Key insights in this post

Most AI discussions focus on internal uses at banks rather than how AI might empower customers; yet, AI may help payments customers optimize their economics at the expense of banks

Wholesale is less at risk

Corporate Treasurers are already paid to manage cash flow and costs, and have teams and tools to execute that mission

AI will improve their performance and reduce their costs, but it will be improvements on the margin

Retail faces new risks as AI overcomes consumer inertia

AI threatens to turn everyone into an “optimizer”

“Optimizer” consumers already go after the best economics without technological assistance

Optimizers are too small a group today to influence bank economics overall

If many more consumers optimize, bank profits take a major hit — particularly if they optimize balances

In Cards, both spend revenue and lend revenue are at risk

Spend: AIs in digital wallets can help cardholders automatically optimize their rewards by selecting the optimal card in for each purchasing opportunity. This will disproportionately impact cobrand cards with unbalanced on-us rewards. The risk is that consumers only use their cobrand for on-us purchases at unprofitable rewards levels

Lend: AIs can automatically seek out low-APR balance transfers and continually move balances after those offers expire

In DDA, spread revenue is most at risk

AI’s with Instant Payments can sweep excess DDA balances to high-APY, interest-bearing instruments on a continual basis

Instant Payments and Open Banking ensure the money can be swept back to avoid NSFs

In Both, AIs, with Open Banking & Instant Payments can automatically shift excess DDA balances to pay down revolve, costing banks profits on both deposits and lending

Banks have not yet acknowledged these risks. They focus on the threat from new types of FIs, but not on enabling technologies that help consumers optimize among incumbents

The solution to disappearing “inertia profits” is to restructure products in ways that make it harder for AIs to optimize

Cards – compete on the fundamentals

Lend

Move to best-in-class underwriting to avoid adverse selection

Eliminate 0% APR balance transfers

Spend

Retire cobrands with unbalanced rewards propositions

Retire accelerators on bank-branded cards

Replace some cash-based rewards with amenities that are hard to value (e.g., lounge access)

Introduce monthly spend thresholds to qualify

DDA – migrate products and pricing structures closer to Small Business and Wholesale models

Raise minimum balances to avoid monthly fees

Charge for transactions above a certain threshold

Potentially, introduce sweeps more broadly

Both – reward multi-product relationships with better pricing, higher service levels and more amenities

None of this is happening overnight, banks have time to adapt -- but that time is not unlimited

Introduction

In most of my conversations about AI and Payments, the focus is on cost savings. AI can indeed help with fraud detection, AML, call centers and other back-office functions. But I rarely see AI mentioned on the revenue side. It is discussed as an aid in underwriting but, runs up against Fair Lending concerns – if the lender can’t explain how the AI arrives at its decision, it faces compliance risk.

Yet, AI will undoubtedly undermine payments revenues as it arms customers with tools to manage their costs – which are the banks’ revenues. The impact will fall much harder on Retail revenues than Wholesale revenues, largely because so much of Retail payments revenues are from balances rather than transactions. The combination of AI, open banking, instant payments, and digital wallets will allow retail customers to manage their balances to the same degree that corporate treasurers already do.

The threat here is not that some kind of alternative financial institution emerges, but that an AI money manager automatically moves loans and deposits to the highest-return option in real time. This overcomes the normal consumer inertia that leaves balances where they are.

This post is pure speculation as there is no evidence this is happening yet, but the challenge is existential if it does.

Retail is more vulnerable than Wholesale

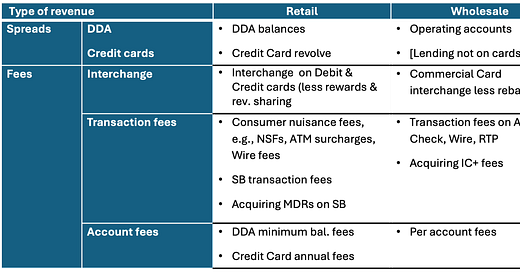

Retail & Wholesale payments businesses earn revenue in different ways. The bulk of Retail payments revenue is from spreads while the bulk of wholesale payments revenue is from fees:

Wholesale

Wholesale clients don’t have the equivalent of a revolving line on credit cards. They do have credit lines, but they are not tapped through a card. They use payments services in three broad areas:

Treasury Services. Corporate Treasury teams use software to manage down operating account balances and sweep the residual to interest bearing asset classes like money market funds. They may be “on analysis” where the DDA balances get an “earnings credit” (a shadow interest rate) to pay their per item transaction fees. Nothing is free, but they get volume discounts that push per item fees down

Commercial Cards. Commercial cards pay for employee travel or for low-dollar purchasing. A growing use case is Virtual Cards for Accounts Payable. In all cases, the client gets a rebate on the interchange. The bank treats these rebates as a contra-revenue

Merchant acquiring. Large retailers pay for merchant acquiring on the IC+ method. Their acquirer passes through Interchange and Network Fees at cost and adds a flat, per transaction fee for processing. These flat fees can be as low as a fraction of a penny. The bigger the merchant the lower the fee

Integration between the corporate and their treasury bank is complex and can’t be changed overnight. Services are bid out periodically using an RFP process. The exception is in the middle market where if the bank lends to the client, that customer is obligated to use some combination of these payment services from that lender.

The key point is that the pricing on these services is already transparent and subject to competitive bidding. Corporations have the market power to get better deals and periodically exercise that power. They also have personnel whose sole job is to maximize cash flow without leaving idle balances around. AI will make those treasury departments more efficient, but it won’t fundamentally change the economic model with their bank.

Retail

Retail banking thrives on consumer inertia. Unlike corporate treasurers, the typical consumer or small business has no time to fine-tune their financial arrangements for the last penny of return. I say typical, because some do. The industry calls them “Optimizers” and they come in many forms.

I have a friend with 5 or 6 credit cards. They use their Amazon card only at Amazon (5% cash back) their Costco card only at Costco (3% cash back), another card only for dining at 3x rewards, another card only for gas at 3x rewards, and a premium card for everything else that gives 2% cash back. No revolve. Every one of those issuers loses money on those cards. In contrast, I use exactly one card – I just can’t be bothered. My friend is an optimizer and I have inertia.

This optimizer phenomenon also occurs in promotions:

Digital wallet promotions where traffic booms during the promotional period but disappears when the promotion ends

Deposit bonuses that require a six-month period to earn the bonus – and the account closes after the six-month period

Credit Card balance transfers where cardholder takes the 0% offer for the contracted period, then transfer to a different 0% issuer

I had a client who accidentally ended up on top of the Bankrate.com Savings league table. They got a billion dollars of deposits in one week, but all of it left when their APY fell back into the pack.

Banks are not blind to this, but they know optimizers are rare. Most customers take the promotions and stay for the normal economics. Banks are transparent about this and customers go in with their eyes open. But, what if everyone turns into an Optimizer? That is what AI can do.

Emerging technologies facilitate retail optimizers

AI alone is necessary but not sufficient to trigger the optimization era. AI can constantly scan for deals that optimize returns. But AI can’t easily move money or open new accounts. The supplementary technologies that help with this are Open Banking, Instant Payments, and Digital Wallets:

Open banking allows the AI to see real-time information on a consumer’s balances and transactions; they can also extract historical data. They can see when balances might be excessive in a DDA or when the next direct deposit is likely to hit. On cards it can see normal monthly spend, recurring payments and all the pricing and rewards details on an account

Instant payments move money between any two accounts in real time, and if the AI miscalculates, move it back just as quickly. Today, consumers still have to initiate those transfers. In Europe, they have something call PISP that allows third-parties to initiate instant payments on behalf of a consumer. In the US, we will use the Request for Payment transaction instead, which allows the receiving entity to request funds from the sending entity. The consumer approves the request in their banking app. That approval requirement introduces friction and delay. For some transactions, Same-Day ACH may be sufficient and doesn’t require consumer approval for each transaction

Digital wallets hold identifying information on the customer that authenticates identify and transfers demographic data. For example Apple Pay validates identity via Face ID and transfers shipping address to eCommerce merchants. They are beginning to host drivers’ licenses which are often used by banks for KYC. And of course, they hold payments credentials

So how might these technologies interact to turn all of us into Optimizers? Here are some hypotheticals:

Cards

Cards economics are threatened on both the spend and lend side. AI may kill off the cobrand, also reducing differentiation.

