption continues across a diverse range of use cases”. Most of these seem like pilots or simple integrations to me, not key sources of new volume. All these are certainly worthy and may pay off over time, but time horizon to pay-off is likely very long.

Interest Rates

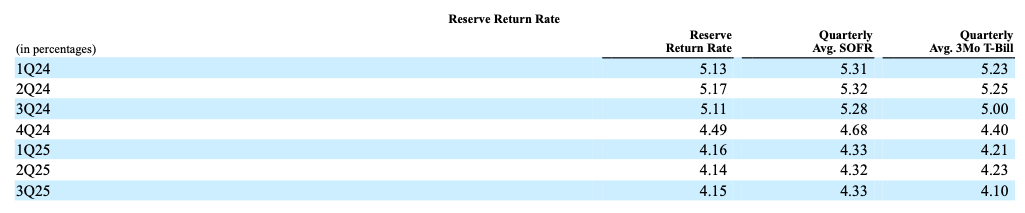

Circle is transparent about the yield on its reserves. Here is the chart from their 10-Q:

Rates are down almost 100bps in a year. Had the Q3 24 rate stayed at 5.11% for Q3 25, Reserve income would have been 23% higher. The Fed is still debating rate cuts in the 25-50bp range, so Reserve Income is at risk for another 6-12% drop. I am not a Fed-watcher, but the headlines point towards modestly lower rates at some point in the next couple of quarters.

Volume

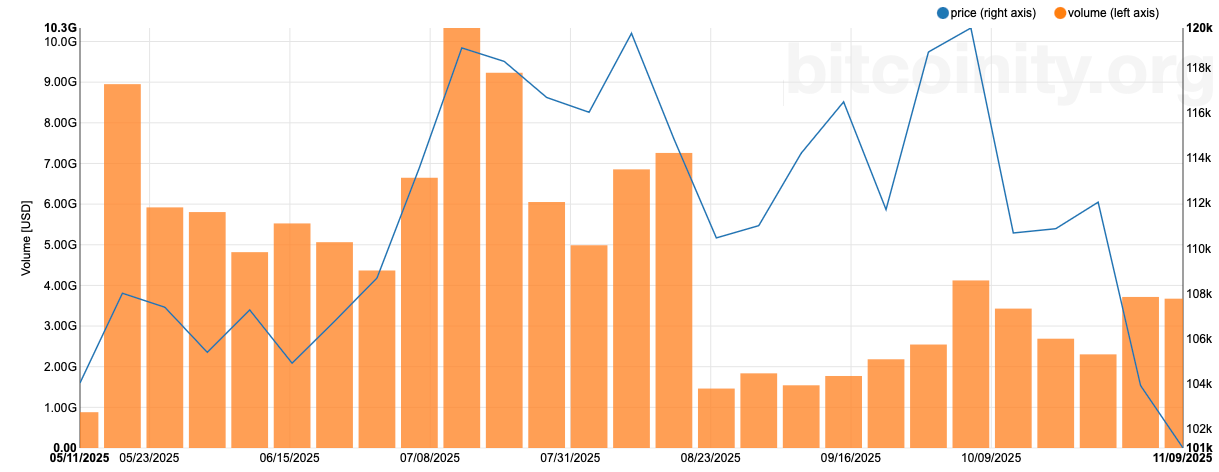

While not directly linked, you can see from the chart below high Trading Activity (the orange bars) from May through July, as the Bitcoin price was rising (the blue line). After a price fall in early August, trading ratcheted down by ~70% and then recovered somewhat. It has settled in ~40% lower than the pre-fall level.

Source: data.bitcoinity.org. 6-month view for “Bitcoin price and volume”

Presumably, the big outflow in late August meant a boom in minted stablecoins (to hold exit capital), but likely also meant a boom in retired Stablecoins (to return to fiat). The impact of the latest sell-off won’t be felt until Q4. That assumes the price doesn’t recover, setting off a new boom for Circle.

According to their 10-Qs, Redemptions in Q2 were ~97% of mints, while in Q3 that ratio was ~84%. Both quarters showed net growth, but that growth was smaller in Q2 as Bitcoin Prices and volumes were growing. It was higher in Q3 after the volume crash. Perhaps traders were using Stablecoins as a safe harbor in Q3, just waiting for the market to turn.

