Agentic Commerce: Less than meets the eye

Most consumer spending can’t use it, won’t use it or has good alternatives

Key insights in this post

Agentic Commerce (AC) is defined as autonomous AI Agents that purchase on behalf of consumers. They determine “… what to buy, when to buy it, and where”

The first challenge is that less than 5% of consumer spend is in categories not amenable to Agentic Commerce:

~85% of consumer spend is in categories like housing, transport, and education where the buying journey requires paper-bound application processes. AC may help with discovery but can’t autonomously purchase

Most of what remains are categories where AC can help get the best price but not decide what to buy; many of these are replenishment use cases, already served by incumbents, particularly large marketplaces

Less than 5% of spend is in categories where AC can compete, such as apparel; but, these categories are subject to consumer taste & fit intangibles that will be difficult to overcome

AC faces other challenges in taking share

Legacy competition can deploy on-site, captive AI that uses their proprietary data to do similar things

All major merchants are blocking third-party AI scrapers, limiting access to price, selection and review data; without an “Open Retailing” law like Rule 1033 in banking, third-party AC can’t get the data it needs to make decisions

Some merchants (e.g. Shopify) require the actual consumer to hit the purchase button to confirm liability. That breaks up the E2E, autonomous AC journey

All these factors limit the AC TAM, SAM & SOM

Assuming 5 major AC competitors, each can expect $20-50B in AC spend in the end state

This might translate to $200-500M in revenue per AC competitor in the end state

The remainder of consumer spend is either not amendable to AC at all or will remain with incumbents deploying on-site AI

In the shorter run, AC can succeed in niche use cases similar to smart contracts in the stablecoin world. Basically, an AC waits until a consumer-selected SKU drops below a target price and then purchases

Conclusion: While AC is a very intriguing technology, it faces many obstacles to widespread adoption

A small fraction of consumer spend is amenable to autonomous AC journeys

Incumbents will block third-party AC from accessing data while deploying their own, on-site AI to capture the opportunity

That may leave third-party AC in niche markets such as the smart contract structures to optimize sale prices

Introduction

I am a believer in Agentic Commerce (AC); I wrote about it in this post. Fully autonomous agents should help shorten shopping journeys for bigger ticket purchases and help consumers get better deals. Payments & AI companies entering Agentic Commerce today are smart to get ahead of the curve.

However, the more I thought about it, the smaller I think the market is. At the end of the day, Agentic Commerce is more evolutionary than revolutionary. Why?

Most categories of consumer spend are not amenable to Agentic Commerce

Even amenable categories may not support fully Autonomous Agents

Where Agentic Commerce is most useful, major marketplaces and platforms will offer similar capabilities

My overall answer is similar to what I found in the Guest Checkout post a few weeks ago: the open space AC solves for is attractive but modest.

What is Agentic Commerce (AC)?

I like Stripe’s definition of Agentic Commerce:

“AI agents are autonomous or semiautonomous software programs that use artificial intelligence to act on a user’s behalf. What they do goes far beyond surfacing search results—they decide what to buy, when to buy it, and where. They can follow instructions, weigh trade-offs, and transact. In other words, they don’t assist with the purchase—they actually are the purchaser.”

The paradigm of “what to buy, when to buy it, and where” summarizes the key point and the autonomy they describe creates a sharp distinction between AC and AI-enhanced discovery tools. However, I also believe it limits market size.

What kinds of purchases are AC-friendly?