Transactors (Spend)

Some of you may know an app called Wallaby. It recommends which card to use at any merchant based on the merchants’ MCC (Merchant Category Code, i.e., vertical). If you are at a restaurant, it might recommend your card with high dining rewards. If you are filling up it might recommend one with a fueling bonus, etc.

Wallaby recommends a card but cannot present that card at the point of sale — but, Apple Pay and Google Pay could. It would not be that hard for an AI to inventory the rewards propositions of the cards in your digital wallet and then automatically pick the one that optimizes your rewards for each purchase. It might present your Amazon card at Amazon, your dining card at restaurants, etc. Basically, a robot version of my optimizer friend.

If Apple & Google don’t want to upset the status quo, some Fintech might. Apple just opened its opened its NFC chip to third-party wallets. Apple will charge for usage, but the consumer benefit of a Wallaby-type “agent” should be high enough to charge a fee or share in the savings. Instant business model with none of the compliance risk or capital required to get a banking license.

Issuers will be forced to reduce unbalanced rewards propositions, particularly on cobrand cards where the 3% or 5% on-us rewards will become disastrous when they are not balanced by 1% off-us spending. This is a potential extinction level event for cobrands.

In this environment, only flat rewards are economically sustainable and all cards would converge on some ceiling. Without rewards differentiation, cobrands lose appeal to issuers and cardholders. Issuers may be kept whole as rewards costs overall may drop and cobrand revenue sharing goes away.

But CAC will go up. Without cobrands or “accelerators”, issuers will have to differentiate cards in other ways. The biggest issuers already do this with amenities like lounges, travel portals, redemption options, etc. The trick here may be to have the client earn into these amenities rather than get them at any spending level. If cardholders need to spend $X per month to get lounge access they may concentrate their spend on one card rather than spread it around. Creating such tiers may be the best way around economically focused AI advisors. The amenities may be more highly valued by cardholders than their cost to issuers.

Better linkage between card products and deposit accounts may also help. Chase’s Sapphire-branded checking account and BofA’s cross-product “Preferred Rewards” program are early attempts at this strategy, but they could go further.

Note that this particular threat only requires an AI Agent and a Digital Wallet, it doesn’t require Open Banking or Instant Payments.

Revolvers (Lend)

AI advisors would kill off the 0% APR balance transfer. They will quickly move balances to any issuer that offers this, and quickly move those balances out once the 0% period expires. An issuer can no longer count on consumer inertia to retain balances past the 0% period. Adding a post-0% lock-in might be an option, but AI’s will do the math and may not move the balance if the average cost over the lock-in period is too high.

The only real solution is best-in-class underwriting to price risk at a profitable level. If you are better at underwriting – perhaps assisted by in-house AI – you can charge less for a given risk and still get an above hurdle return. This has been Capital One’s strategy for decades, and Progressive does something similar in insurance. This requires technology and skill sets that not all issuers have. It will advantage the biggest issuers over smaller ones. It will also impose adverse selection on any issuer that underprices its credit risk.

This empowers balance consolidation providers. The balance does not have to move to another card, but can move to whatever lending vehicle has the lowest APR. Using open banking, the balcon lender can see repayment history, ongoing spend activity, bank balances and all the other factors that go into making an informed underwriting decision. It has access to all the information that an actual card issuer has.

DDA

Checking accounts have a different problem. Consumers don’ t manage their balance as precisely as corporate treasurers. They keep too much in DDA rather than manually sweeping it to interest bearing accounts or capital markets products. I know I don’t optimize for this. Instead, my bank gets a long-term, interest free source of funds from my inertia.

Many banks offer automatic sweeps, usually to their affluent customers. A Fintech called “Digit” does this as a form of financial inclusion. It helps lower-income consumers build up savings. But Digit got into CFPB trouble because its algorithm often took too much balance and caused its customers to incur NSFs. AI, open banking, and instant payments can avoid such faux pas.