Share

One way Circle can offset the reduction in trading volume and yield is by increasing share – which they are doing. The chart below is from page 10 of Circle’s Q3 Investor Presentation:

The middle chart shows plateauing between Q2 & Q3 and the first chart shows an actual decline. But the rightmost chart shows Circle share versus Tether (USDT), so in a two-coin race Circle is winning. It is gaining share in a volatile market, which offsets some of the negatives from declining volumes and declining rates.

How might Payments help?

Commerce payments are not as volatile as trading – that is why Visa & MasterCard are such reliable investments. However, Stablecoins are not yet relevant in consumer commerce and just beginning to find use cases in B2B Cross-border.

Circle earns very modest revenue from payments today as its “Other Revenue” category is <4% of total income and seems mostly to be one-time integration fees and other miscellaneous income items.

I don’t expect cross-border B2B to be a windfall for independent coins. Banks, particularly JPM, are capturing some of this with their own coins and are in a better position to mix coin transfers with incumbent transfers. Further, MNCs will not hold their cash in coins, but simply go in and out to invest excess cash – that is the Treasurer’s job. If Coin issuers could pay market interest rates, they might hold onto more balances, but the Genius Act prohibits that in general and, if it were allowed, Treasurers would expect market returns, squeezing Circle reserve income down to the ~10bp level.

But consumers are not precision cash managers. They hold excess balances in non-interest-bearing accounts, like DDA at banks and stored value at P2P companies. It is helpful with consumers that PayPal and CoinBase (a big investor in Circle) pay rewards on those balances, provided the regulators continue to allow it.

However, few domestic merchants accept Stablecoins, and those that do don’t see much volume. Stablecoins have not yet built out a robust dispute infrastructure to address Reg E requirements (Circle is trying). And Stablecoins likely won’t connect to many POS merchants where the bulk of commerce happens.

The other point is that Stablecoins are a debit method and likely wouldn’t earn a high MDR from merchants. At normal (regulated) debit rates, Stablecoin payments would earn 25¢ per transaction. Circle would need a lot of those to smooth out the trading volatility. Coins offer no credit or float, which makes it hard to compete with US Credit Cards.

In consumer, cross-border remains the killer app, but stablecoins have competition. The Fintechs are adopting Stablecoins for internal cross-border transfers at wholesale rates while delivering the on-ramps/off-ramps themselves. They will not hold excess balances.

Circle is likely first in line when any new use case emergers, but it will take time to reach materiality.

Conclusions

Circle is a leader in a hyper-growth market, they are gaining share from their key rival, and they are profitable; but, their core market is subject to volatility and Circle revenue is also exposed to declining interest rates – which seem likely in the next few quarters. They can’t control either volume or rates.

They are trying to expand use cases beyond Crypto trading, but that will take time. Today other, use cases are a trivial share of revenue. Circle is building a foundation to launch other use cases, but those use cases will take a long time to gain traction. Consumer cross-border is the most likely to catch-on but it is a smallish market with many entrenched competitors – some of whom are adopting stablecoins for internal transactions.

Unlike Visa & MasterCard, Circle is building a core network in a volatile market. It’s performance will gyrate with that market until it can diversify into more stable use cases (pun intended).

From my perspective, the problem with B2B is that large companies won't hold Stablecoins for long unless the reserve income goes to them. To get MNCs to adopt, Circle will have to give them most of its reserve income to get them to stay in Stable. If Circle doesn''t pay out the reserve income, the Corporate Treasurers will redeem USDC as fast as they can and invest in Money Market funds overnight. If Circle just does settlement, the fees per transaction need to be pretty low to encourage usage. RTP & Fednow in the US charge under 5¢ per transaction for settlement and even less for ACH. And retreating to on-ramps/off-ramps as the key revenue source puts them in competition with the biggest banks, like JPM or the big Acquirers like Stripe or Adyen. And you can't charge that much for on-ramp/off-ramp to a big company. They pay banks pennies or sub-pennies per transaction for similar services today.

The volatility trap you've outlined is really intresting. Circle's growing market share against Tether is impressive, but it feels like they're still dancing to the rhythm of forces they can't control. Your point about consumers not being precision cash managers is spot on, but I wonder if the path to stable revenue is longer than even your conservative estimate. Do you think they could pivot harder into B2B settlment infrastructure rather than waiting for consumer adoption?