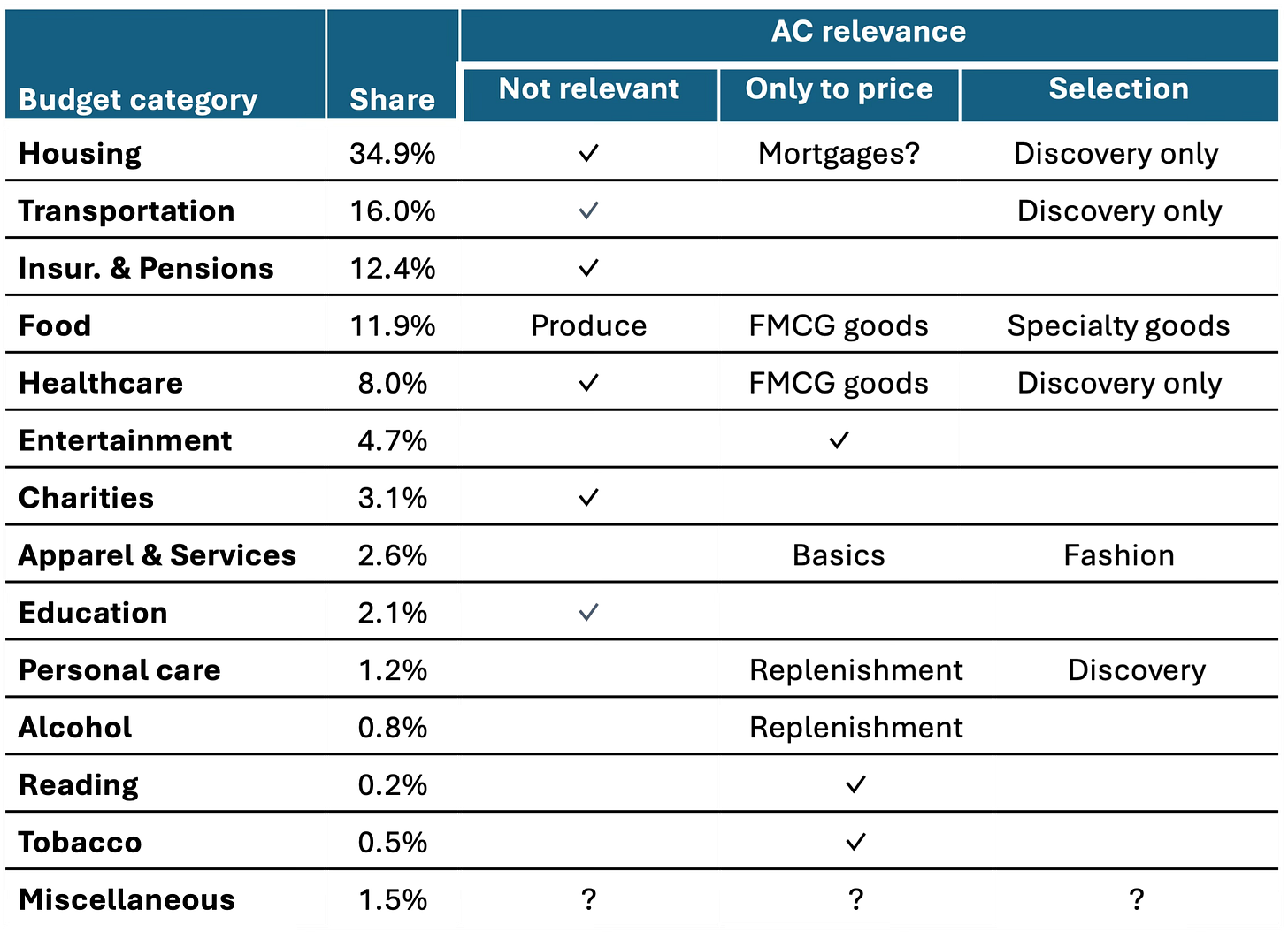

Below is the BLS breakdown of the average American household’s budget in 2023. The percentages shift on the margin from year to year, but I doubt 2025 is materially different. I have divided the spending into categories reflecting AC relevance. The percentages next to the categories are share of the household budget:

The columns represent the degree to which a spending category is amenable to AC:

AC not relevant: Big ticket categories that are rarely transacted, like Housing; they often involve legal paperwork or factors not amenable to AI

AC relevant to price: Standardized goods where the consumer knows what they want, but may need help getting the best price

AC relevant to selection: Goods where the consumer needs help sorting through the options with price being only one factor in the decision

My categorization between columns 2 & 3 is idiosyncratic, but 85% of household spend ends up in the “not relevant” column where I think the placement is sound. For the center column, consumers already know what they want, they just need help getting the best price. Less than 5% of spend, particularly apparel and personal care, are where Agentic Commerce can routinely help with selection. What follows are more detailed explanations.