Many sweep accounts move money from checking to savings at the same bank, but most big banks don’t pay high APYs on savings. While the consumer does better, they are not optimized. As of today, all the highest rates on Bankrate.com are at small banks I never heard of. A better option for the consumer is to sweep to a money market fund that always pays market rates.

This activity takes advantage of AI, Open Banking, & Instant payments. The balance predictions can be more accurate due to AI and Open Banking, and the solution can instantly top up the account via instant payments if an NSF is likely to occur. Further, if such a product is aimed at high-balance customers rather than low-balance ones, the margin of error is wider.

The funds don’t just have to go to interest bearing deposits or capital markets funds, they can pay down loans – particularly credit card revolve. If a relationship bank has a customer with both a credit card and a DDA, netting the excess DDA balance against the credit card revolve could save the customer hundreds of dollars a year, coming right out of the bank’s pocket.

The main missing piece here is the PISP model of Open Banking (mandated in Europe). That allows third-parties to initiate instant payments on behalf of the consumer. In the US, we would have more friction: The transactions would either have to travel by Same-day ACH, with some NSF risk, or use the Request For Payment (RFP) model with some friction. RFPs require the consumer to approve the transactions one-by-one – they aren’t entirely automatic.

Conclusion on consumer impacts

All the tactics I describe above are in play today by optimizers executing manually. A motivated individual can research all the options and maximize their personal economics. Sites like Bankrate.com and Credit Karma provide all the information one needs. But most consumers don’t have the time or skill to do it. Their inertia keeps excess balances in high APR loans or low APY deposits.

AI and the associated technologies eliminate inertia. They would automatically optimize on behalf of the consumer. If they require consumer authorizations along the way, it may slow things down, but the AIs will leap on any arbitrage opportunities in their customer’s interest.

Given how much retail banking profit derives from consumer inertia, this is bad news for the industry.

Banks don’t yet acknowledge these risks

I went through the 10-Ks of the three biggest banks to see if any of them are anticipating the kinds of challenges described here, and none seem to have done so specifically. They outline vague competitive threats from Fintechs and Incumbents, but they don’t address the threats of AI optimizers that simply move balances to incumbent FIs with better terms.

JPMorgan Chase (page 31)

“New technologies have required and could require JPMorganChase to spend more to modify or adapt its products to attract and retain clients and customers or to match products and services offered by its competitors, including technology companies”

“Ongoing or increased competition may put pressure on the pricing for JPMorganChase’s products and services or may cause JPMorganChase to lose market share, particularly with respect to traditional banking products. This competition may be based on quality and variety of products and services offered, transaction execution, innovation, reputation and price.”

Bank of America (page 21)

“Emerging technologies and the growth of e-commerce have lowered geographic and monetary barriers of other financial institutions, made it easier for non-depository institutions to offer traditional banking products and services and allowed non-traditional financial services providers and technology companies to compete with traditional financial service companies…”

“Wide-spread adoption and rapid evolving of, … emerging technologies, including analytic capabilities, AI …, automated decision-making, … create additional strategic risks, … including … increased volatility in deposits and/or significant long-term reduction in deposits (i.e., financial disintermediation).”

Wells Fargo (Annual Report page 75)

“Continued technological advances and the growth of e-commerce have made it possible for non-depository institutions to offer products and services that traditionally were banking products and for financial institutions and other companies to provide electronic and internet-based financial solutions, including … lending and payment solutions. … Furthermore, technological advances, such as artificial intelligence, and other innovations may be leveraged by competitors to improve their products and services, efficiencies, operations, and customer service.”

“We … may be forced to offer products and services at lower prices, increase our investment in our business to modify or adapt our existing products and services and/or develop new products and services to respond to our customers’ needs and preferences.”

I shortened these a bit where you see “…”, but I don’t think I changed the meaning.

In general, these banks rightly worry that alternative products or institutions will create substitutes for banking products – like stablecoins or crypto. However, the threat may instead be AI agents moving balances from one incumbent to another to get a better deal. Other large banks may have acknowledged this kind of threat, but if these three didn’t, I suspect others don’t either. And I can’t bear to read any more “Risk” sections of 10-Ks.

What can incumbents do about consumer AI advisors?