Column 1: Agentic not relevant

For housing, I don’t think it is a great leap to say that no one is going to allow an Agent to pick their house or apartment. It is too expensive a decision and there are too many intangibles that are hard to capture in a prompt.

The seller is usually another household rather than a merchant and likely can’t sell to an agent. Anyone who has bought a house knows how many intermediaries are involved end-to-end and how much legal paperwork is involved.

Mortgages are different. The terms are fairly standardized but the price can vary across lenders. An AI could recommend the best lender given a prompt, but, it can’t do the paperwork to compete the transaction. First Mortgages cannot be an E2E, frictionless experience although Refis may be.

Yet housing costs are one-third of expenditures.

For Transport (16% of budgets), An AI may recommend a brand & model (Toyota Camry vs. Nissan Altima vs. Honda Accord, etc.); but once that decision is made, the car is exactly the same wherever you buy it. The differences are on the margin with option packages, add-ons, color, and financing. On all of these you usually buy from the closest dealer, not in a competitive marketplace. In most states the sale has to go through a dealer.

Option packages and add-ons are a dealer monopoly, assuming you want them pre-installed rather than aftermarket. Financing is sourced in a competitive marketplace distributed through the dealer, but the associated OEM “Acceptance Corp” usually wins via a subsidized APR. Used cars and/or sub-prime loans are amenable to AI but no easier to close.

The other categories I placed in this column are similar. Either the selection is limited, the prices are not strictly comparable, or the purchase journey can’t be end-to-end. For example, an AI could recommend a good college for your teenager, but the student still has to apply, get accepted and evaluate financial aid. Paying the bills is routine after that.

Column 2: AC relevant to price

Here, the consumer already knows what they want: Some branded good that is identical between retailers. The only factors to consider are price and convenience. I really don’t care where I get my Heinz Ketchup I just want it when I want it and prefer to pay a low price. Don’t try to convince me to get another brand regardless of price!

For most of these goods, there is an easier way: buy via Amazon, Walmart, other mass retailers, other marketplaces, or direct from the manufacturers. Both Amazon & Walmart have “everyday low price” policies, so while they might not be the lowest, they are low. Further, they both offer free shipping and fast delivery, so they may be more convenient even when they are not the absolute lowest price.

Column 3: AC relevant to selection

In my opinion, AC is most useful when you don’t quite know what you want beyond a category. For example, I want winter boots for dog walking in slushy conditions. I found plenty of review articles that rate them and still couldn’t make up my mind. Each review uses different criteria and rating schemes and I sometimes don’t like the look of the “top choices”. The top choices also vary from site to site so I wonder about pay-to-play bias. I would love an agent to make my mind up for me. Winter is coming!

A counterexample of this is produce. I asked my wife whether she would let an Agent pick our fruits and vegetables and the look I got back was chilling. She often changes what she buys based on the look and feel of what is available. She curates the specific pieces, looking for firmness, color, and lack of blemish. AC is not happening in our household for produce. By the way, I do the supermarket shopping and am far less picky, but still wouldn’t trust AC for produce.

The biggest qualifying category here is Apparel. Clothes & Shoes fit the bill: you don’t quite know what you want, you may be less brand loyal, and there is almost too much choice. The challenges here are taste and fit.

I am attending a black tie wedding soon and need a tuxedo. I started shopping with a web search and found a few models that looked OK from a price and style perspective. Then I went in person to try them on. The fits were all terrible and would need major alterations – even though I am a standard size in everything else. I also didn’t like the weight of some of them or they looked different in person than online.

I could never have given an Agent a detailed enough prompt to pre-empt all that wasted time. The two barriers are not quantifiable today:

Fit: In the early days of eCommerce, a few start-ups created tools to precisely capture your measurements and then screen manufacturers for what size fits you. I distinctly recall this for shoes and women’s clothes. Maybe those ideas will come back to support AC

Taste: We have seen this crop up in several areas above. Cars, Books, Housing, Education, etc. I would be hard pressed to describe my personal style to an Agent to avoid a lot of misfires. Maybe you could photograph your favorite clothes and shoes and the Agent deduces Taste from that. Of course, that means you never try anything new, and it is a lot of work for the consumer.

So the categories where AC could provide the most help can’t really determine what the customer will really like. Higher conversion offset by higher returns.

I moved “Basics” and replenishment items to the “price” column. Here Taste and Fit have been removed from the equation. If I like a certain brand of jeans and my size hasn’t changed, I am more than happy to delegate an Agent to order new ones. All that matters then is price. The only taste variable left is color. But replenishment services already exist for items like this. My household uses them for dog food, coffee, cleaning products and other staples. We order mostly from Amazon, where prices are usually low and delivery is free.

Legacy competition

Consumers already have a lot of tools to help them do commerce. Replenishment services are just one example. Larger merchants can also add AI tools tools to improve experience without going all the way to AC.

AC not relevant

Zillow comes to mind for housing and various auto ranking sites for transport. Dozens of sites rank colleges. It is likely that these vendors add on-site AIs to improve their utility to users. That may push out generic, third-party ACs from the category. This column is also not AC-friendly as you cannot convert the purchase as part of the discovery process.

AC relevant to price

Google shopping is perhaps the best incumbent example. Google Gemini describes Google Shopping this way:

“… helps users find, research, and compare products from various online retailers by organizing product listings and images, prices, and reviews in a single searchable platform, make it easier to discover and purchase desired items.”

Google shopping assembles all the data an AC would need, leaving the final research and decision making to the customer – in other words Google delegates taste back to the consumer. Of course, Google could apply Gemini to this process to help prioritize the results, making it a leader here.

I have already mentioned Amazon & Walmart.com. They sell pretty much everything other than the full range of apparel brands and they offer everyday low prices. They have free, fast shipping. Checkout is already invisible. Once they add proprietary AIs, the bulk of the price column likely disappears. In my household, any branded goods we know we want are already purchased on Amazon with minimal friction. We could reduce that friction further by ordering via Echo.

AC relevant to selection

This is where AC could be uniquely useful rather than just an incremental improvement on what we already have. There are plenty of sites that aggregate clothing brands into a single marketplace (e.g., Macys.com, Zappos), but no site has everything. The challenges to AC are Fit & Taste.

A friend once told me she ordered 5 winter coats from a department store to try on at home. She then returned 4 of them. Shortly thereafter I was at a Money 2020 dinner where I sat right next to head of eCommerce from that retailer. He explained the enormous cost of what my friend had done. The department store would gladly pay an AC to limit that behavior, but I just don’t see how that happens without the kinds of taste and fit services I discussed above. Until then, AC journeys are likely to have high conversion with high return rates.

The challenge beyond inherent Taste & Fit barriers is getting the consumer to write a precise prompt. In order to do that, they probably need to have done research on their own or do it iteratively with the AC. The AC could run a dialogue with the consumer to narrow in on what they like and then write its own prompt, but that demands more consumer time & attention.

Other obstacles

AC faces other obstacles besides the Taste & Fit challenges. Intellectual Property and payments friction are just two of them

Retailers block AI scrapers

One obstacle may be intellectual property. Web sites already limit AI scraping and may up the ante for things like reviews, product specs and prices. Without the review sites, the AC’s will have trouble recommending specific products and without prices they can’t recommend the best deal. If manufacturers limit access to product specs, game over.