The answer likely includes migrating consumer product constructs towards the wholesale model.

DDA

Small Business products are part way between consumer and wholesale. Small businesses have higher balances and therefore more to gain from optimization. Here are Chase’s small business products (from their website):

Notice a couple of things about these products:

They have high minimums to avoid monthly fees

They set a limit on transactions, with additional fees for more transactions

They link activities from other Chase products like Ink card purchases where interchange generates revenue for Chase

The other two megabanks have similar Small Business products and terms:

Bank of America has only two account types and doesn’t seem to charge for transactions, but the higher balance levels to avoid monthly fees are consistent. Accounts above $20K are enrolled in the bank’s Preferred Rewards program

Wells Fargo has lower minimums on their basic account, but imposes more transaction fees above 100 transactions. It has two premium accounts similar to Chase’s that have higher minimum balances or monthly fees and both charge for transactions above a base level

While consumer accounts today charge transaction fees for exception items like off-us ATMs and Wires, there are generally no fees for checks, ACH, on-us ATM usage, etc. regardless of the volume. And the minimum balances are usually much lower – typically $500 with direct deposit.

In an interesting twist, low-balance accounts may not be vulnerable to AI Agents. Balances are too low to sweep, and account owners use Debit Cards with no rewards for spending, generating interchange revenue. Nothing to optimize.

Higher balance accounts are vulnerable to sweeps and use rewards credit cards — both of which can be optimized.

Credit Cards

In credit card, the threat is more to lending revenues than interchange revenues. Interchange would be threatened by Wallaby-type solutions, but leveling out rewards can address that problem. The proliferation of surcharging and the potential retirement of Honor All Cards would still be a challenge even if rewards optimization wasn’t.

The challenge is AIs that decouple revolve from cards. If AIs optimize for APRs, cards would no longer be as reliable sources of profit. Each issuer would have to offer best-in-class APRs backed by best-in-class risk-based pricing.

The is not dissimilar to what banks face in Commercial Cards. The cards are generic and issuers compete mostly on how much of the interchange they rebate to the clients. Effectively rebate is like rewards.

Lending in wholesale is a standalone function. It does not depend on using a bank’s commercial card products. Further, the commercial card products are more like charge cards, paid in full at the end of the month.

If revolve balance always moves to the lowest APR lender anyway, this Commercial model could apply in consumer. That could mean the return of charge cards for the high spenders, who don’t revolve anyway, and perhaps the return of annual fees — which are already common into high-end products like Amex Platinum.

The prime revolver segment is where the bigger risks are. Unless each issuer has best-in-class, risk-based underwriting, they will lose the balances or incur higher losses; their credit cards will become mostly a spend product. Balances would remain for a short period until the AI optimizers find a lower-APR home for them. That could be at another bank or at a balance consolidation lender.

In that environment, Credit Cards become a an affluent-focused spend product similar to the role of debit cards for low-balance customers.

Overall conclusion

Today, the industry just absorbs adverse selection from the rare Optimizers. Product managers design around the worst damage. But AI, Open Banking, Instant Payments, and Digital Wallets threaten to turn everyone into an optimizer.

The threat here is not new financial institutions and asset classes taking volume away, like stablecoins and DeFi. The risk is that AI Agents manage the consumer’s loans and deposits with the same economic rigor as corporate treasurers. They simply move balances from one incumbent to another. They are advisors, not competitors. Closer to RIAs than Neobanks.

The response needs to be a redesign of Retail products more in the image of Wholesale products:

For DDA, that includes higher minimums, more fees, better links between loans and deposits, and intangible services to confound the AIs. Small Business accounts already have some of these features to use as a model

For Cards, that likely means the eventual end to cobrands and the return of flat rewards propositions — without accelerators. Issuers can substitute amenities like lounge access that are hard for an AI to value. On lending, it means investing in best-in-class underwriting as the costs of adverse selection are much higher

None of this is happening tomorrow — I am not a “chicken little” — but eventually. Amara’s law captures the level or urgency: “We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run”. Incumbents have time to adjust, but complacency is not an option as “inertia profits” are surely at risk.

Very thoughtful article. Well written. Thanks for sharing.