Amazon, Walmart.com & Shopify already limit AI scraping and they collectively account for over half of eCommerce. In fact, every major retailer I checked does similar blocking. Sounds familiar to Rule 1033 dynamics, doesn’t it? Congress could pass an “Open Retailing rule”, modeled on Rule 1033, that would legitimize scraping, but I doubt it. If anything, I could see an anti-scraping rule getting more support.

I don’t think the worst case will prevail. Some smaller retailers will want to be discovered, even if it means more pricing pressure. Etsy’s entire business model is built on niche merchant discovery, but it turns out, Etsy blocks scraping too. They want you on-site to discover merchants. They are building proprietary AI to help both merchants and consumers. I think most large merchants and marketplaces will go that route.

AC optimism assumes that agents can access all prices, reviews, and product specs to do their magic. If those data sources are blocked, AC loses much of its value.

Payments obstacles

To add fuel to the fire, AC may not be autonomous for the last mile. Retailers are requiring that an actual human authorize the final purchase. This is to establish liability under network rules and Regs E & Z. If the agent can’t prove in real time that they were authorized to make a particular purchase, the merchant is liable if the end-consumer reneges. Requiring a human to be in control of the “Purchase” button solves this problem. Shopify publicly announced that on their site, a human must hit the “Purchase” button.

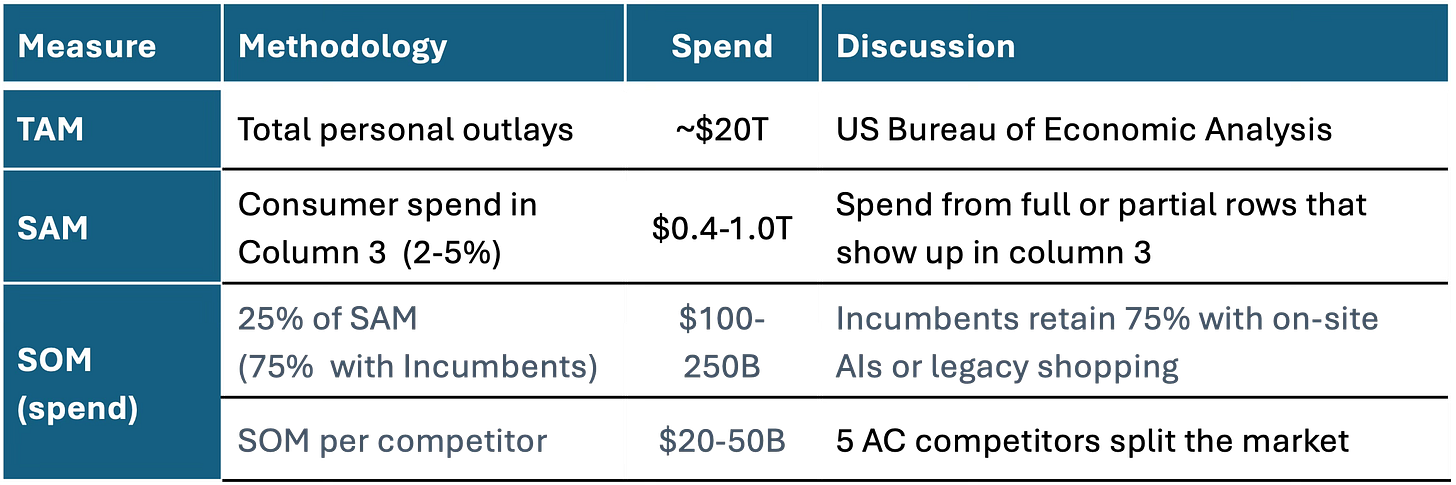

How big is the AC market

If you buy the above analysis, what is the market opportunity for AC? I estimate the TAM, SOM, & SAM below. Here are the definitions of those terms from Gemini:

TAM (Total Addressable Market) -- The largest possible revenue opportunity

SAM (Serviceable Available Market) -- The segment of TAM a company can realistically target

SOM (Serviceable Obtainable Market) -- The actual portion of SAM a company can reasonably capture given its resources

Most AC estimates focus on that first row which is indeed huge. but if you pare down for the obstacles and competition, it shrinks to a SOM of $20-50B per AC competitor. Assuming ACs monetize by a 100bp fee on either the consumer or the merchant, this translates to $200-$500M of revenue per AC competitor. I suspect the lower end is closer to the truth.

This is nothing to sneeze at, but it isn’t earth shaking. It also assumes 100% penetration of the in-scope market. This estimate is an end-state and it will take many years to get there given the need to overcome Taste and Fit obstacles.

Where AC has few obstacles

I think the best use case for AC is similar to a smart contract in blockchain-land: The consumer wants a particular item but not at current prices. This might happen before known sales periods like after-Christmas. The AC can monitor prices and notify the consumer when prices fall below the target. AC still has to bring the consumer in for the final “Pay”-button push to address liability.

The same model would work for items that frequently go out of stock or launch new colors & models (e.g., for sneaker heads). I have used on-site services like this from manufacturers, but those weren’t general purpose tools like AC.

This use case doesn’t delegate anything about taste or fit. The consumer knows exactly what they want, they just don’t like the price or the item is temporarily unavailable. The Agent patiently waits until it finds a qualifying deal and then initiates the purchase. It is not clear to me how big that market is. Some consumers already do this manually, ACs democratize that behavior.

Conclusions

The more I thought about AC, the less optimistic I was:

A small percentage of consumer expenditure is even open to AC where AC is defined as an Agent that autonomously makes purchases for consumers:

In-scope categories often have taste & fit challenges that AC can’t yet solve for

Those categories are hard for consumers to write precise prompts for without doing a lot of research on their own

The major incumbents will adopt their own AIs (not AC) to stay relevant

They have proprietary review and purchase data to drive on-site AIs

They are already low price and high variety, with massive consumer bases

They will continue to excel on branded goods that don’t rely on Taste or Fit

They have near-frictionless checkout

The major retailers I checked all block AI scrapers from getting the data AC needs to make good recommendations

Instead, AC’s can help consumers get the items they know they want at better prices or availability. Some day, the taste and fit challenge will be overcome and larger markets may open up, but the market will take a while to get there.

In the meantime, AC is one of those cool technologies that seems like it should be really useful until you actually try to use it.

Sushil -- thanks for the comment! I don't get enough of these.

In general, I agree with your take and my friends at BCG have a document out that makes a similar point. I was trying to distinguish between AI Discovery and E2E AC (including purchase). There are already lots of non-LLM discovery tools, like Zillow for houses, that get you most of the way there and the greater likelihood is that these incumbents deploy proprietary, on-site AI using their proprietary data to complete the E2E journey. General tools like ChatGPT are getting blocked from that proprietary data, so will have a harder time getting there.

I also think big-ticket journeys like leasing an apartment often involve legal paperwork, like signing leases, that you can't or shouldn't delegate.

I also don't think that last step, "purchase", adds much friction once a decision on what to purchase and where is made. If the difference were better discover without auto-purchase and worse discovery with auto-purchase, I would usually choose better discovery. Purchase is usually well under a minute and getting shorter with tools like Apple Pay.

Andy, I agree with your take. The piece that feels underestimated in the near term is iterative discovery with AIs — we’re already seeing people find products through LLMs, just not completing the purchase yet. Once the “app layer” opens up (like OpenAI’s recent announcement), I think we’ll see that last step — discovery and transaction — start to converge. I’m genuinely hoping the next apartment I rent comes via an LLM.